ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in the global ETFs and ETPs industry extended its lead over the global hedge fund industry to US$2.54 trillion at the end of Q3 2019, an increase of 2.52% since of Q2 2019. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in global ETFs and ETPs industry extend lead over assets in global hedge fund industry to $2.54 trillion at the end of September

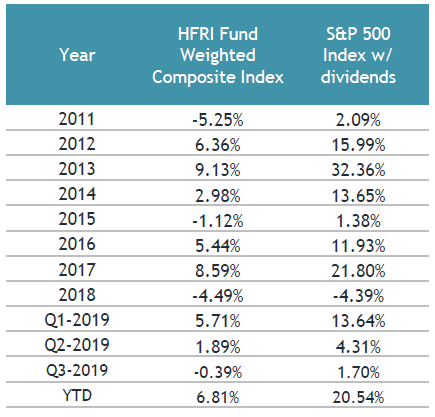

- Year to date through the end of Q3 the HFRI Fund Weighted Composite Index has returned 6.81% underperforming the S&P 500 Index with dividends which has delivered 20.54%

-

Hedge fund suffered net outflows of $6.8 billion in Q3 while ETFs/ETPs gathered net inflows of $140.79 billion

Assets invested in the global ETF/ETP industry first surpassed those invested in the hedge fund industry at the end of Q2 2015, as ETFGI had forecasted. Growth in assets in the ETF/ETP industry has outpaced growth in the hedge fund industry since the financial crisis in 2008. According to ETFGI’s analysis a record $5.78 trillion were invested in 7,787 ETFs/ETPs listed globally at the of Q3 2019, representing growth in assets of 2.52% over the quarter. Over the same period assets invested in hedge funds globally shrunk by 0.17%, to $3.24 trillion in 8,242 hedge funds, according to a report by Hedge Fund Research.

During the third quarter of 2019, ETFs/ETPs listed globally gathered $140.79 billion in net inflows, according to ETFGI’s Global ETF and ETP industry insights report. In contrast, HFR reported that hedge fund suffered net outflows of $6.8 billion in Q3 2019.

Growth in global ETF/ETP and global hedge fund assets, as at end of September 2019

In Q3 2019 the performance of the HFRI Fund Weighted Composite Index was down 0.39%; which is less than the 1.70% return of the S&P 500 Index with dividends. This is the first time this year that the performance of the HFRI Fund Weighted Composite Index fell into negative territory. Year to date through the end of Q3 the HFRI Fund Weighted Composite Index has returned 6.81% underperforming the S&P 500 Index with dividends which has delivered 20.54%.

Sources: Hedge Fund Research HFR, ETFGI