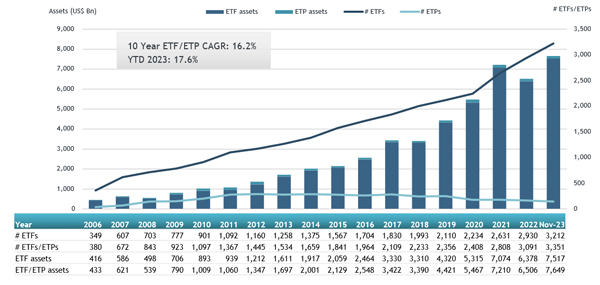

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reports assets invested in the ETFs industry in the United States reached a new milestone of US$7.65 trillion at the end of November. During November net inflows of US$101.4 billion were gathered, bringing year-to-date net inflows to US$473.96 billion. Assets have increased 17.6% YTD in 2023, going from US$6.51 trillion at end of 2022 to US$7.65 trillion, according to ETFGI's November 2023 US ETFs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the ETFs industry in the United States reached a new milestone of $7.65 Tn at the end of November beating the previous record of $7.6 Tn set at the end of July 2023.

- Assets invested in the ETFs industry have increased 17.6% YTD in 2023, going from $6.51 Tn at end of 2022 to $7.65 Tn.

- Net inflows of $101.4 Bn during November.

- YTD net inflows of $473.96 Bn are the 3rd highest, the highest YTD net inflows was $803.41 Bn in 2021 then $561.79 Bn in net inflows YTD in 2022.

- 19th month of consecutive net inflows.

“The S&P 500 index increased by 9.13% in November and was up by 20.8% YTD in 2023. Developed markets excluding the US increased by 9.75% in November and are up 11.65% YTD in 2023. Israel (up 19.37%) and Sweden (up 18.02%) saw the largest increases amongst the developed markets in November. Emerging markets increased by 7.19% during November and are up 6.98% YTD in 2023. Egypt (up 14.64%) and Brazil (up 14.15%) saw the largest increases amongst emerging markets in November.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

The ETFs industry in the United States had 3,351 products, assets of $7.649 trillion, from 303 providers listed on 3 exchanges.

During November, ETFs gathered net inflows of $101.4 Bn. Equity ETFs gathered net inflows of $55.39 Bn during November, bringing YTD net inflows to $206.21 Bn, lower than the $283.81 Bn in net inflows YTD in 2022. Fixed income ETFs reported net inflows of $22.43 Bn during November, bringing YTD net inflows to $151.93 Bn, lower than the $172.03 Bn in net inflows YTD in 2022. Commodities ETFs/ETPs reported net inflows of $450 Mn during November, bringing YTD net outflows to $7.78 Bn, significantly more than the $6.11 Bn in net outflows YTD in 2022. Active ETFs attracted net inflows of $22.43 Bn during the month, gathering YTD net inflows of $122.14 Bn, much higher than the $87.12 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $56.91 Bn during November. Vanguard S&P 500 ETF (VOO US) gathered $6.54 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets November 2023: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

VOO US |

354,465.49 |

39,522.96 |

6,542.79 |

|

iShares Core S&P 500 ETF |

IVV US |

374,646.69 |

32,698.71 |

6,315.80 |

|

SPDR S&P 500 ETF Trust |

SPY US |

435,626.77 |

11,252.96 |

6,229.14 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

17,029.49 |

693.14 |

5,382.86 |

|

Vanguard Total Stock Market ETF |

VTI US |

326,912.41 |

19,126.06 |

3,645.38 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

95,615.84 |

13,898.46 |

2,828.49 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

45,980.76 |

22,509.40 |

2,561.15 |

|

Vanguard Information Technology ETF |

VGT US |

57,678.94 |

7,280.90 |

2,034.29 |

|

Fidelity Enhanced Large Cap Growth ETF |

FELG US |

2,023.56 |

2,027.44 |

2,027.44 |

|

SPDR Bloomberg Barclays High Yield Bond ETF |

JNK US |

8,075.25 |

(1,415.97) |

1,986.80 |

|

Technology Select Sector SPDR Fund |

XLK US |

55,448.77 |

(351.49) |

1,980.80 |

|

iShares J.P. Morgan USD Emerging Markets Bond ETF |

EMB US |

14,782.62 |

192.45 |

1,931.91 |

|

Invesco QQQ Trust |

QQQ US |

217,642.20 |

6,350.49 |

1,890.34 |

|

Fidelity Enhanced Large Cap Core ETF |

FELC US |

1,883.91 |

1,883.70 |

1,883.70 |

|

Fidelity Enhanced Large Cap Value ETF |

FELV US |

1,777.71 |

1,770.66 |

1,770.66 |

|

Vanguard Total Bond Market ETF |

BND US |

99,870.51 |

15,821.43 |

1,740.03 |

|

Invesco Nasdaq 100 ETF |

QQQM US |

17,036.80 |

7,805.44 |

1,575.48 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

VCIT US |

39,000.69 |

(1,130.24) |

1,536.74 |

|

SPDR Portfolio S&P 500 ETF |

SPLG US |

23,245.43 |

5,363.65 |

1,523.72 |

|

iShares Russell 1000 Growth ETF |

IWF US |

77,702.66 |

(1,839.84) |

1,520.36 |

The top 10 ETPs by net assets collectively gathered $2.26 Bn during November. SPDR Gold Shares (GLD US) gathered $1.09 Bn, the largest individual net inflow.

Top 10 ETPs by net new assets November 2023: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

57,341.98 |

(2,161.99) |

1,088.03 |

|

ProShares Ultra DJ-UBS Natural Gas |

BOIL US |

858.24 |

1,815.36 |

508.62 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

387.93 |

620.16 |

245.44 |

|

United States Natural Gas Fund LP |

UNG US |

976.41 |

1,130.65 |

189.50 |

|

ProShares Ultra DJ-UBS Crude Oil |

UCO US |

641.87 |

(310.88) |

78.57 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

173.60 |

160.82 |

42.74 |

|

Invesco CurrencyShares Japanese Yen Trust |

FXY US |

266.72 |

110.10 |

34.48 |

|

iShares S&P GSCI Commodity-Indexed Trust |

GSG US |

1,068.30 |

(121.82) |

27.10 |

|

SPDR Gold MiniShares Trust |

GLDM US |

6,118.36 |

323.77 |

23.61 |

|

ProShares Short VIX Short-Term Futures |

SVXY US |

322.30 |

(175.02) |

23.13 |

Investors have tended to invest in Equity ETFs/ETPs during November.