ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today the global ETFs industry gathered US$136.17 billion in net inflows in June 2024, bringing year to date net inflows to a record US$730.36 billion, according to ETFGI's June 2024 global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted)

Highlights

- We expect 2024 to be a record year for net inflows and for assets invested in the global ETFs industry

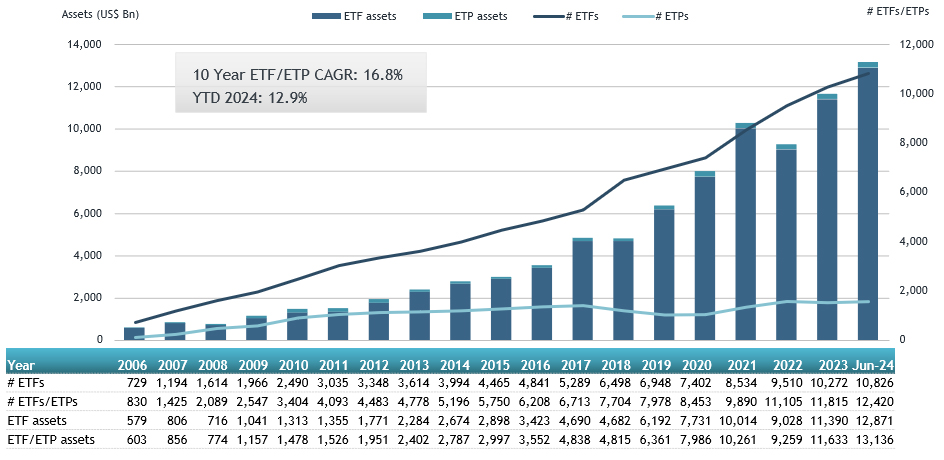

- Assets invested in the global ETFs industry reached a new record of $13.14 Tn at the end of June beating the previous record of $12.89 Tn at the end of May 2024.

- Assets have increased 12.9% YTD in 2024, going from $11.63 Tn at end of 2023 to $13.14 Tn.

- Net inflows of $136.17 Bn during June.

- YTD net inflows of $730.36 Bn is the highest on record, while the second highest recorded YTD net inflows was of $658.86 Bn in 2021 and the third highest recorded YTD net inflows of 462.53 Bn in 2022.

- 61st month of consecutive net inflows.

“The S&P 500 index increased 3.59% in June and is up 15.29% YTD in 2024. The developed markets excluding the US index decreased by 1.40% in June while it is up 4.60% YTD in 2024. France (down 7.88%) and Portugal (down 6.39%) saw the largest decreases amongst the developed markets in June. The emerging markets index increased by 2.97% during June and is up 8.09% YTD in 2024. Taiwan (up 10.09%) and South Africa (up 9.91%) saw the largest increases amongst emerging markets in June.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Asset growth in the Global ETFs industry at the end of June

The Global ETFs industry had 12,420 products, with 24,891 listings, assets of $13.14 trillion, from 758 providers listed on 80 exchanges in 63 countries at the end of June.

During June, ETFs industry gathered net inflows of $136.17 Bn. Equity ETFs reported net inflows of $81.21 Bn in June, bringing YTD net inflows to $410.33 Bn, higher than the $162.22 Bn YTD net in 2023. Fixed income ETFs reported net inflows of $26.56 Bn during June, bringing YTD net inflows to $138.12 Bn, lower than the $141.96 Bn YTD net inflows in 2023. Commodities ETFs reported net inflows of $1.61 Bn during June, bringing YTD net outflows to $6.12 Bn, greater than the $1.41 Bn in net outflows YTD in 2023. Active ETFs attracted net inflows of $28.85 Bn over the month, gathering net inflows for the year of $154.00 Bn, significantly higher than the $70.48 Bn in net inflows YTD in 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $53.62 Bn during June. iShares Core S&P 500 ETF (IVV US) gathered $13.56 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows June 2024: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

iShares Core S&P 500 ETF |

|

IVV US |

484,879.09 |

30,460.37 |

13,555.23 |

|

iShares 20+ Year Treasury Bond ETF |

|

TLT US |

53,173.94 |

5,253.86 |

4,832.69 |

|

Invesco QQQ Trust |

|

QQQ US |

288,022.09 |

17,248.79 |

4,287.82 |

|

iShares S&P 500 Growth ETF |

|

IVW US |

52,740.04 |

7,015.63 |

3,918.80 |

|

iShares MSCI EAFE Growth ETF |

|

EFG US |

14,631.77 |

3,321.63 |

2,732.37 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

|

LQD US |

30,837.82 |

60.14 |

2,541.95 |

|

Huatai-Pinebridge CSI 300 ETF |

|

510300 CH |

29,146.65 |

10,830.58 |

2,273.03 |

|

CCB Cash TianYi Traded Money Market Fund - Acc |

|

511660 CH |

1,905.18 |

1,838.64 |

1,937.77 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

116,296.35 |

6,446.42 |

1,859.23 |

|

Invesco MSCI Global Climate 500 ETF |

|

KLMT US |

1,618.82 |

1,621.77 |

1,621.77 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

404,463.49 |

14,401.21 |

1,620.38 |

|

GraniteShares 2x Long NVDA Daily ETF |

|

NVDL US |

4,723.33 |

2,485.64 |

1,610.77 |

|

BMO Aggregate Bond Index ETF |

|

ZAG CN |

6,764.74 |

1,933.53 |

1,509.94 |

|

Vanguard FTSE Developed Markets ETF |

|

VEA US |

132,172.15 |

6,199.78 |

1,500.47 |

|

SPDR Portfolio S&P 500 ETF |

|

SPLG US |

39,710.52 |

9,545.13 |

1,384.42 |

|

Yuanta/P-shares Taiwan Top 50 ETF |

|

0050 TT |

12,739.77 |

36.33 |

1,371.62 |

|

Blackrock US Equity Factor Rotation ETF |

|

DYNF US |

9,707.26 |

8,844.46 |

1,308.13 |

|

Global X Russell 2000 ETF |

|

RSSL US |

1,301.60 |

1,291.26 |

1,291.26 |

|

Vanguard Russell 1000 Growth |

|

VONG US |

22,043.65 |

1,513.69 |

1,235.63 |

|

iShares MSCI USA ESG Enhanced UCITS ETF |

|

EEDS LN |

18,138.47 |

1,452.74 |

1,227.75 |

The top 10 ETPs by net new assets collectively gathered $2.33 Bn over June iShares Silver Trust (SLV US) gathered $701.80 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows June 2024: Global

|

Name |

|

Ticker |

Asset |

NNA |

NNA |

|

|

SLV US |

12,842.97 |

51.85 |

701.80 |

|

|

iShares Physical Gold ETC - Acc |

|

SGLN LN |

15,213.37 |

(269.68) |

428.40 |

|

WisdomTree Brent Crude Oil - Acc |

|

BRNT LN |

930.86 |

(872.25) |

336.82 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

|

GOLD FP |

4,609.68 |

91.44 |

301.18 |

|

Invesco Physical Gold ETC - Acc |

|

SGLD LN |

15,297.97 |

(1,314.15) |

161.87 |

|

Hashdex Nasdaq Crypto Index Europe ETP |

|

HASH SW |

112.58 |

90.46 |

98.51 |

|

ProShares Ultra Silver |

|

AGQ US |

570.85 |

32.16 |

82.80 |

|

MERITZ SECURITIES MERITZ KIS CD RATE ETN 63 |

|

610063 KS |

761.72 |

366.26 |

75.79 |

|

Korea Investment & Securities KIS lnverse2X Nasdaq100 ETN B 103 |

|

570103 KS |

71.66 |

71.66 |

71.66 |

|

WisdomTree Core Physical Gold - Acc |

|

WGLD LN |

835.54 |

172.77 |

66.61 |

Investors have tended to invest in Equity ETFs/ETPs during June.