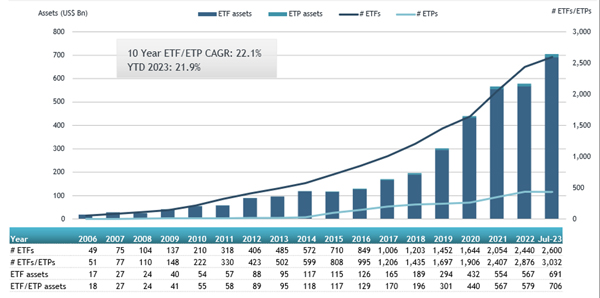

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that assets invested in the ETFs industry in Asia Pacific (ex-Japan) reached a record of US$705 billion at the end of July. The ETFs industry in Asia Pacific (ex-Japan) gathered net inflows of US$13.84 billion during July, bringing year-to-date net inflows to US$70.24 billion. Assets have increased by 21.9% YTD in 2023, going from US$578.72 Bn at end of 2022 to US$705.51 Bn., according to ETFGI's July 2023 Asia Pacific (ex-Japan) ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the ETFs industry in Asia Pacific (ex Japan) reached a record of $705.51 Bn at the end of July beating the previous record of $647.40 Bn at the end of June 2023.

- Assets have increased by 21.9% YTD in 2023, going from $578.72 Bn at end of 2022 to $705.51 Bn.

- Net inflows of $13.84 Bn during July.

- YTD net inflows of $70.24 Bn are the second highest, behind the $72.63 Bn in YTD net inflows in 2022.

- 25th month of consecutive net inflows.

“The S&P 500 increased by 3.21% in July and is up 20.65% year-to-date in 2023. Developed markets excluding the US increased by 3.62% in July and are up 15.09% YTD in 2023. Norway (up 8.97%) and Israel (up 8.06%) saw the largest increases amongst the developed markets in July. Emerging markets increased by 6.15% during July and are up 11.08% YTD in 2023. Turkey (up 20.52%) and Pakistan (up 15.89%) saw the largest increases amongst emerging markets in July.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

ETFs industry in Asia Pacific (ex-Japan) asset growth as of the end of July

At the end of July 2023, the Asia Pacific (ex-Japan) ETF/ETP industry had 3,032 ETFs/ETPs, with 3,199 listings, assets of $706 Bn, from 247 providers listed on 20 exchanges in 15 countries.

During July, ETFs/ETPs gathered net inflows of 13.84 Bn. Equity ETFs/ETPs gathered net inflows of $8.59 Bn over July, bringing YTD net inflows to $45.19 Bn, much lower than the $62.22 Bn in net inflows equity products had attracted at this point in 2022. Fixed income ETFs/ETPs had net inflows of $3.79 Bn during July, bringing net inflows for the year through July 2023 to $16.50 Bn, higher than the $6.41 Bn in net inflows fixed income products had attracted by the end of July 2022. Commodities ETFs/ETPs reported net inflows of $45 Mn during July, bringing YTD net outflows to $490 Mn, higher than the $1.03 Bn in net outflows commodities products had reported year to date in 2022. Active ETFs/ETPs attracted net inflows of $1.41 Bn over the month, gathering net inflows for the year of $6.83 Bn, higher than the $3.32 Bn in net inflows active products had reported YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $11.49 Bn during July. Huatai-Pinebridge CSI 300 ETF (510300 CH) gathered $2.20 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets in July 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Huatai-Pinebridge CSI 300 ETF |

510300 CH |

12,903.63 |

1,415.30 |

2195.27 |

|

ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

10,772.39 |

3,314.02 |

1643.51 |

|

Tracker Fund of Hong Kong (TraHK) |

2800 HK |

18,405.54 |

959.70 |

703.29 |

|

Yinhua Traded Money Market Fund |

511880 CH |

16,396.58 |

617.02 |

617.02 |

|

ChinaAMC CSI 1000 ETF |

159845 CH |

2,150.49 |

1,353.02 |

614.16 |

|

E Fund CSI 300 ETF |

510310 CH |

3,282.15 |

866.66 |

586.47 |

|

GTJA Allianz CSI All-share Semi-conductor Product and Equipment ETF - Acc |

512480 CH |

3,994.53 |

1,680.12 |

533.72 |

|

Yuanta US Treasury 20+ Year Bond ETF |

00679B TT |

3,442.41 |

1,550.31 |

450.78 |

|

Samsung Kodex KOSDAQ150 Inverse ETF - Acc |

251340 KS |

919.48 |

873.92 |

429.16 |

|

MIRAE ASSET TIGER Secondary Battery Material ETF |

462010 KS |

424.36 |

424.36 |

424.36 |

|

E Fund CSI Science and Technology Innovation Board 50 ETF |

588080 CH |

3,596.86 |

1,182.06 |

379.54 |

|

China Southern CSI 1000 ETF - Acc |

512100 CH |

1,748.38 |

133.15 |

375.76 |

|

Fuh Hwa Taiwan Technology Dividend Highlight ETF |

00929 TT |

665.61 |

647.68 |

375.52 |

|

E Fund ChiNext Price Index ETF |

159915 CH |

5,756.62 |

2,999.03 |

342.59 |

|

SAMSUNG KODEX CD Rate Active ETF SYNTH |

459580 KS |

446.51 |

442.39 |

315.49 |

|

ChinaAMC CNI Semi-conductor Chip ETF |

159995 CH |

3,814.09 |

784.21 |

312.08 |

|

HFT CSI Commercial Paper ETF |

511360 CH |

3,044.82 |

879.12 |

302.66 |

|

China AMC CSI 300 Index ETF |

510330 CH |

3,850.57 |

196.11 |

301.39 |

|

Yuanta US 20+ Year BBB Corporate Bond ETF - Acc |

00720B TT |

2,638.23 |

1,432.17 |

294.79 |

|

MIRAE ASSET TIGER SYNTH-KOFR ACTIVE ETF |

449170 KS |

962.26 |

959.10 |

287.81 |

The top ETPs by net new assets collectively gathered $462.56 Mn during July. MERITZ SECURITIES MERITZ KIS CD RATE ETN 63 (610063 KS) gathered $158.41 Mn, the largest individual net inflow.

Top ETPs by net inflows in July 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

MERITZ SECURITIES MERITZ KIS CD RATE ETN 63 |

610063 KS |

237.61 |

158.41 |

158.41 |

|

NH QV KIS CD Interest Rate Investment ETN 82 |

550082 KS |

158.39 |

79.20 |

79.20 |

|

Korea Investment & Securities TRUE Inverse 2X KOSDAQ 150 Futures ETN 82 |

570082 KS |

114.20 |

148.10 |

57.10 |

|

Samsung Securities Samsung Inverse 2X KOSDAQ150 Futures ETN 107 |

530107 KS |

170.71 |

184.76 |

56.94 |

|

Shinhan Securities Shinhan Inverse 2X KOSDAQ 150 Futures ETN 72 |

500072 KS |

56.98 |

42.73 |

42.78 |

|

MiraeAsset Securities MiraeAsset Inverse 2X KOSDAQ150 Futures ETN 72 |

520057 KS |

85.42 |

110.66 |

22.74 |

|

Daishin Securities Daishin -2X Iron Ore Futures ETN H 38 |

510038 KS |

17.46 |

17.46 |

17.46 |

|

Global X Physical Gold |

GOLD AU |

1,801.23 |

(69.87) |

11.46 |

|

KB Securities KB Leverage Soybeans Futures ETN 53 |

580053 KS |

8.62 |

8.62 |

8.62 |

|

KB Securities KB Leverage Wheat Futures ETN 51 |

580051 KS |

7.87 |

7.87 |

7.87 |

|