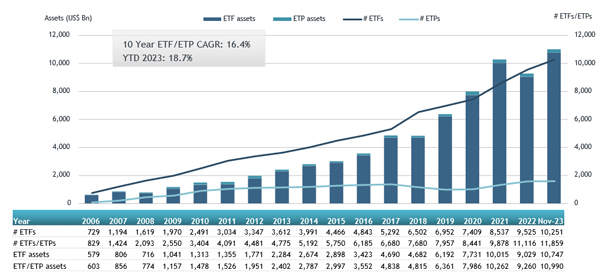

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reports today that asset invested in the Global ETFs industry reached a new milestone US$10.99 trillion at the end of November. During November the global ETFs industry gathered US$140.46 billion in net inflows, bringing year to date net inflows to US$803.11 billion. Assets invested in the global ETFs industry have increased 18.7% year -to-date, going from US$9.26 trillion at end of 2022 to US$10.99 trillion, according to ETFGI's November 2023 global ETFs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted)

Highlights

- Assets invested in the global ETFs industry reached a new milestone of $10.99 Tn at the end of November beating the previous record of $10.86 Tn at the end of July 2023.

- Assets have increased 18.7% YTD, going from $9.26 Tn at end of 2022 to $10.99 Tn.

- Net inflows of $140.46 Bn during November.

- YTD net inflows of $803.11 Bn are the second highest on record, after YTD net inflows of $1.14 Tn in 2021.

- 54th month of consecutive net inflows.

“The S&P 500 index was up 9.13% in November and is up 20.8% YTD in 2023. Developed markets excluding the US index increased by 9.75% in November and is up 11.65% YTD in 2023. Israel (up 19.37%) and Sweden (up 18.02%) saw the largest decreases amongst the developed markets in November. Emerging markets increased by 7.19% during November and were up 6.98% YTD in 2023. Egypt (up 14.64%) and Brazil (up 14.15%) saw the largest increases amongst emerging markets in November.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

The Global ETFs industry had 11,859 products, with 23,931 listings, assets of $10.990 trillion, from 718 providers listed on 81 exchanges in 63 countries at the end of November.

During November, ETFs gathered net inflows of $140.46 Bn. Equity ETFs reported net inflows of $74.49 Bn during November, bringing YTD net inflows to $397.37 Bn, lower than the $444.30 Bn YTD net inflows in 2022. Fixed income ETFs gathered net inflows of $32.44 Bn during November, bringing YTD net inflows to $249.98 Bn, higher than the $217.60 Bn YTD net inflows gathered in 2022. Commodities ETFs/ETPs reported net outflows of $1.85 Bn during November, bringing YTD net outflows to $14.10 Bn, slightly less than the $14.63 Bn in net outflows YTD in 2022. Active ETFs attracted net inflows of $34.82 Bn during the month, gathering net inflows for the year of $166.94 Bn, higher than the $110.25 Bn YTD net inflows in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $62.70 Bn during November. Vanguard S&P 500 ETF (VOO US) gathered $6.54 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows November 2023: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

|

VOO US |

354,465.49 |

39,522.96 |

6,542.79 |

|

iShares Core S&P 500 ETF |

|

IVV US |

374,646.69 |

32,698.71 |

6,315.80 |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

435,626.77 |

11,252.96 |

6,229.14 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

|

HYG US |

17,029.49 |

693.14 |

5,382.86 |

|

Dimensional Global Core Equity Trust Managed Fund |

|

DGCE AU |

3,879.86 |

3,879.86 |

3,879.86 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

326,912.41 |

19,126.06 |

3,645.38 |

|

Dimensional Australian Core Equity Trust Managed Fund |

|

DACE AU |

2,995.65 |

2,995.65 |

2,995.65 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

95,615.84 |

13,898.46 |

2,828.49 |

|

iShares Core € Corp Bond UCITS ETF |

|

IEBC LN |

16,664.23 |

4,593.00 |

2,693.28 |

|

iShares 20+ Year Treasury Bond ETF |

|

TLT US |

45,980.76 |

22,509.40 |

2,561.15 |

|

MIRAE ASSET TIGER SYNTH-KOFR ACTIVE ETF |

|

449170 KS |

4,144.62 |

4,106.14 |

2,380.86 |

|

Vanguard Information Technology ETF |

|

VGT US |

57,678.94 |

7,280.90 |

2,034.29 |

|

Fidelity Enhanced Large Cap Growth ETF |

|

FELG US |

2,023.56 |

2,027.44 |

2,027.44 |

|

SPDR Bloomberg Barclays High Yield Bond ETF |

|

JNK US |

8,075.25 |

(1,415.97) |

1,986.80 |

|

Technology Select Sector SPDR Fund |

|

XLK US |

55,448.77 |

(351.49) |

1,980.80 |

|

iShares J.P. Morgan USD Emerging Markets Bond ETF |

|

EMB US |

14,782.62 |

192.45 |

1,931.91 |

|

Invesco QQQ Trust |

|

QQQ US |

217,642.20 |

6,350.49 |

1,890.34 |

|

Fidelity Enhanced Large Cap Core ETF |

|

FELC US |

1,883.91 |

1,883.70 |

1,883.70 |

|

Fidelity Enhanced Large Cap Value ETF |

|

FELV US |

1,777.71 |

1,770.66 |

1,770.66 |

|

Vanguard Total Bond Market ETF |

|

BND US |

99,870.51 |

15,821.43 |

1,740.03 |

The top 10 ETPs by net new assets collectively gathered $2.62 Bn over November.

SPDR Gold Shares (GLD US) gathered $1.09 Bn, the largest individual net inflow.

Top 10 ETPs by net new inflows November 2023: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

|

GLD US |

57,341.98 |

(2,161.99) |

1,088.03 |

|

|

ProShares Ultra DJ-UBS Natural Gas |

|

BOIL US |

858.24 |

1,815.36 |

508.62 |

|

ProShares Ultra VIX Short-Term Futures |

|

UVXY US |

387.93 |

620.16 |

245.44 |

|

United States Natural Gas Fund LP |

|

UNG US |

976.41 |

1,130.65 |

189.50 |

|

BTCetc – ETC Group Physical Bitcoin - Acc |

|

BTCE GY |

1,022.44 |

402.20 |

175.08 |

|

WisdomTree WTI Crude Oil - Acc |

|

CRUD LN |

721.13 |

(128.64) |

123.35 |

|

WisdomTree Copper - Acc |

|

COPA LN |

1,256.60 |

824.46 |

95.24 |

|

ProShares Ultra DJ-UBS Crude Oil |

|

UCO US |

641.87 |

(310.88) |

78.57 |

|

CoinShares Physical Bitcoin - Acc |

|

BITC SW |

502.07 |

105.26 |

65.23 |

|

21Shares Bitcoin ETP - Acc |

|

ABTC SW |

474.12 |

128.27 |

54.62 |

Investors have tended to invest in Equity ETFs/ETPs during November.