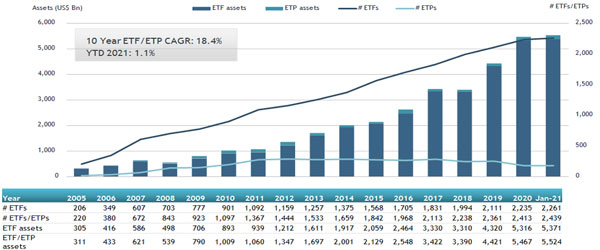

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in ETFs and ETPs listed in the United States reached a new record of US$5.52 trillion at the end of January. US$57.23 billion in net inflows was gathered in January the second largest net inflows, which is greater than the US$41.90 billion in net inflows gathered in 2019, but less than the US$75.96 billion gathered in January 2018. Assets increased by 1.1%, from US$5.47 trillion at the end of December, to US$5.52 trillion at the end of January, according to ETFGI's January 2021 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs and ETPs listed in United States reached a new record of $5.52 trillion at the end of January.

- The $57.23 billion in net inflows gathered in January is the second highest on record, much higher than the $41.90 billion gathered in January 2020 but below the record of $75.96 Bn set in January 2018.

- $26.45 billion or the majorty of net inflows went into ETFs and ETPs providing exposure to equities.

“The S&P 500 posted a loss of 1% for January due to the sell-off during the last week of the month. Small and mid-cap stocks outperformed in January, with the S&P Mid-Cap 400® and the S&P SmallCap 600® up 2% and 6%, respectively. Slower-than-expected COVID-19 vaccine distribution affected global impacted equities globally. The Developed markets ex- the U.S. ended the month down 1% while Emerging markets were up 3% for the month. “According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in US ETF and ETP assets as of the end of January 2021

The ETFs and ETPs industry in the United States had 2,439 products, assets of $5.52 Trillion, from 180 providers listed on 3 exchanges at the end of January.

During January 2021, ETFs/ETPs gathered net inflows of $57.23 Bn. Equity ETFs/ETPs listed in US reported net inflows of $26.45 Bn in January, bringing YTD net inflows for 2021 to $26.45 billion, more than the $19.91 Bn in net inflows equity products attracted in January 2020. Fixed income ETFs/ETPs listed in US reported net inflows of $14.70 Bn during January, which is more than the $13.60 Bn in net inflows fixed income products attracted in January 2020. Commodity ETFs/ETPs accumulated net inflows of $461 Mn in January, which is less than the $1.88 Bn gathered in January 2020.

Active ETFs/ETPs saw net inflows of $15.13 Bn during January, significantly more than the net inflows of $5.01 Bn in January 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $41.96 Bn during January. The Financial Select Sector SPDR Fund (XLF US) gathered 4.15 Bn.

Top 20 ETFs by net new assets January 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Financial Select Sector SPDR Fund |

XLF US |

28,331.47 |

4,149.58 |

4,149.58 |

|

iShares Core Total USD Bond Market ETF |

IUSB US |

9,692.85 |

3,713.58 |

3,713.58 |

|

iShares MSCI EAFE Value ETF |

EFV US |

10,300.21 |

3,272.99 |

3,272.99 |

|

iShares Core MSCI Emerging Markets ETF |

IEMG US |

73,723.65 |

3,156.00 |

3,156.00 |

|

ARK Innovation ETF |

ARKK US |

22,609.04 |

3,097.15 |

3,097.15 |

|

Vanguard Total Stock Market ETF |

VTI US |

202,732.92 |

2,824.17 |

2,824.17 |

|

Vanguard Total Bond Market ETF |

BND US |

70,221.98 |

2,745.86 |

2,745.86 |

|

ARK Genomic Revolution Multi-Sector ETF |

ARKG US |

10,699.23 |

2,435.05 |

2,435.05 |

|

iShares Global Clean Energy ETF |

ICLN US |

6,538.74 |

1,657.33 |

1,657.33 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

86,266.80 |

1,594.07 |

1,594.07 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

VCIT US |

43,754.05 |

1,567.31 |

1,567.31 |

|

Vanguard S&P 500 ETF |

VOO US |

177,910.66 |

1,558.20 |

1,558.20 |

|

Vanguard Total International Bond ETF |

BNDX US |

38,400.91 |

1,404.03 |

1,404.03 |

|

JPMorgan BetaBuilders Developed Asia EX-Japan ETF |

BBAX US |

3,076.13 |

1,336.48 |

1,336.48 |

|

Vanguard Short-Term Bond ETF |

BSV US |

30,812.70 |

1,298.87 |

1,298.87 |

|

Vanguard Small-Cap ETF |

VB US |

39,541.92 |

1,291.66 |

1,291.66 |

|

JPMorgan BetaBuilders Japan ETF |

BBJP US |

7,456.86 |

1,282.46 |

1,282.46 |

|

Energy Select Sector SPDR Fund |

XLE US |

15,393.63 |

1,229.03 |

1,229.03 |

|

SPDR Dow Jones Industrial Average ETF |

DIA US |

24,986.09 |

1,173.08 |

1,173.08 |

|

Vanguard Value ETF |

VTV US |

62,137.88 |

1,171.41 |

1,171.41 |

The top 10 ETPs by net new assets collectively gathered $2.23 Bn during January. The iShares Silver Trust (SLV US) gathered $1.18 Bn.

Top 10 ETPs by net new assets January 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Silver Trust |

SLV US |

16,496.27 |

1,181.76 |

1,181.76 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

22,45.30 |

273.75 |

273.75 |

|

SPDR Gold MiniShares Trust |

GLDM US |

41,44.47 |

186.45 |

186.45 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

1,421.30 |

172.83 |

172.83 |

|

iShares Gold Trust |

IAU US |

31,561.48 |

117.32 |

117.32 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

483.78 |

81.98 |

81.98 |

|

Aberdeen Standard Physical Silver Shares |

SIVR US |

975.87 |

74.67 |

74.67 |

|

iShares S&P GSCI Commodity-Indexed Trust |

GSG US |

922.35 |

55.32 |

55.32 |

|

iPath Shiller CAPE ETN |

CAPE US |

315.75 |

42.83 |

42.83 |

|

Invesco DB Agriculture Fund |

DBA US |

700.87 |

42.25 |

42.25 |

Investors have tended to invest in Equity ETFs/ETPs during January.