ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that equity-based Smart Beta ETFs and ETPs listed globally gathered net inflows of US$5.73 billion during September. Year-to-date through to the end of September 2019, Smart Beta Equity ETFs/ETPs assets have increased by 26.1% from US$618 billion to US$779 billion, with a 5-year CAGR of 19.9%, according to ETFGI’s September 2019 Smart Beta ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Smart Beta Equity ETFs/ETPs reached a record of $779 billion.

- In September 2019, Equity Smart Beta ETFs/ETPs attracted $5.73 billion in net inflows.

- 44th consecutive month of net inflows into Smart Beta Equity ETFs/ETPs.

At the end of September 2019, there were 1,336 smart beta equity ETFs/ETPs, with 2,506 listings, assets of $779 billion, from 169 providers on 41 exchanges in 33 countries. Following net inflows of $5.73 billion and market moves during the month, assets invested in Smart Beta ETFs/ETPs listed globally increased by 1.26%, from $759 billion at the end of August 2019 to $779 billion.

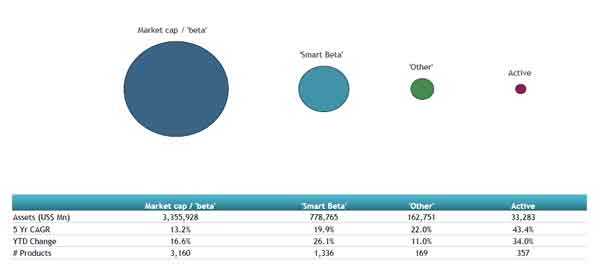

Comparison of assets in market cap, smart beta, other and active equity products

Value ETFs and ETPs attracted the greatest monthly net inflows, gathering $2.31 billion in September. Growth ETFs and ETPs suffered the greatest outflows during the month and amounted to $542 million.

Substantial inflows can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $8.48 billion in September, the iShares MSCI USA Minimum Volatility ETF (USMV US) gathered $1.62 billion alone.

Top 20 Smart Beta ETFs/ETPs by net new assets September 2019

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares MSCI USA Minimum Volatility ETF |

USMV US |

35,135.99 |

11,191.79 |

1,615.68 |

|

First Trust Financial AlphaDEX Fund |

FXO US |

1,796.14 |

769.17 |

864.82 |

|

Vanguard Dividend Appreciation ETF |

VIG US |

38,544.01 |

2,933.49 |

831.56 |

|

SPDR Portfolio S&P 500 Value ETF |

SPYV US |

3,674.32 |

1,031.29 |

522.39 |

|

First Trust Value Line Dividend Index Fund |

FVD US |

7,865.23 |

2,492.93 |

467.03 |

|

Vanguard Value ETF |

VTV US |

49,883.19 |

2,509.70 |

453.19 |

|

iShares Edge MSCI Minimum Volatility EAFE ETF |

EFAV US |

11,982.73 |

1,418.49 |

427.69 |

|

Schwab US Large-Cap Value ETF |

SCHV US |

6,545.80 |

1,102.74 |

411.96 |

|

UBS Irl ETF plc - MSCI USA Select Factor Mix UCITS ETF |

USFMA SW |

484.18 |

479.17 |

346.44 |

|

iShares Edge MSCI USA Quality Factor ETF |

QUAL US |

11,725.10 |

3,313.04 |

336.72 |

|

iShares Core Dividend Growth ETF |

DGRO US |

8,643.82 |

2,533.16 |

328.66 |

|

iShares S&P Small-Cap 600 Value ETF |

IJS US |

6,373.57 |

220.72 |

272.87 |

|

Schwab US Dividend Equity ETF |

SCHD US |

10,286.31 |

1,330.43 |

250.28 |

|

iShares Edge MSCI USA Value Factor ETF |

VLUE US |

3,540.46 |

(313.56) |

217.40 |

|

Invesco S&P 500 Low Volatility ETF |

SPLV US |

12,815.87 |

2,626.30 |

216.49 |

|

Vanguard Small-Cap Value ETF |

VBR US |

13,390.61 |

473.19 |

198.87 |

|

Invesco DWA Momentum ETF |

PDP US |

1,705.89 |

(69.38) |

196.59 |

|

John Hancock Multi-Factor Mid Cap ETF |

JHMM US |

1,376.72 |

518.94 |

184.23 |

|

Xtrackers Equity Low Beta Factor UCITS ETF (DR) - 1C |

XDEB GY |

744.84 |

565.71 |

183.07 |

|

First Trust Capital Strength ETF |

FTCS US |

2,862.53 |

1,189.39 |

151.31 |