ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that Crypto ETFs and ETPs listed globally gathered net inflows of US$227 million during July, bringing year-to-date net inflows to US$727 million, which is much lower than the US$4.07 billion gathered at this point last year. Total assets invested in Crypto ETFs and ETPs increased by 38.7% from US$6.02 billion at the end of June 2022 to US$8.35 billion, according to ETFGI’s July 2022 ETF and ETP Crypto industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Net inflows of $227 Mn during July 2022.

- Year-to-date net inflows of $727 Mn are the second highest, after 2021 YTD net inflows of $4.07 Bn.

- Assets of $8.35 Bn invested in Crypto ETFs and ETPs listed globally at end of July 2022.

- Assets have decreased 48.9% during 2022 going from $16.34 Bn at end of 2021 to $8.35 Bn.

“The S&P 500 increased by 9.22% in July but is down 12.58% YTD 2022. Developed markets excluding the US increased by 5.32% in July but are down 15.84% YTD 2022. Sweden (up 12.13%) and Netherlands (up 9.64%) saw the largest increases amongst the developed markets in July. Emerging markets decreased by 0.40% during July and are down 16.46% YTD in 2022. Pakistan (down 16.59%) and China (down 8.77%) saw the largest decreases amongst emerging markets in July, while Chile (up 12.24%) and India (up 9.14%) saw the largest increases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

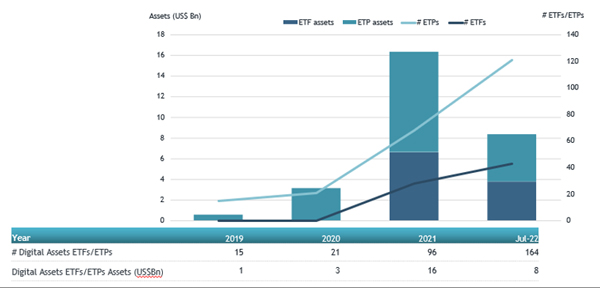

Global Crypto ETF and ETP asset growth as at end of July 2022

Since the launch of the first Crypto ETF/ETP in 2015, the Bitcoin Tracker One-SEK, the number and diversity of products have increased steadily.

There are 164 crypto ETFs/ETPs listed globally, with 486 listings, assets of $8.35 Bn, from 32 providers listed on 18 exchanges in 14 countries at the end of July. Following net inflows of $227 Mn and market moves during the month, assets invested in Crypto ETFs/ETPs listed globally increased by 38.7% from $6.02 Bn at the end of June 2022 to $8.35 Bn at the end of July 2022.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $273 Mn during July. Purpose Bitcoin ETF - CAD - Acc (BTCC/B CN) gathered $73.45 Mn, the largest individual net inflow.

Top 20 Crypto ETFs/ETPs by net new assets July 2022

|

Name |

Ticker |

Assets ($ Mn) Jul-22 |

NNA ($ Mn) YTD-22 |

NNA ($ Mn) Jul-22 |

|

Purpose Bitcoin ETF - CAD - Acc |

BTCC/B CN |

571.41 |

108.49 |

73.45 |

|

Purpose Ether ETF - CAD Hdg |

ETHH CN |

317.45 |

232.79 |

68.30 |

|

ProShares Bitcoin Strategy ETF |

BITO US |

803.89 |

229.87 |

34.36 |

|

ProShares Short Bitcoin Strategy ETF |

BITI US |

67.44 |

85.94 |

21.88 |

|

CI Galaxy Ethereum ETF |

ETHX/B CN |

363.89 |

(167.57) |

21.83 |

|

21Shares Ethereum ETP - Acc |

AETH SW |

230.83 |

19.49 |

7.48 |

|

21Shares Bitcoin ETP - Acc |

ABTC SW |

203.54 |

41.28 |

7.16 |

|

Fidelity Advantage Bitcoin ETF |

FBTC CN |

28.24 |

28.51 |

5.19 |

|

CoinShares Physical Staked Algorand |

RAND GY |

5.06 |

4.95 |

4.95 |

|

VanEck Bitcoin ETN - Acc |

VBTC GY |

127.87 |

7.83 |

4.91 |

|

CI Galaxy Bitcoin ETF - Acc |

BTCX/B CN |

212.31 |

(1.08) |

3.70 |

|

CoinShares Physical Bitcoin - Acc |

BITC SW |

224.20 |

43.75 |

3.12 |

|

21Shares Crypto Basket Index ETP - Acc |

HODL SW |

103.98 |

31.56 |

3.10 |

|

CoinShares Physical Ethereum - Acc |

ETHE SW |

117.67 |

30.44 |

2.47 |

|

21Shares Solana Staking ETP |

ASOL SW |

45.02 |

9.32 |

2.25 |

|

Investo VanEck ETF Crypto Compare Smart Contract Leaders Fundo de Índice |

BLOK11 BZ |

2.65 |

2.17 |

2.17 |

|

WisdomTree Solana |

SOLW SW |

2.24 |

1.94 |

1.61 |

|

21Shares Short Bitcoin ETP - Acc |

SBTC SW |

13.22 |

(2.58) |

1.58 |

|

WisdomTree Ethereum |

ETHW SW |

35.90 |

13.08 |

1.50 |

|

SEBA Crypto Asset Select Index ETP (USD) |

SEBAX SW |

34.81 |

21.75 |

1.50 |