ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in Thematic ETFs and ETPs listed globally reached a record US$394 billion at the end of February 2021. These products gathered net inflows of US$17.67 billion during February, bringing year-to-date net inflows to a record US$42.63 billion which is much higher than the US$13.33 billion gathered at this point last year, according to ETFGI’s February 2021 ETF and ETP Thematic industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Thematic ETFs and ETPs listed globally reached a record $393.67 Bn at the end of February

- During February Thematic ETFs and ETPs gathered net inflows of $17.67 Bn the second highest monthly net inflows on record, the record was $24.96 Bn gathered in January 2021.

YTD net inflows of $42.63 Bn are a record, surpassing the prior record of $13.33 Bn gathered at this point last year.

“Despite a sell-off in the last week of the month, the S&P 500 gained of 2.76% in February, driven by optimism on COVID-19 vaccines, as well as continued monetary and fiscal stimulus. Developed markets ex- the U.S. ended the month up 2.50% while Emerging markets were up by 1.50% for the month. The leaders of the developed market in February were Hong Kong (6.03%), Canada (5.66%) and Spain (5.32%).“ according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

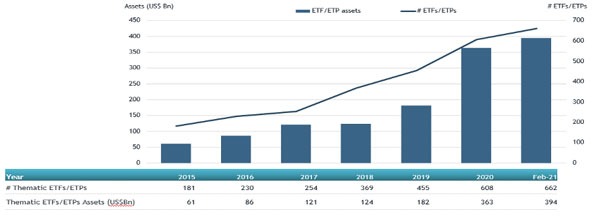

Global Thematic ETF and ETP asset growth as at end of February 2021

There were 662 thematic ETFs and ETPs listed globally, with 1,258 listings, assets of US$394 Bn, from 183 providers on listed on 48 exchanges in 40 countries at the end of February 2021. During February, 53 new Thematic ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$13.15 Bn at the end of February. ARK Innovation ETF (ARKK US) gathered $2.37 Bn.

Top 20 Thematic ETFs/ETPs by net new assets February 2021

|

Name |

Ticker |

Assets (US$ Mn) Feb-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) Feb-21 |

|

ARK Innovation ETF |

ARKK US |

23,431.99 |

5,465.72 |

2,368.57 |

|

ARK Fintech Innovation ETF |

ARKF US |

4,412.96 |

2,355.98 |

1689.80 |

|

ARK Web x.O ETF |

ARKW US |

8,075.87 |

2,412.75 |

1583.86 |

|

ARK Autonomous Technology & Robotics ETF |

ARKQ US |

3,609.34 |

1,794.19 |

877.96 |

|

ARK Genomic Revolution Multi-Sector ETF |

ARKG US |

10,486.05 |

3,293.29 |

858.24 |

|

Invesco Dynamic Leisure and Entertainment ETF |

PEJ US |

1,649.33 |

779.79 |

649.89 |

|

Global X Cybersecurity ETF |

BUG US |

838.47 |

695.41 |

620.42 |

|

ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

2,518.23 |

711.55 |

515.75 |

|

FlexShares Morningstar Global Upstream Natural Resources Index Fund |

GUNR US |

4,264.49 |

465.27 |

480.74 |

|

Amplify Transformational Data Sharing ETF |

BLOK US |

1,091.22 |

543.51 |

409.32 |

|

AdvisorShares Pure US Cannabis ETF |

MSOS US |

1,019.40 |

708.03 |

375.75 |

|

China Southern CSI New Energy ETF |

516160 CH |

348.04 |

375.26 |

375.26 |

|

3D Printing ETF |

PRNT US |

611.44 |

499.12 |

359.37 |

|

Invesco Elwood Global Blockchain UCITS ETF - Acc |

BCHN LN |

1,016.37 |

434.15 |

316.32 |

|

Lyxor S&P Eurozone Paris-Aligned Climate (EU PAB) (DR) UCITS ETF - Acc |

EPAB FP |

673.42 |

327.14 |

313.96 |

|

Global X U.S. Infrastructure Development ETF |

PAVE US |

1,510.39 |

658.38 |

304.59 |

|

Global X Lithium & Battery Tech ETF |

LIT US |

2,805.97 |

960.52 |

274.98 |

|

iShares Ageing Population UCITS ETF - Acc |

AGES LN |

678.26 |

292.47 |

274.10 |

|

ChinaAMC CSI 5G Communications Theme ETF |

515050 CH |

3,110.98 |

21.96 |

252.83 |

|

First Trust NASDAQ Clean Edge Green Energy Index Fund |

QCLN US |

2,947.16 |

982.21 |

251.22 |