ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed Globally gathered net inflows of US$68.95 billion in June, bringing year-to-date net inflows to US$209.54 billion. Assets invested in the Global ETF/ETP industry have increased by 6.1%, from US$5.31 trillion at the end of May, to US$5.64 trillion setting a new record, according to ETFGI's June 2019 Global ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Asset invested in the Global ETF/ETP industry reached a record $5.64 Trillion.

- Asset invested in the Global ETF/ETP industry increased 6.1% in June.

- June 2019, ETFs/ETPs listed Globally saw $68.95 Bn in net inflows.

“Global equities rebounded from prior month losses, with 45 of 49 countries in S+P’s global index posting gains. The S&P 500 gained 7.1% in June (up 4.3% Q2 and up 18.7% H1), bolstered by a dovish Federal Reserve sentiment and optimism surrounding a potential trade deal during the G20 talks contributed to a rebound in U.S. equities with the S&P 500 finishing near all-time high. This trend was followed in the Eurozone and Japanese markets” according to Deborah Fuhr, managing partner and founder of ETFGI.

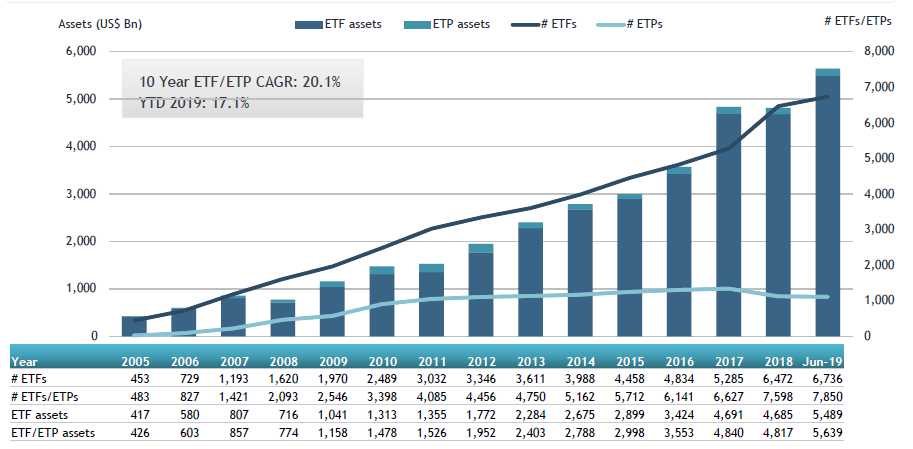

Growth in Global ETF and ETP assets as of the end of June 2019

Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources and data generated in-house.

At the end of June 2019, the Global ETF/ETP industry had 7,850 ETFs/ETPs, with 15,731 listings, assets of US$5.64 Tn, from 420 providers listed on 71 exchanges in 58 countries.

In June 2019, ETFs/ETPs gathered net inflows of US$68,953 Mn. Fixed income ETFs/ETPs listed Globally attracted net inflows of $33.87 Bn in June, bringing net inflows for 2019 to $113.26 Bn, considerably greater than the $46.61 Bn in net inflows fixed income products had attracted by the end of June 2018. Equity ETFs/ETPs listed Globally attracted net inflows of $26.80 Bn in June, bringing net inflows for 2019 to $78.69 Bn, substantially less than the $149.45 Bn in net inflows equity products had attracted by the end of June 2018. Commodity ETFs/ETPs gathered $5.57 Bn bringing net inflows to $3.50 Bn for 2019 which is greater than the $1.01 Bn in net inflows gathered through June 2018.

Substantial inflows can be attributed to the top 20 ETF's by net new assets, which collectively gathered $38.83 Bn in June, the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD US) gathered $4.54 Bn alone.

Top 20 ETFs by net new assets June 2019: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares iBoxx $ Investment Grade Corp Bond ETF |

LQD US |

36,999.68 |

4,157.28 |

4,539.55 |

|

iShares Short Treasury Bond ETF |

SHV US |

24,595.27 |

3,832.42 |

4,064.91 |

|

SPDR S&P 500 ETF Trust |

SPY US |

268,585.32 |

(11,914.46) |

3,761.21 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

17,598.68 |

3,379.83 |

2,967.84 |

|

Vanguard S&P 500 ETF |

VOO US |

115,721.67 |

9,290.93 |

2,487.70 |

|

iShares 7-10 Year Treasury Bond ETF |

IEF US |

16,873.73 |

5,937.51 |

2,262.45 |

|

Polaris Taiwan Top 50 ETF |

0050 TT |

4,456.11 |

1,900.50 |

2,255.20 |

|

TOPIX Exchange Traded Fund |

1306 JP |

84,722.00 |

8,980.42 |

2,198.55 |

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

12,489.26 |

3,605.33 |

2,016.45 |

|

Invesco QQQ Trust |

QQQ US |

74,329.41 |

462.36 |

1,766.74 |

|

Listed Index Fund TOPIX |

1308 JP |

38,553.39 |

4,772.92 |

1,301.17 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

64,060.39 |

4,145.55 |

1,227.12 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

65,775.57 |

7,237.59 |

1,181.62 |

|

iShares Short-Term Corporate Bond ETF |

IGSB US |

12,439.53 |

1,807.44 |

1,091.18 |

|

iShares € High Yield Corp Bond UCITS ETF |

IHYG LN |

8,353.02 |

2,546.43 |

1,001.83 |

|

SPDR Bloomberg Barclays Intermediate Term Treasury ETF |

ITE US |

1,706.19 |

1,068.51 |

964.32 |

|

Vanguard Mortgage-Backed Securities ETF |

VMBS US |

9,831.89 |

2,060.23 |

960.09 |

|

Vanguard Total Bond Market ETF |

BND US |

41,516.80 |

3,280.85 |

948.34 |

|

Consumer Staples Select Sector SPDR Fund |

XLP US |

11,935.86 |

962.27 |

926.35 |

|

iShares MSCI USA Minimum Volatility ETF |

USMV US |

28,604.14 |

5,807.16 |

911.56 |

The top 10 ETP's by net new assets collectively gathered $5.83 Bn in June. The SPDR Gold Shares (GLD US) gathered $2.24 Bn alone.

Top 10 ETPs by net new assets June 2019: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

34,945.36 |

422.89 |

2,240.94 |

|

ETFS Physical Swiss Gold |

SGBS LN |

1,981.70 |

1,096.78 |

991.90 |

|

iShares Physical Gold ETC |

SGLN LN |

5,542.67 |

750.41 |

899.26 |

|

iShares Gold Trust |

IAU US |

13,346.62 |

659.88 |

537.28 |

|

Invesco Gold ETC |

SGLD LN |

6,460.40 |

954.27 |

239.82 |

|

Amundi Physical Metals PLC |

GOLD FP |

323.15 |

305.29 |

234.60 |

|

VelocityShares Daily 3x Long Natural Gas ETN |

UGAZ US |

580.22 |

627.09 |

200.87 |

|

iShares Silver Trust |

SLV US |

4,919.27 |

99.77 |

171.27 |

|

Xtrackers Physical Gold ETC |

XGLD LN |

961.50 |

129.93 |

157.35 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

779.60 |

810.98 |

154.49 |

Investors have tended to invest in Fixed Income and equity ETFs in June.