ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in ETFs and ETPs listed in United States broke though the US$ 6 trillion milestone at the end of April. ETFs and ETPs listed in US gained net inflows of US$76.79 billion during April, bringing year-to-date net inflows to a record US$329.03 billion. Assets invested in the US ETFs and ETPs industry have increased by 5.1%, from US$5.91 trillion at the end of March, to US$6.21 trillion, according to ETFGI's April 2021 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets break through the $6 tillion milestone to a record $6.21 trillion invested in ETFs and ETPs listed in US at the end of April.

- Net inflows of $76.79 Bn during April

- Record YTD net inflows of $329.03 Bn beating the prior record of $169.67 Bn gathered YTD in 2017.

- 19 months of consecutive net inflows

The S&P 500 gained 5.34% in April and 11.84% YTD as positive corporate earnings and US stimulis measures helped push U.S. equities higher. Developed markets ex-U.S. gained 3.35% in April. Denmark 7.07% and Finland 7.05% were the leaders of the month while Japan lost 1.60% and was the only country to be down for the month. Emerging markets were up 2.93% at the end of April. Poland (up 9.9%) and Greece were the leaders (up 9.20%), whilst Chile (down 8.1%), Peru (down 7.1%), and Colombia (down 6.5%) were down the most. “ According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

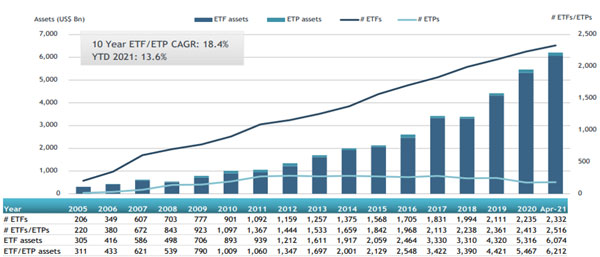

Growth in US ETF and ETP assets as of the end of April 2021

At the end of April, the US ETFs and ETPs industry had 2,516 products, assets of $6.21 trillion, from 196 providers listed on 3 exchanges.

During April 2021, ETFs/ETPs gathered net inflows of $76.79 Bn. Equity ETFs/ETPs listed in US gathered net inflows of $47.19 Bn over April, bringing YTD net inflows for 2021 to $231.71 Bn, much higher than the $28.29 Bn in net inflows equity products attracted YTD in 2020. Fixed income ETFs/ETPs listed in US reported net inflows of $23.33 Bn during April, bringing YTD net inflows for 2021 to $55.42 Bn, more than the $30.61 Bn in net inflows fixed income products attracted YTD in 2020. Commodities ETFs/ETPs reported net outflows of $1.31 Bn over April, bringing year to date net outflows for 2021 to $9.16 Bn, while YTD in 2020 commodities products attracted net inflows of $21.40 Bn. Active ETFs/ETPs gathered net inflows of $9.00 Bn during April, bringing year to date net inflows for 2021 to $46.06 Bn, significantly more than the $7.79 Bn in net inflows active products gathered YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $38.82 Bn during April. The Vanguard Total Stock Market ETF (VTI US) gathered $4.30 Bn the largest net inflows.

Top 20 ETFs by net new assets April 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Total Stock Market ETF |

VTI US |

238,048.62 |

14,150.32 |

4,301.38 |

|

Vanguard S&P 500 ETF |

VOO US |

220,351.89 |

20,602.64 |

3,974.76 |

|

iShares Core S&P 500 ETF |

IVV US |

275,373.12 |

11,733.23 |

2,597.04 |

|

Vanguard Total Bond Market ETF |

BND US |

73,997.99 |

8,298.23 |

2,551.91 |

|

Vanguard Short-Term Treasury ETF |

VGSH US |

12,572.53 |

2,798.24 |

2,450.48 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

87,226.14 |

4,639.77 |

2,320.10 |

|

Vanguard Value ETF |

VTV US |

77,535.95 |

6,962.07 |

2,268.88 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

VCIT US |

44,770.51 |

3,876.01 |

1,902.05 |

|

iShares US Treasury Bond ETF |

GOVT US |

16,299.19 |

2,278.32 |

1,872.61 |

|

Schwab US Dividend Equity ETF |

SCHD US |

23,595.06 |

4,446.92 |

1,855.94 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

91,743.13 |

1,722.14 |

1,722.14 |

|

JPMorgan BetaBuilders Europe ETF |

BBEU US |

6,226.33 |

2,486.57 |

1,655.74 |

|

iShares U.S. Real Estate ETF |

IYR US |

6,476.45 |

353.61 |

1,327.97 |

|

Blackrock US Carbon Transition Readiness ETF |

LCTU US |

1,342.40 |

1,314.12 |

1,314.12 |

|

Vanguard Short-Term Corporate Bond ETF |

VCSH US |

39,294.12 |

3,321.37 |

1,288.51 |

|

Vanguard Total International Bond ETF |

BNDX US |

40,915.06 |

4,854.51 |

1,258.91 |

|

iShares J.P. Morgan USD Emerging Markets Bond ETF |

EMB US |

19,162.43 |

701.49 |

1,084.61 |

|

iShares Edge MSCI USA Value Factor ETF |

VLUE US |

15,373.23 |

3,995.65 |

1,077.56 |

|

SPDR Portfolio S&P 500 Value ETF |

SPYV US |

11,665.42 |

2,862.55 |

1,029.67 |

|

Vanguard Mortgage-Backed Securities ETF |

VMBS US |

14,883.04 |

1,958.42 |

960.83 |

The top 10 ETPs by net new assets collectively gathered $914 Mn during April. The iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX US) gathered $325 Mn in net inflows.

Top 10 ETPs by net new assets April 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

1,341.75 |

1,012.36 |

324.52 |

|

Invesco DB Commodity Index Tracking Fund |

DBC US |

2,241.94 |

570.38 |

190.07 |

|

Invesco DB Agriculture Fund |

DBA US |

961.17 |

209.95 |

81.35 |

|

SPDR Gold MiniShares Trust |

GLDM US |

4,194.43 |

453.46 |

73.68 |

|

iShares S&P GSCI Commodity-Indexed Trust |

GSG US |

1,271.15 |

238.29 |

64.90 |

|

United States Copper Index Fund |

CPER US |

261.10 |

161.91 |

47.86 |

|

Credit Suisse Silver Shares Covered Call ETN |

SLVO US |

160.32 |

116.32 |

36.11 |

|

Aberdeen Standard Physical Palladium Shares ETF |

PALL US |

494.31 |

37.35 |

32.64 |

|

Aberdeen Standard Physical Silver Shares |

SIVR US |

987.80 |

147.11 |

31.75 |

|

Invesco DB Base Metals Fund |

DBB US |

348.20 |

134.19 |

31.07 |

Investors have tended to invest in Equity ETFs and ETPs during April.