ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$7.54 billion during February, bringing year-to-date net inflows to US$14.30 billion which is higher than the US$2.40 billion gathered at this point last year. Total assets invested in ESG ETFs and ETPs increased by 4.93% from US$64.79 billion at the end of January 2020 to a new record US$67.99 billion, according to ETFGI’s February 2020 ETF and ETP ESG industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ESG ETFs and ETPs listed globally gathered $7.54 billion in net new assets at the end of February which is the 2ndhighest monthly inflow on record.

- Assets in ESG ETFs and ETPs listed globally increased by 4.93% at the end of February 2020, to a new record of $67.99 billion.

- Europe leads with the most ESG classified products available, followed by the US and APAC (ex-Japan).

“At the end of February, the S&P 500 was down 8.2% as coronavirus cases continued to spread and the potential economic impact weighed on investors and the markets. Outside the U.S., the S&P Developed ex-U.S. BMI declined nearly 9.0%. The S&P Emerging BMI lost 5.1% during the month. Global equities as measured by the S&P Global BMI ended down 8.1% with 49 of 50 included country indices down, while China gained 0.9%.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The Global ESG ETF/ETP industry had 293 ETFs/ETPs, with 805 listings, assets of $68 Bn, from 75 providers listed on 30 exchanges in 58 countries at the end of February. Following net inflows of $7.54 billion and market moves during the month, assets invested in ESG ETFs/ETPs listed globally increased by 4.93%, from $64.79 billion at the end of January 2020 to a record $67.99 billion.

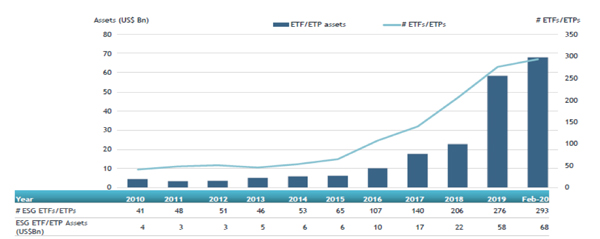

Global ESG ETF and ETP asset growth as at end of February 2020

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products has increased steadily, with 293 ESG ETFs/ETPs and 805 listings globally at the end of February 2020. During February, 10 new ESG ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $4.92 billion at the end of February, Ping An CSI New Energy Automobile Industry ETF (515700 CH) gathered $1.08 billion alone.

Top 20 ESG ETFs/ETPs by net new assets February 2020

|

Name |

Ticker |

Assets (US$ Mn) Feb-20 |

NNA (US$ Mn) YTD-20 |

NNA (US$ Mn) Feb-20 |

|

Ping An CSI New Energy Automobile Industry ETF |

515700 CH |

1,019.77 |

1,081.01 |

1,081.01 |

|

iShares ESG MSCI EM Leaders ETF |

LDEM US |

587.76 |

637.51 |

637.51 |

|

iShares Trust iShares ESG MSCI USA ETF |

ESGU US |

3,375.62 |

2,249.22 |

292.95 |

|

iShares MSCI USA SRI UCITS ETF |

SUAS LN |

2,088.82 |

390.50 |

291.81 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

967.23 |

350.01 |

289.71 |

|

iShares MSCI World ESG Screened UCITS ETF Acc |

SAWD LN |

378.98 |

285.69 |

273.23 |

|

L&G US Equity Responsible Exclusions UCITS ETF |

RIUS LN |

748.15 |

233.36 |

231.25 |

|

Bosera CSI Sustainable Development 100 ETF |

515090 CH |

196.80 |

203.86 |

203.86 |

|

iShares MSCI Europe SRI UCITS ETF |

IESG LN |

1,217.33 |

218.29 |

196.91 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

763.93 |

396.18 |

177.53 |

|

Amundi Index MSCI Europe SRI UCITS ETF DR |

EUSRI FP |

627.22 |

386.47 |

166.84 |

|

iShares MSCI EM ESG Optimized ETF |

ESGE US |

2,029.38 |

1,383.79 |

156.42 |

|

UBS ETF (LU) MSCI World Socially Responsible UCITS ETF (USD) A-dis |

UIMM GY |

1,599.48 |

268.07 |

152.13 |

|

iShares MSCI EAFE ESG Optimized ETF |

ESGD US |

1,583.09 |

280.80 |

135.83 |

|

Xtrackers ESG MSCI World UCITS ETF |

XZW0 LN |

280.72 |

164.21 |

127.68 |

|

iShares Global Clean Energy ETF |

ICLN US |

633.42 |

185.48 |

116.67 |

|

iShares MSCI Japan SRI UCITS ETF |

SUJP LN |

261.87 |

75.79 |

99.80 |

|

Vanguard ESG US Stock ETF |

ESGV US |

994.84 |

207.74 |

98.69 |

|

iShares Euro Corp Bond SRI UCITS ETF |

SUOE LN |

1,124.78 |

69.73 |

96.80 |

|

Xtrackers II ESG EUR Corporate Bond UCITS ETF DR |

XB4F GY |

562.28 |

108.03 |

93.84 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity. Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.