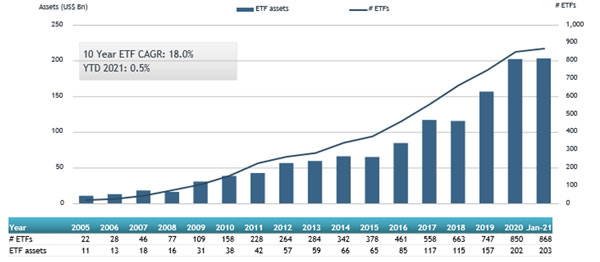

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reports assets invested in ETFs listed in Canada reached a new record of US$203.04 billion at the end of January. ETFs listed in Canada gathered net inflows of US$2.77 billion during January which is less than the US$3.17 billion gathered in January 2020. ETF assets in Canada have increased by 0.5% from US$202.07 billion in December 2020 to US$20.04 billion, according to ETFGI's January 2021 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs listed in Canada reach a record $203.04 billion at the end of January.

- ETFs listed in Canada gathered net inflows of $2.77 billion in January.

- March 9th will mark the 31st anniversary of listing of the first ETF.

“The S&P 500 posted a loss of 1% for January due to the sell-off during the last week of the month. Small and mid-cap stocks outperformed in January, with the S&P Mid-Cap 400® and the S&P SmallCap 600® up 2% and 6%, respectively. Slower-than-expected COVID-19 vaccine distribution affected global impacted equities globally. The Developed markets ex- the U.S. ended the month down 1% while Emerging markets were up 3% for the month. “According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in Canadian ETF and ETP assets as of the end of January 2021

The Canadian ETF/ETP industry had 868 ETFs/ETPs, with 1,059 listings, assets of $203Bn, from 39 providers listed on 2 exchanges at the end of January.

Equity ETFs/ETPs gathered net inflows of $1.12 Bn during January, which is higher than the $800 Mn in net inflows equity products attracted in January 2020. Fixed income ETFs/ETPs had net inflows of $839 Mn during January, which is lower than the $1.11Bn in net inflows fixed income products attracted in January 2020. Commodity ETFs/ETPs saw net outflows of $30 Mn in January which is less than the net inflows of $31 Mn over the same period in 2020. Active ETFs/ETPs attracted net inflows of $740 Mn over the month, which is lower than the $1.16 Bn in net inflows active products reported in January 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $2.25 Bn during January. Horizon S&P/TSX 60 Index ETF - Acc (HXT CN) gathered $361.55 Mn.

Top 20 ETFs by net new assets January 2021: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

HXT CN |

2126.34 |

361.55 |

361.55 |

|

|

BMO Aggregate Bond Index ETF |

ZAG CN |

4482.33 |

274.49 |

274.49 |

|

BMO S&P 500 Index ETF |

ZSP CN |

7496.91 |

150.92 |

150.92 |

|

iShares S&P/TSX Capped Financials Index Fund |

XFN CN |

879.66 |

127.76 |

127.76 |

|

Vanguard S&P 500 Index ETF |

VFV CN |

2962.21 |

111.94 |

111.94 |

|

Mackenzie US Large Cap Equity Index ETF |

QUU CN |

767.79 |

110.59 |

110.59 |

|

Vanguard U.S. Total Market Index ETF |

VUN CN |

2478.54 |

105.19 |

105.19 |

|

Vanguard Growth ETF Portfolio |

VGRO CN |

1503.92 |

104.99 |

104.99 |

|

TD International Equity Index ETF |

TPE CN |

785.57 |

102.59 |

102.59 |

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

3436.58 |

99.68 |

99.68 |

|

Franklin Ftse Japan Index ETF |

FLJA CN |

136.18 |

81.44 |

81.44 |

|

BMO Long Federal Bond Index ETF |

ZFL CN |

1770.55 |

74.35 |

74.35 |

|

Vanguard FTSE Emerging Markets All Cap Index ETF |

VEE CN |

1101.45 |

74.21 |

74.21 |

|

iShares Core S&P US Total Market Index ETF |

XUU CN |

1198.55 |

73.95 |

73.95 |

|

TD S&P/TSX Capped Composite Index ETF |

TTP CN |

766.28 |

70.16 |

70.16 |

|

Vanguard All-Equity ETF Portfolio |

VEQT CN |

511.29 |

67.33 |

67.33 |

|

Vanguard FTSE Developed All Cap EX North America Index ETF |

VIU CN |

1457.16 |

66.05 |

66.05 |

|

Vanguard Balanced Etf Portfolio |

VBAL CN |

1120.93 |

65.86 |

65.86 |

|

Vanguard FTSE Canada All Cap Index ETF |

VCN CN |

2307.10 |

65.41 |

65.41 |

|

Fidelity International High Quality Index ETF |

FCIQ CN |

376.63 |

60.05 |

60.05 |

Investors have tended to invest in Equity ETFs during January.