ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that Crypto ETFs listed globally gathered US$3.69 billion of net inflows in April, according to ETFGI’s April 2025 ETFs and ETPs Crypto industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Net inflows of $3.69 Bn in April.

- Year-to-date (YTD) net inflows of $5.99 billion are the second highest on record. The highest were recorded in 2024 at $42.33 billion, while the third highest were $2.69 billion in 2021.

- Global assets invested in crypto ETFs reached $146.27 billion at the end of April, marking the fourth highest level on record. This is just below the all-time high of $170.94 billion recorded at the end of January 2025.

- 1st month of net inflows.

The S&P 500 Index declined by 0.68% in April and is down 4.92% year-to-date (YTD) in 2025. In contrast, the Developed Markets Ex-U.S. Index rose 4.86% in April and is up 10.85% YTD. Among developed markets, Spain and Portugal posted the strongest gains in April, rising 8.65% and 7.67%, respectively. The Emerging Markets Index increased by 0.88% during April and is up 1.80% YTD. Within emerging markets, Hungary led with a 10.78% gain, followed closely by Mexico at 10.40%," said Deborah Fuhr, Managing Partner, Founder, and Owner of ETFGI.

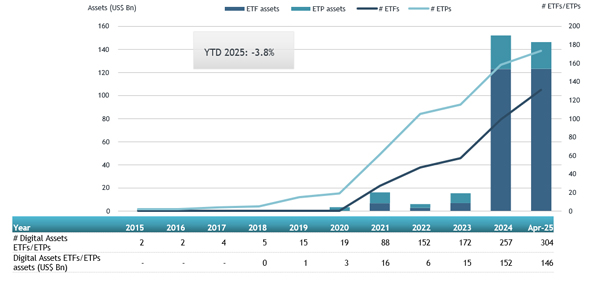

Growth in assets in Crypto ETFs listed globally as of the end of April

Since the launch of the first Crypto ETP in 2015, the Bitcoin Tracker One-SEK, the number and diversity of products have increased steadily, with 304 Crypto ETPs and 756 listings globally at the end of April. During April, 23 Digital Assets ETPs were launched.

There were 304 Crypto ETPs listed globally with 756 listings, assets of US$146.27 Bn, from 65 providers listed on 26 exchanges in 20 countries at the end of April. With monthly net inflows of $3.69 Bn and the market movement during the month, assets invested in Crypto ETPs listed globally decreased by 3.8% from $152.10 Bn at the end of December 2024 to $146.27 Bn at the end of April.

Substantial inflows can be attributed to the top 20 Crypto ETPs by net new assets, which collectively gathered $3.94 Bn during April. iShares Bitcoin Trust (IBIT US) gathered $2.69 Bn, the largest individual net inflow.

Top 20 Crypto ETFs/ETPs by net new assets April 2025

|

Name |

Ticker |

Assets ($ Mn) Apr-25 |

NNA ($ Mn) YTD-25 |

NNA ($ Mn) Apr-25 |

|

iShares Bitcoin Trust |

IBIT US |

56,768.88 |

5,406.13 |

2,693.67 |

|

Fidelity Wise Origin Bitcoin Fund |

FBTC US |

18,651.59 |

(87.34) |

155.63 |

|

Grayscale Bitcoin Mini Trust ETF |

BTC US |

3,981.49 |

435.03 |

152.32 |

|

ARK 21Shares Bitcoin ETF |

ARKB US |

4,587.11 |

276.10 |

125.81 |

|

iShares Bitcoin ETP |

IB1T GY |

207.88 |

197.48 |

121.98 |

|

iShares Ethereum Trust |

ETHA US |

2,234.24 |

656.66 |

108.19 |

|

3iQ Solana Staking ETF |

SOLQ CN |

88.47 |

82.44 |

82.44 |

|

21Shares XRP ETP |

AXRP SW |

594.84 |

181.00 |

76.77 |

|

Teucrium 2x Long Daily XRP ETF |

XXRP US |

50.81 |

50.06 |

50.06 |

|

Ether Strategy ETF |

ETHU US |

418.73 |

578.66 |

46.93 |

|

Fidelity Ethereum Fund |

FETH US |

749.37 |

(130.16) |

43.48 |

|

Hashdex Nasdaq XRP Fundo De Indice |

XRPH11 BZ |

38.99 |

38.99 |

38.99 |

|

Grayscale Ethereum Mini Trust ETF |

ETH US |

850.45 |

3.96 |

34.42 |

|

CoinShares Physical Bitcoin |

BITC SW |

1,512.20 |

235.59 |

34.13 |

|

WisdomTree Physical Bitcoin |

BTCW SW |

1,014.79 |

10.06 |

29.87 |

|

Bitwise Bitcoin ETP Trust |

BITB US |

3,599.21 |

(146.80) |

29.71 |

|

Coinshares Valkyrie Bitcoin Fund |

BRRR US |

572.79 |

(237.88) |

29.39 |

|

NEOS Bitcoin High Income ETF |

BTCI US |

167.59 |

135.88 |

28.58 |

|

Fidelity Advantage Bitcoin ETF |

FBTC CN |

766.16 |

83.00 |

28.09 |

|

VanEck Celestia ETN |

VTIA NA |

23.66 |

27.49 |

27.49 |