ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in ETFs and ETPs listed in Japan reached a record US$556 billion at the end of May. ETFs and ETPs listed in Japan gathered net inflows of US$3.25 billion during May, bringing year-to-date net inflows to US$13.42 billion. Assets invested in the Japanese ETFs/ETPs industry have increased by 1.7%, from US$545 billion at the end of April, to US$556 billion, according to ETFGI's May 2021 Japanese ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $556 Billion invested in ETFs and ETPs listed in Japan at the end of May.

- Bank of Japan owns $322 Billion or 60% of total assets invested in Japanese ETFs and ETPs.

- ETFs/ETPs listed in Japan attracted $13.42 Bn in year-to-date net inflows.

“The S&P 500 gained 0.7% in May and 12.62% YTD, with positive figures for four consecutive months. Developed markets ex-U.S. gained 3.11% in May. Austria 8.29% and Luxembourg 8.12% were the leaders for the month while New Zealand lost the most at 3.92%. Emerging markets were up 2.58% at the end of May. Hungary (up 15.54%) and Poland (up 13.98%) were the leaders, whilst Egypt (down 3.86%), Chile (down 3.64%), and Malaysia (down 2.79%) were down the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The Japanese ETF/ETP industry had 235 ETFs/ETPs, with 269 listings, assets of $556 Bn, from 20 providers on 2 exchanges at the end of May 2021.

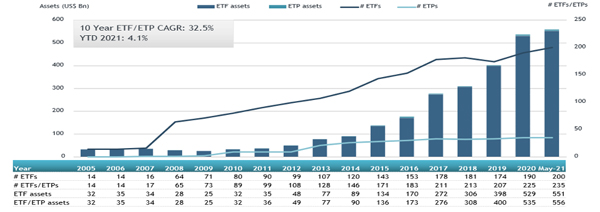

Japan ETF and ETP asset growth as at the end of May 2021

Equity ETFs/ETPs listed in Japan had net inflows of $3.74 Bn during May, bringing net inflows for the year to May 2021 to $16.59 Bn, lower than the $36.10 Bn in net inflows equity products had YTD in 2020. Fixed income ETFs/ETPs listed in Japan gathered net inflows of $89 Mn during May, bringing net inflows for the year to May 2021 to $501 Mn, much greater than the $71 Mn in net outflows fixed income products reported YTD in 2020. Commodities ETFs /ETPs listed in Japan suffered net outflows of $142 Mn during May 2021, taking net outflows for the year to May 2021 to $622 Mn, much lower than the $2.14 Bn in net inflows commodities products attracted in the same period last year.

The Bank of Japan reported owning $322 Bn in ETFs at the end of May. During May 2021, the Bank of Japan did not make ant ETF/ETP purchases.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $4.55 Bn during May, the MAXIS NIKKEI225 ETF (1346 JP) gathered the largest net inflows $644 Mn.

Top 20 ETFs by net new assets May 2021: Japan

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

MAXIS NIKKEI225 ETF |

1346 JP |

18,465.70 |

917.13 |

643.78 |

|

Daiwa ETF NIKKEI 225 |

1320 JP |

35,656.24 |

1,352.04 |

561.77 |

|

Daiwa ETF TOPIX |

1305 JP |

66,736.49 |

1,148.22 |

488.53 |

|

NEXT FUNDS TOPIX Exchange Traded Fund |

1306 JP |

145,069.30 |

3,444.00 |

442.20 |

|

Listed Index Fund 225 |

1330 JP |

35,436.19 |

485.42 |

385.74 |

|

SMDAM NIKKEI225 ETF |

1397 JP |

1,310.87 |

590.24 |

380.10 |

|

iShares Core Nikkei 225 ETF |

1329 JP |

7,891.80 |

759.19 |

262.78 |

|

Listed Index Fund TOPIX |

1308 JP |

67,871.12 |

2,155.05 |

237.86 |

|

NZAM ETF Nikkei 225 |

2525 JP |

1,796.41 |

1,281.95 |

173.03 |

|

One ETF TOPIX – Acc |

1473 JP |

3,483.52 |

549.19 |

156.64 |

|

MAXIS TOPIX ETF |

1348 JP |

19,861.37 |

560.64 |

108.14 |

|

Daiwa ETF Tokyo Stock Exchange REIT Index - Acc |

1488 JP |

1,598.37 |

35.31 |

105.33 |

|

NEXT FUNDS Nikkei 225 Exchange Traded Fund |

1321 JP |

75,129.08 |

495.88 |

99.36 |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

1570 JP |

3,482.48 |

(1,476.39) |

89.84 |

|

iShares Core TOPIX ETF |

1475 JP |

5,760.17 |

643.92 |

89.41 |

|

SMDAM REIT Index ETF |

1398 JP |

988.84 |

79.72 |

84.26 |

|

NEXT FUNDS Japan Bond NOMURA-BPI Exchange Traded Fund |

2510 JP |

207.96 |

177.09 |

71.06 |

|

Listed Index Fund US Equity Dow Average Currency Hedged |

2562 JP |

140.36 |

35.72 |

68.60 |

|

Listed Index Fund US Equity NASDAQ100 Currency Hedge - JPY Hdg |

2569 JP |

265.37 |

180.34 |

49.64 |

|

MAXIS J-REIT ETF - Acc |

1597 JP |

1,579.88 |

6.91 |

47.11 |

Investors have tended to invest in Equity ETFs/ETPs during May.