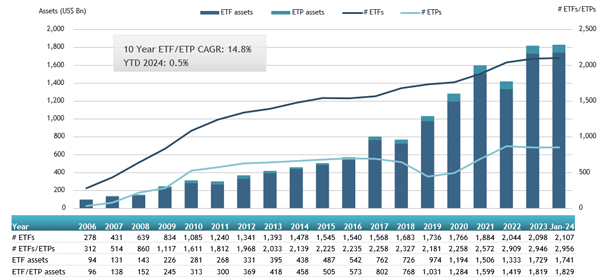

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that at the end of January the assets invested in the ETFs industry in Europe reached a new record of US$1.83 trillion. During January the ETFs industry in Europe gathered US$21.68 billion in net inflows. In the first month of 2024, assets invested in the ETFs industry in Europe increased by 0.5% going from US$1.82 trillion at the end of 2023 to US$1.83 trillion, according to ETFGI's January 2024 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the ETFs industry in Europe reached a record $1.83 Tn at the end of January beating the previous record of $1.82 Tn at the end of December 2023.

- Assets increased 0.5% in the first month of 2024, going from $1.82 Tn at end of 2023 to $1.83 Tn.

- Net inflows of $21.68 Bn in January.

- January net inflows of $21.68 Bn are 2nd highest on record after January net inflows of $29.12 Bn in 2022.

- 16th month of consecutive net inflows.

“The S&P 500 increased by 1.68% in January. Developed markets excluding the US decreased by 0.31% in January. Hong Kong (down 9.80%) and Korea (down 9.69%) saw the largest decreases amongst the developed markets in January. Emerging markets decreased by 3.46% during January. China (down 11.18%) and Chile (down 9.68%) saw the largest decreases amongst emerging markets in January”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

The ETFs industry in Europe had 2,956 products, with 12,076 listings, assets of $1.83 trillion, from 99 providers listed on 29 exchanges in 24 countries at the end of January.

During January, ETFs gathered net inflows to $21.68 Bn. Equity ETFs gathered net inflows of $13.76 Bn, higher than the $9.56 Bn in net inflows at this point in 2023. Fixed income ETFs had net inflows of $8.07 Bn during January, lower than the $8.94 Bn in net inflows at the end January 2023. Commodities ETFs/ETPs reported net outflows of $859.18 Mn during January, more than the $361.87 Mn in net outflows in January 2023. Active ETFs attracted net inflows of $730.75 Mn over the month, on par with the $729.71 Mn in net inflows in January 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $15.82 Bn during January. iShares Core S&P 500 UCITS ETF - Acc (CSSPX SW) gathered $3.01 Bn, the largest individual net inflow.

Top 20 ETFs by net inflows in January 2024: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

CSSPX SW |

75,956.98 |

3013.81 |

3,013.81 |

|

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

19,440.06 |

2079.63 |

2,079.63 |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

67,907.69 |

1338.54 |

1,338.54 |

|

SPDR S&P 500 UCITS ETF |

SPY5 GY |

9,337.97 |

1135.64 |

1,135.64 |

|

Vanguard S&P 500 UCITS ETF |

VUSA LN |

47,075.19 |

1091.79 |

1,091.79 |

|

iShares € High Yield Corp Bond UCITS ETF |

IHYG LN |

7,476.69 |

1031.66 |

1,031.66 |

|

Xtrackers II EUR Overnight Rate Swap UCITS ETF - 1C - Acc |

XEON GY |

5,889.66 |

720.56 |

720.56 |

|

iShares USD Treasury Bond 0-1yr UCITS ETF |

IBTU LN |

13,820.46 |

614.04 |

614.04 |

|

Seligson & Co OMX Helsinki 25 Exchange Traded Fund UCITS ETF - Acc |

H25ETF FH |

522.36 |

529.38 |

529.38 |

|

iShares $ TIPS UCITS ETF - Acc |

ITPS LN |

5,355.81 |

517.98 |

517.98 |

|

Xtrackers MSCI World ESG UCITS ETF - 1C - Acc |

XZW0 LN |

5,796.11 |

425.02 |

425.02 |

|

Xtrackers MSCI World Health Care UCITS ETF - Acc |

XDWH GY |

2,449.59 |

412.81 |

412.81 |

|

SPDR S&P 500 ESG Leaders UCITS ETF - Acc |

SPPY GY |

2,120.16 |

395.48 |

395.48 |

|

iShares MSCI ACWI UCITS ETF - Acc |

ISAC LN |

10,893.28 |

388.62 |

388.62 |

|

Vanguard FTSE All-World UCITS ETF |

VWRD LN |

22,152.86 |

375.33 |

375.33 |

|

Amundi S&P 500 II UCITS ETF |

LSPU LN |

10,299.51 |

373.20 |

373.20 |

|

JPMorgan US Research Enhanced Index Equity ESG UCITS ETF - Acc |

JREU LN |

5,646.65 |

360.73 |

360.73 |

|

iShares NASDAQ 100 UCITS ETF - Acc |

CSNDX SW |

12,765.28 |

343.92 |

343.92 |

|

iShares $ Treasury Bond 1-3yr UCITS ETF |

IBTS LN |

10,963.53 |

340.18 |

340.18 |

|

Xtrackers Artificial Intelligence & Big Data UCITS ETF - Acc |

XAIX GY |

2,144.91 |

336.05 |

336.05 |

The top 10 ETPs by net new assets collectively gathered $710.09 Mn during January. AMUNDI PHYSICAL GOLD ETC (C) - Acc (GOLD FP) gathered $289.06 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in January 2024: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

4,205.30 |

289.06 |

289.06 |

|

WisdomTree Copper - Acc |

COPA LN |

1,410.55 |

125.34 |

125.34 |

|

WisdomTree Core Physical Gold - Acc |

WGLD LN |

631.06 |

56.80 |

56.80 |

|

SG ETC FTSE MIB -3x Daily Short Collateralized - Acc |

MIB3S IM |

5.69 |

47.61 |

47.61 |

|

Leverage Shares 3x Tesla ETP - Acc |

TSL3 LN |

137.48 |

45.96 |

45.96 |

|

WisdomTree WTI Crude Oil - Acc |

CRUD LN |

813.78 |

39.99 |

39.99 |

|

WisdomTree Physical Bitcoin - Acc |

BTCW SW |

347.88 |

39.29 |

39.29 |

|

SG ETC DAX -3x Daily Short Collateralized - Acc |

DAX3S IM |

2.89 |

32.42 |

32.42 |

|

WisdomTree Carbon - Acc |

CARB LN |

227.28 |

19.35 |

19.35 |

|

iShares Physical Silver ETC - Acc |

SSLN LN |

516.17 |

14.29 |

14.29 |

Investors have tended to invest in Equity ETFs and ETPs during January.