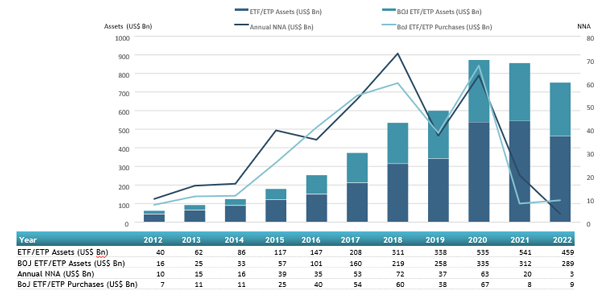

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that the BOJ reported owning US$289 billion US dollars or 63% of the assets in the ETFs industry in Japan at the end of July 2022. ETFs industry in Japan suffered net outflows of US$1.29 billion during July, bringing year-to-date net inflows to US$3.38 billion. Assets invested in the Japanese ETFs/ETPs industry have increased by 2.6%, from US$447 billion at the end of June to US$459 billion, according to ETFGI's July 2022 Japanese ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

-

BOJ reported owning US$289 billion or 63% of the assets in the ETFs industry in Japan at the end of July 2022.

-

Assets of $459 Bn invested in ETFs and ETPs listed in Japan at the end of July 2022.

-

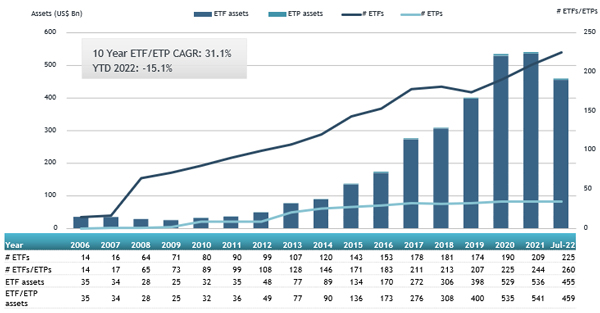

Assets decreased 15.1% YTD in 2022, going from $541 Bn at end of 2021 to $459 Bn.

-

Net outflows of $1.29 Bn in July 2022.

-

YTD net inflows of $3.38 Bn gathered in 2022.

“The S&P 500 increased by 9.22% in July but is down 12.58% YTD 2022. Developed markets excluding the US increased by 5.32% in July but are down 15.84% YTD 2022. Sweden (up 12.13%) and Netherlands (up 9.64%) saw the largest increases amongst the developed markets in July. Emerging markets decreased by 0.40% during July and are down 16.46% YTD in 2022. Pakistan (down 16.59%) and China (down 8.77%) saw the largest decreases amongst emerging markets in July, while Chile (up 12.24%) and India (up 9.14%) saw the largest increases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Japanese ETF and ETP asset growth as at the end of July 2022

The ETFs industry in Japan had 260 products, with 293 listings, assets of $459 Bn, from 18 providers on 3 exchanges at the end of July 2022.

Equity ETFs suffered net outflows of $345 Mn during July, bringing net inflows for the year through July 2022 to $4.63 Bn, lower than the $20.57 Bn in net inflows equity products had attracted for the year through July 2021. Fixed income ETFs suffered net outflows of $249 Mn during July, bringing YTD net inflows to $271 Mn, lower than the $685 Mn in net inflows fixed income products had suffered YTD in 2021. Commodities ETFs reported net outflows of $42 Mn during July, bringing YTD net outflows to $532 Mn, which is less than the $757 Mn in net outflows commodities products reported for the year through July 2021.

BOJ reported owning US$289 billion or 63% of the assets in the ETFs industry in Japan at the end of July 2022. During July 2022, the Bank of Japan did not purchase any ETF/ETP assets.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $1.80 Bn during July. NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund - Acc (1357 JP) gathered $474 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets July 2022: Japan

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund - Acc |

1357 JP |

1,496.24 |

220.11 |

474.38 |

|

Daiwa ETF NIKKEI 225 |

1320 JP |

26,638.33 |

(940.49) |

397.34 |

|

SMDAM NIKKEI225 ETF |

1397 JP |

794.19 |

131.35 |

162.28 |

|

Rakuten ETF-Nikkei 225 Double Inverse Index - Acc |

1459 JP |

320.90 |

126.83 |

123.12 |

|

Simplex - Nikkei Average Bear Double Exchange Trade Fund - Acc |

1360 JP |

378.21 |

75.72 |

117.23 |

|

Kokusai S&P500 VIX Short-Term Futures Index ETF - Acc |

1552 JP |

225.83 |

20.98 |

64.26 |

|

NZAM ETF Nikkei 225 |

2525 JP |

1,403.25 |

17.42 |

64.25 |

|

NEXT FUNDS TOPIX Exchange Traded Fund |

1306 JP |

122,057.97 |

3,342.03 |

59.82 |

|

NEXT FUNDS Nikkei 225 Inverse Index ETF |

1571 JP |

326.82 |

127.63 |

53.72 |

|

Daiwa ETF Japan Nikkei225 Inverse Index |

1456 JP |

79.98 |

47.57 |

41.47 |

|

NZAM ETF TOPIX |

2524 JP |

1,102.18 |

90.51 |

37.33 |

|

iShares Japan REIT ETF |

1476 JP |

2,547.89 |

208.77 |

37.02 |

|

iShares MSCI Japan High Dividend ETF |

1478 JP |

333.06 |

(128.05) |

26.62 |

|

iFreeETF NASDAQ100 JPY HEDGED |

2841 JP |

56.11 |

54.11 |

26.31 |

|

iShares 20 Year US Treasury Bond JPY Hedged ETF |

2621 JP |

65.36 |

7.71 |

24.57 |

|

Daiwa ETF Japan TOPIX Inverse (-1x) Index |

1457 JP |

131.18 |

91.61 |

23.05 |

|

iFreeETF NASDAQ100 Inverse |

2842 JP |

68.68 |

72.53 |

22.44 |

|

MAXIS J-REIT Core ETF |

2517 JP |

343.35 |

74.27 |

16.05 |

|

Daiwa ETF TOPIX |

1305 JP |

55,429.49 |

266.44 |

15.99 |

|

Listed Index Fund US Equity Dow Average Currency Hedged |

2562 JP |

277.60 |

75.08 |

14.81 |

Investors have tended to invest in leveraged inverse ETFs/ETPs during July.

.jpg)