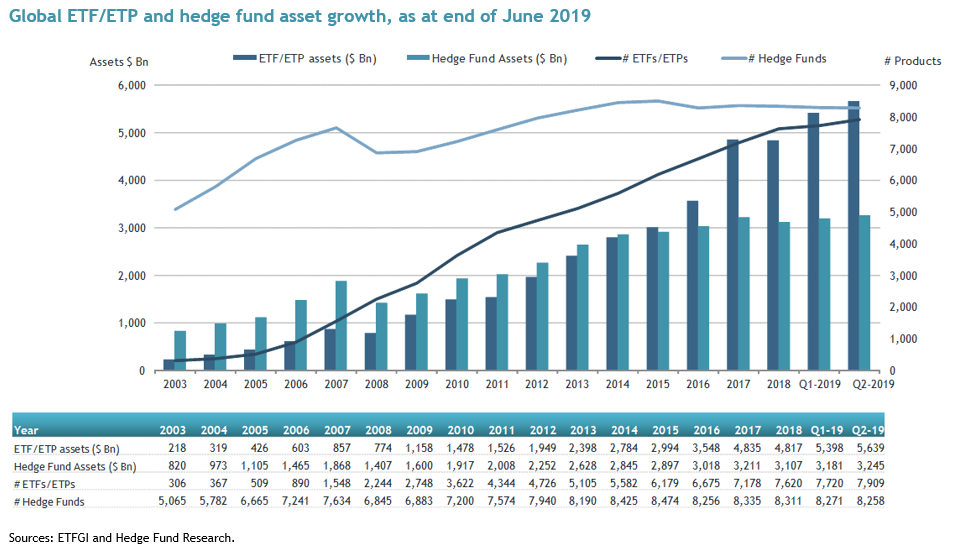

ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed Globally extended their lead over assets invested in the global hedge fund industry to US$2.39 trillion at the end of Q2 2019, an increase of 7.98% over the gap at the end of Q1 2019, according to ETFGI’s Q2 2019 Global ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in global ETF/ETP industry extended lead over assets in global hedge fund industry to US$2.39 trillion at the end of June 2019.

- Assets invested in the Global ETF/ETP industry reached a record US$5.64 trillion.

- 4.46% growth in assets invested in ETFs/ETPs over Q2 2019 outpaces 2.01% growth in assets in hedge funds over the same period. In contrast, growth over Q1 2019 was 12% and 2.38%, respectively.

- US$5.64 trillion invested in 7,909 ETFs/ETPs listed globally at end of Q2 2019.

- US$3.25 trillion invested in 8,258 Hedge Funds listed globally at end of Q2 2019.

The Global Hedge Fund industry saw assets rise to US$3.25 trillion, with net outflows of US$4.9 billion during the quarter (source HFR). According to analysis by ETFGI, US$5.64 Tn were invested in 7,909 ETFs/ETPs listed globally at the end of Q2 2019 representing growth in assets of 4.46%. Over the same period Hedge Fund assets reached a new record level of US$3.25 Tn representing growth in assets of 2.01%according to a report by Hedge Fund Research.

The HFRI Fund weighted composite index returned 7.44% in the first half of 2019, the strongest first half since 2009. Growth in assets in the ETF/ETP industry has outpaced growth in the hedge fund industry since the financial crisis in 2008. In Q2 2019 the return of the S&P 500 Index was better than the performance of the HFRI Fund weighted Composite index: 4.31% vs 1.89%, respectively.

During the second quarter of 2019, ETFs/ETPs listed globally gathered US$209.50 Bn in net inflows, according to ETFGI’s Global ETF and ETP industry insights report. In contrast, HFR reported net outflows of US$4.90 Bn into hedge funds over the same period.