ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that assets invested in the European ETF industry reached a record high of $2.47 trillion at the end of April. Year-to-date (YTD) net inflows of $118.60 billion mark the highest on record, according to ETFGI's April 2025 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in the European ETF industry reached a record high of $2.47 trillion at the end of April, surpassing the previous peak of $2.41 trillion recorded at the end of February 2025.

- Net inflows of $19.56 Bn in April 2025.

- Year-to-date (YTD) net inflows of $118.60 billion mark the highest on record, surpassing the previous highs of $78.84 billion in 2021 and $66.83 billion in 2022, which rank as the second and third highest, respectively.

- 31st month of consecutive net inflows.

The S&P 500 Index declined by 0.68% in April and is down 4.92% year-to-date (YTD) in 2025. In contrast, the Developed Markets Ex-U.S. Index rose 4.86% in April and is up 10.85% YTD. Among developed markets, Spain and Portugal posted the strongest gains in April, rising 8.65% and 7.67%, respectively. The Emerging Markets Index increased by 0.88% during April and is up 1.80% YTD. Within emerging markets, Hungary led with a 10.78% gain, followed closely by Mexico at 10.40%," said Deborah Fuhr, Managing Partner, Founder, and Owner of ETFGI.

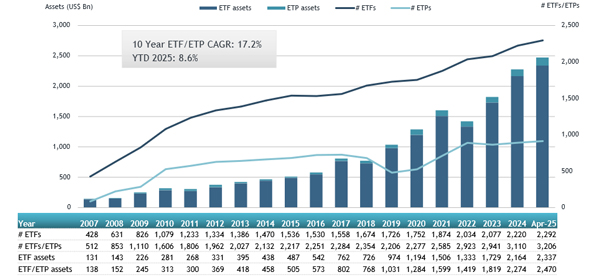

Growth in assets in the ETFs industry in Europe as of the end of April

The ETFs industry in Europe has 3,206 products, with 13,541 listings, assets of $2.47 Tn, from 124 providers listed on 29 exchanges in 24 countries at the end of April.

In April, ETFs recorded net inflows of $19.56 billion. Equity ETFs led the way with $16.55 billion in net inflows during the month, bringing year-to-date (YTD) inflows to $88.70 billion—nearly double the $45.35 billion recorded by the same point in 2024. Fixed income ETFs attracted $2.10 billion in April, with YTD inflows reaching $15.76 billion, slightly below the $16.30 billion seen by the end of April 2024. Commodity ETFs experienced net outflows of $1.47 billion in April; however, YTD inflows stand at $3.99 billion, a significant turnaround from the $6.20 billion in YTD outflows reported in 2024. Active ETFs gathered $1.84 billion in April, pushing YTD inflows in Europe to $8.48 billion—well above the $2.49 billion recorded during the same period last year

A significant portion of April’s net inflows can be attributed to the top 20 ETFs by net new assets, which collectively attracted $14.89 billion. Leading the group was the Vanguard FTSE All-World UCITS ETF (VWRD LN), which recorded the highest individual net inflow of $1.89 billion.

Top 20 ETFs by net new assets April 2025

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

VWRD LN |

37,080.53 |

4,730.35 |

1,891.00 |

|

|

iShares Core MSCI World UCITS ETF |

IWDA LN |

99,934.65 |

6,068.08 |

1,853.82 |

|

Vanguard S&P 500 UCITS ETF |

VUSA LN |

63,063.87 |

3,513.54 |

1,031.37 |

|

Xtrackers II EUR Overnight Rate Swap UCITS ETF - 1C |

XEON GY |

19,876.18 |

4,102.54 |

1,001.86 |

|

Amundi Stoxx Europe 600 UCITS ETF - Acc |

MEUD FP |

12,797.07 |

2,449.82 |

831.99 |

|

iShares Core S&P 500 UCITS ETF |

CSSPX SW |

109,034.18 |

4,532.93 |

772.38 |

|

WisdomTree Europe Defence UCITS ETF |

WDEF IM |

1,564.11 |

1,477.71 |

713.42 |

|

iShares MSCI USA ESG Screened UCITS ETF |

SASU LN |

12,179.88 |

3,068.46 |

710.13 |

|

iShares MSCI ACWI UCITS ETF |

SSAC LN |

18,660.73 |

1,590.08 |

680.03 |

|

iShares Core EURO STOXX 50 UCITS ETF (DE) |

SX5EEX GY |

9,209.51 |

192.62 |

673.88 |

|

BNP Paribas Easy MSCI Europe Min TE |

EEUE FP |

2,827.52 |

1,739.60 |

596.42 |

|

UBS ETF US Equity Defensive Covered Call SF UCITS ETF |

SPXCC SW |

554.70 |

531.87 |

526.83 |

|

Xtrackers MSCI World ex USA UCITS ETF |

EXUS LN |

2,044.74 |

1,489.78 |

522.51 |

|

Xtrackers II Eurozone Government Bond 1-3 UCITS ETF 1C |

DBXP GY |

2,858.16 |

1,195.18 |

474.64 |

|

iShares MSCI Europe UCITS ETF EUR (Dist) |

IMEU LN |

10,883.35 |

1,113.02 |

463.47 |

|

Amundi EURO STOXX 50 II UCITS ETF |

MSE FP |

4,165.33 |

504.75 |

440.65 |

|

Amundi MSCI Japan DR UCITS ETF - Acc |

LCUJ GY |

5,199.76 |

843.96 |

436.90 |

|

SPDR S&P 500 Leaders UCITS ETF |

SPPY GY |

4,202.88 |

(288.66) |

430.16 |

|

Invesco MDAX UCITS ETF - Acc |

DEAM GY |

1,488.87 |

1,163.22 |

421.63 |

|

Vanguard FTSE Developed Europe ex UK UCITS ETF |

VERX LN |

3,842.16 |

738.86 |

421.57 |

The top 10 ETPs by net new assets collectively attracted $1.18 billion in April. The AMUNDI PHYSICAL GOLD ETC (C) - Acc (GOLD FP) led the group with the largest individual net inflow of $391.18 million.

Top 10 ETPs by net new assets April 2025

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

7,895.64 |

895.96 |

391.18 |

|

iShares Bitcoin ETP |

IB1T GY |

207.88 |

197.48 |

121.98 |

|

Xtrackers Physical Gold Euro Hedged ETC |

XAD1 GY |

1,641.29 |

50.94 |

118.38 |

|

Xetra Gold EUR |

4GLD GY |

18,624.11 |

797.86 |

103.48 |

|

iShares Physical Gold GBP Hedged ETC - GBP Hdg |

IGLG LN |

149.20 |

104.07 |

101.06 |

|

WisdomTree WTI Crude Oil |

CRUD LN |

502.44 |

36.97 |

85.91 |

|

21Shares XRP ETP |

AXRP SW |

594.84 |

181.00 |

76.77 |

|

WisdomTree NASDAQ 100 3x Daily Leveraged |

QQQ3 LN |

416.41 |

141.78 |

68.43 |

|

WisdomTree Physical Silver |

PHAG LN |

1,978.07 |

453.30 |

57.22 |

|

WisdomTree Physical Gold - EUR Daily Hedged |

GBSE GY |

646.37 |

68.44 |

51.34 |

Investors have tended to invest in Equity ETFs during April.