ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that the ETFs industry in Europe suffered net outflows of US$2.94 billion during July, bringing year-to-date net inflows to US$65.23 billion. During the month, assets invested in the ETFs industry in Europe increased by 4.1%, from US$1.37 trillion at the end of June to US$1.43 trillion, according to ETFGI's July 2022 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in the ETFs industry in Europe increased by 4.1% during July, going from $1.37 trillion at the end of June to $1.43 trillion.

- Net outflows of $2.94 Bn in July 2022.

- YTD net inflows of $65.23 Bn are the third highest on record, after YTD net inflows of $127.10 Bn in 2021 and YTD net inflows of $73.89 Bn in 2017.

- 2nd month of net outflows.

“The S&P 500 increased by 9.22% in July but is down 12.58% YTD 2022. Developed markets excluding the US increased by 5.32% in July but are down 15.84% YTD 2022. Sweden (up 12.13%) and Netherlands (up 9.64%) saw the largest increases amongst the developed markets in July. Emerging markets decreased by 0.40% during July and are down 16.46% YTD in 2022. Pakistan (down 16.59%) and China (down 8.77%) saw the largest decreases amongst emerging markets in July, while Chile (up 12.24%) and India (up 9.14%) saw the largest increases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

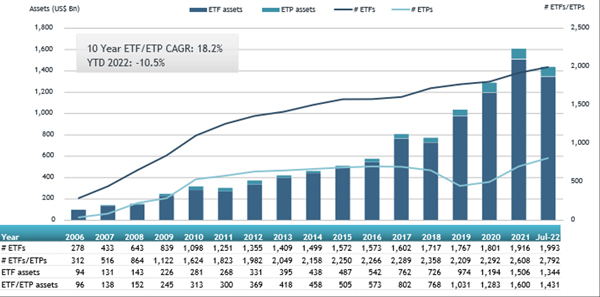

Europe ETFs and ETPs asset growth as at the end of July 2022

The ETFs industry in Europe had 2,792 products, with 11,350 listings, assets of $1.43 Tn, from 93 providers listed on 29 exchanges in 24 countries at the end of July.

During July, ETFs/ETPs gathered net outflows of $2.94 Bn. Equity ETFs/ETPs suffered net outflows of $2.08 Bn during July, bringing YTD net inflows to $47.94 Bn, lower than the $93.87 Bn in net inflows equity products had attracted at in the first 7 month of 2021. Fixed income ETFs/ETPs gathered net inflows of $3.96 Bn during July, bringing YTD net inflows to $15.31 Bn, lower than the $24.16 Bn in net inflows fixed income products attracted in the first 7 months of 2021. Commodities ETFs/ETPs reported net outflows of $5.43 Bn during July, bringing YTD net inflows to $710 Mn, lower than the $2.74 Bn in net inflows commodities products had reported year to date in 2021. Active ETFs/ETPs attracted net inflows of $360 Mn during the month, gathering YTD net inflows of $748 Mn, lower than the $3.70 Bn in net inflows active products had reported YTD in 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $9.40 Bn during July. Xtrackers II ESG EUR Corporate Bond UCITS ETF DR (XB4F GY) gathered $967 Mn, the largest individual net inflow.

Top 20 ETFs by net inflows in July 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

XB4F GY |

2,672.30 |

1,064.36 |

966.97 |

|

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

5,481.84 |

1,478.14 |

958.19 |

|

iShares MSCI USA ESG Enhanced UCITS ETF |

EEDS LN |

6,220.48 |

1,678.37 |

858.68 |

|

iShares MSCI EM ESG Enhanced UCITS ETF |

EEDM LN |

2,550.41 |

1,102.42 |

757.64 |

|

iShares $ Corp Bond UCITS ETF |

LQDE LN |

7,123.80 |

2,223.31 |

627.18 |

|

Invesco US Treasury Bond UCITS ETF |

TRES LN |

1,484.80 |

677.61 |

626.86 |

|

iShares € Corp Bond ESG UCITS ETF |

SUOE LN |

2,964.03 |

417.02 |

497.28 |

|

UBS Lux Fund Solutions - Bloomberg TIPS 10+ UCITS ETF |

SS1EUA SW |

1,213.38 |

635.37 |

473.35 |

|

SPDR S&P US Technology Select Sector UCITS ETF |

ZPDT GY |

960.29 |

398.51 |

394.08 |

|

iShares $ Treasury Bond 20+yr UCITS ETF |

IBTL LN |

3,084.10 |

1,588.61 |

379.76 |

|

Xtrackers II Eurozone Government Bond UCITS ETF DR - Acc |

XGLE GY |

2,222.27 |

28.84 |

359.78 |

|

iShares EUR High Yield Corp Bond ESG UCITS ETF - Acc |

EHYA NA |

1,400.51 |

84.23 |

349.53 |

|

JPMorgan US Research Enhanced Index Equity ESG UCITS ETF - Acc |

JREU LN |

1,471.46 |

603.73 |

300.46 |

|

UBS ETF (IE) Factor MSCI USA Quality UCITS ETF - Acc |

UBUT GY |

733.21 |

169.31 |

288.02 |

|

Xtrackers II iBoxx Sovereigns Eurozone 5-7 UCITS ETF - 1C - Acc |

X57E GY |

1,146.66 |

496.67 |

271.24 |

|

iShares MSCI EMU ESG Enhanced UCITS ETF |

EMUD LN |

742.64 |

237.83 |

267.77 |

|

iShares Edge MSCI World Minimum Volatility ESG UCITS ETF - Acc |

MVEW NA |

1,090.81 |

709.00 |

261.65 |

|

Amundi Index Euro Agg Sri UCITS ETF DR - Acc |

EGRI FP |

1,053.41 |

755.37 |

258.89 |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

44,559.49 |

4,041.92 |

252.26 |

|

Invesco S&P 500 ESG UCITS ETF - Acc |

SPXE LN |

2,224.68 |

681.20 |

243.97 |

The top 10 ETPs by net new assets collectively gathered $433 Mn during July. iShares Physical Gold ETC - Acc (SGLN LN) gathered $235 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in July 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

15154.27 |

1,667.09 |

234.64 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

1818.31 |

162.04 |

36.95 |

|

Invesco Physical Gold ETC - EUR Hdg Acc |

SGLE IM |

302.39 |

258.22 |

26.33 |

|

Xtrackers IE Physical Gold ETC Securities - EUR Hdg Acc |

XGDE GY |

634.66 |

103.26 |

23.75 |

|

WisdomTree Physical Gold - GBP Daily Hedged - Acc |

GBSP LN |

1202.99 |

(20.98) |

23.47 |

|

Elementum Physical Carbon Neutral Nickel ETC |

NIC0 AV |

22.69 |

22.31 |

22.31 |

|

WisdomTree Long JPY Short EUR - Acc |

SJPS GY |

91.01 |

69.55 |

21.06 |

|

WisdomTree FTSE MIB 3x Daily Short - Acc |

3ITS IM |

39.55 |

7.52 |

17.96 |

|

WisdomTree Aluminium - Acc |

ALUM LN |

57.30 |

24.29 |

13.73 |

|

WisdomTree Core Physical Gold - Acc |

WGLD LN |

638.55 |

256.26 |

12.58 |

Investors have tended to invest in Fixed Income ETFs and ETPs during July.