ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in ETFs and ETPs listed in the United States reached a record US$6.34 trillion at the end of May. ETFs and ETPs listed in US gained net inflows of US$63.95 billion during May, bringing year-to-date net inflows to US$392.98 billion. Assets invested in the US ETFs/ETPs industry have increased by 2.1%, from US$6.21 trillion at the end of April to US$6.34 trillion, according to ETFGI's May 2021 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $6.34 Tn invested in ETFs and ETPs listed in United States at the end of May.

- Record YTD net inflows of $392.98 Bn beating the prior record of $200.76 Bn gathered YTD in 2017.

- Twenty-one consecutive months of net inflows.

“The S&P 500 gained 0.7% in May and 12.62% YTD, with positive figures for four consecutive months. Developed markets ex-U.S. gained 3.11% in May. Austria 8.29% and Luxembourg 8.12% were the leaders of the month while New Zealand lost 3.92%. Emerging markets were up 2.58% at the end of May. Hungary (up 15.54%) and Poland (up 13.98%) were the leaders, whilst Egypt (down 3.86%), Chile (down 3.64%), and Malaysia (down 2.79%) were down the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

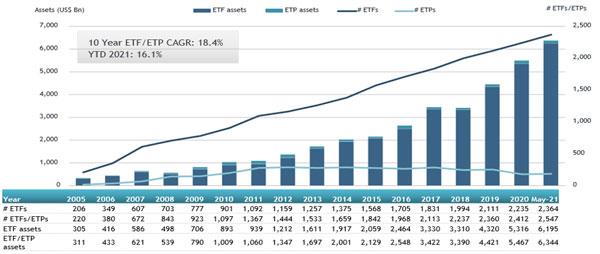

Growth in US ETF and ETP assets as of the end of May 2021

The ETFs and ETPs industry in the United States had 2,547 products, assets of US$6.34 Tn, from 202 providers listed on 3 exchanges at the end of May.

During May 2021, ETFs/ETPs gathered net inflows of $63.95 Bn. Equity ETFs/ETPs listed in US gained net inflows of $38.84 Bn during May, bringing YTD net inflows for 2021 to $270.55 Bn, much higher than the $22.15 Bn in net inflows YTD in 2020. Fixed income ETFs/ETPs listed in US reported net inflows of $14.26 Bn during May, bringing YTD net inflows for 2021 to $69.68 Bn, more than the $54.75 Bn in net inflows YTD in 2020. Commodities ETFs/ETPs reported net inflows of $2.84 Bn over May, bringing year to date net outflows for 2021 to $6.32 Bn, less than net inflows of $27.62 Bn commodities products had attracted over the same period last year. Active ETFs/ETPs saw net inflows of $6.24 Bn during May, bringing year to date net inflows for 2021 to $52.30 Bn, significantly more than the $13.87 Bn in net inflows YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $38.82 Bn during May. The Vanguard S&P 500 ETF (VOO US) gathered the largest net inflow $3.58 Bn.

Top 20 ETFs by net new assets May 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

VOO US |

225,706.38 |

24,178.69 |

3,576.05 |

|

Vanguard Total Stock Market ETF |

VTI US |

243,653.31 |

16,853.58 |

2,703.27 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

96,942.43 |

3,825.55 |

2,103.42 |

|

JPMorgan BetaBuilders Europe ETF |

BBEU US |

8,616.93 |

4,564.37 |

2,077.81 |

|

Vanguard Value ETF |

VTV US |

81,905.63 |

8,988.94 |

2,026.87 |

|

Vanguard Short-Term Bond ETF |

BSV US |

34,132.40 |

4,774.76 |

1,884.66 |

|

Financial Select Sector SPDR Fund |

XLF US |

44,835.00 |

11,151.17 |

1,587.63 |

|

iShares Global Financials ETF |

IXG US |

2,669.70 |

2,195.59 |

1,584.87 |

|

Health Care Select Sector SPDR Fund |

XLV US |

27,714.79 |

(60.59) |

1,583.26 |

|

Invesco S&P 500 Equal Weight ETF |

RSP US |

28,680.03 |

6,678.31 |

1,550.49 |

|

iShares Commodities Select Strategy ETF |

COMT US |

2,059.02 |

1,755.12 |

1,344.38 |

|

Vanguard FTSE Europe ETF |

VGK US |

18,941.27 |

2,495.98 |

1,329.83 |

|

Vanguard Real Estate ETF |

VNQ US |

39,986.46 |

3,281.29 |

1,312.81 |

|

Materials Select Sector SPDR Trust |

XLB US |

9,733.26 |

3,258.06 |

1,242.23 |

|

iShares Core Total USD Bond Market ETF |

IUSB US |

13,967.88 |

8,168.36 |

1,236.31 |

|

iShares TIPS Bond ETF |

TIP US |

28,405.49 |

1,914.97 |

1,223.17 |

|

Vanguard Total Bond Market ETF |

BND US |

75,150.70 |

9,498.59 |

1,200.35 |

|

Vanguard Short-Term Inflation-Protected Securities Index Fund |

VTIP US |

13,947.31 |

3,963.12 |

1,117.57 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

47,716.58 |

5,143.15 |

1,096.12 |

|

Vanguard FTSE Emerging Markets ETF |

VWO US |

82,474.08 |

5,772.22 |

1,065.62 |

The top 10 ETPs by net new assets collectively gathered $2.67 Bn during May. The SPDR Gold Shares (GLD US) gathered $1.57 Bn alone.

Top 10 ETPs by net new assets May 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

62,558.36 |

(7037.55) |

1,570.75 |

|

iShares Gold Trust |

IAU US |

30,570.66 |

(1305.46) |

295.95 |

|

iShares Silver Trust |

SLV US |

15,927.55 |

671.52 |

263.40 |

|

Invesco DB Commodity Index Tracking Fund |

DBC US |

2,484.20 |

734.97 |

164.59 |

|

SPDR Gold MiniShares Trust |

GLDM US |

4,602.30 |

545.21 |

91.75 |

|

United States Copper Index Fund |

CPER US |

349.92 |

237.55 |

75.64 |

|

iShares S&P GSCI Commodity-Indexed Trust |

GSG US |

1,368.76 |

304.34 |

66.05 |

|

MicroSectors FANG+ Index 3X Leveraged ETNs due January 8, 2038 |

FNGU US |

1,518.54 |

708.07 |

57.11 |

|

Invesco DB Base Metals Fund |

DBB US |

410.28 |

179.87 |

45.68 |

|

Aberdeen Standard Precious Metals Basket Trust |

GLTR US |

1,042.84 |

156.09 |

35.61 |

Investors have tended to invest in Equity ETFs and ETPs during May.