ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that assets invested in ETFs and ETPs listed in Europe reached a record US$1.43 trillion at the end of April. ETFs and ETPs listed in Europe reported net inflows of US$19.54 billion during April, bringing year-to-date net inflows to a record US$79.97 billion. Assets invested in the European ETFs/ETPs industry have increased by 5.1%, from US$1.36 trillion at the end of March to US$1.43 trillion, according to ETFGI's April 2021 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record $1.43 trillion invested in the ETFs and ETPs listed in Europe at the end of April

- Net inflows of $19.54 Bn in April – the 13th month of consecutive net inflows

- Record YTD net inflows of $79.97 Bn beating the prior record of $40.58 Bn gathered YTD in 2017.

The S&P 500 gained 5.34% in April and 11.84% YTD as positive corporate earnings and US stimulis measures helped push U.S. equities higher. Developed markets ex-U.S. gained 3.35% in April. Denmark 7.07% and Finland 7.05% were the leaders of the month while Japan lost 1.60% and was the only country to be down for the month. Emerging markets were up 2.93% at the end of April. Poland (up 9.9%) and Greece were the leaders (up 9.20%), whilst Chile (down 8.1%), Peru (down 7.1%), and Colombia (down 6.5%) were down the most. “ According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

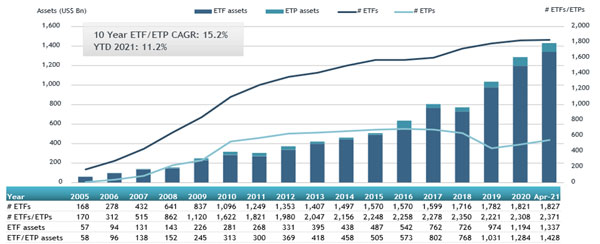

Europe ETFs and ETPs asset growth at the end of April 2021

At the end of April 2021, the European ETFs and ETPs industry had 2,371 products, with 9,199 listings, assets of $1.43 Tn, from 83 providers on 29 exchanges in 24 countries.

Equity ETFs/ETPs listed in Europe reported net inflows of $11.54 Bn during April, bringing net inflows for the year 2021 to $68.85 Bn, much higher than the $5.01 Bn in net outflows equity products had attracted YTD in 2020. Fixed income ETFs/ETPs listed in Europe had net inflows of $5.94 Bn during April, taking net inflows for the year to $6.59 Bn, greater than the $4.63 Bn in net inflows fixed income products had reported at this point in 2020. Commodity ETFs/ETPs reported $900 Mn in net inflows, bringing net inflows to $1.48 Bn for 2021, which is lower than the $11.17 Bn in net inflows gathered over the same period in 2020. Active ETFs/ETPs listed in Europe reported net inflows of $806 Mn, bringing net inflows for the year 2021 to $1.37 Bn, significantly higher than the $630 Mn in net outflows active products had attracted year to date in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $8.75 Bn during April. iShares Core MSCI World UCITS ETF - Acc (IWDA LN) gathered $1.30 Bn the largest net inflows.

Top 20 ETFs by net inflows in April 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

35,062.05 |

3,144.85 |

1,295.19 |

|

iShares EURO STOXX Banks 30-15 UCITS ETF (DE) |

SX7EEX GY |

2,238.99 |

598.72 |

622.70 |

|

iShares MSCI Europe Financials Sector UCITS ETF - Acc |

ESIF GY |

582.89 |

584.26 |

584.26 |

|

Invesco S&P 500 ETF - Acc |

SPXS LN |

9,639.96 |

(240.22) |

561.00 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

5,444.97 |

1,360.81 |

494.28 |

|

iShares MSCI Europe UCITS ETF EUR (Acc) - Acc |

SMEA LN |

5,773.32 |

1,231.98 |

488.20 |

|

iShares Edge MSCI USA Value Factor UCITS ETF - Acc |

IUVL LN |

5,466.13 |

2,776.73 |

476.07 |

|

iShares MSCI USA SRI UCITS ETF - Acc |

SUAS LN |

6,703.43 |

1,235.78 |

464.05 |

|

Vanguard S&P 500 UCITS ETF - Acc - Acc |

VUAA LN |

2,405.04 |

645.00 |

443.71 |

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

10,796.90 |

(687.35) |

399.73 |

|

iShares € Ultrashort Bond UCITS ETF |

ERNE LN |

3,761.25 |

916.69 |

379.26 |

|

iShares $ High Yield Corp Bond UCITS ETF |

IHYU LN |

4,918.81 |

143.94 |

366.00 |

|

Vanguard FTSE All-World UCITS ETF |

VWRD LN |

8,118.39 |

881.70 |

325.45 |

|

Amundi MSCI USA ESG Leaders Select UCITS ETF DR - Acc |

SADU GY |

1,715.15 |

1,251.39 |

295.71 |

|

Xtrackers MSCI EM Asia Swap UCITS ETF |

XMA1 GY |

283.63 |

281.06 |

280.84 |

|

iShares $ TIPS UCITS ETF - Acc |

ITPS LN |

3,131.31 |

522.54 |

279.24 |

|

Xtrackers MSCI World ESG UCITS ETF - 1C - Acc |

XZW0 LN |

2,170.84 |

730.02 |

262.39 |

|

Amundi MSCI EMU ESG Leaders Select UCITS ETF DR - Acc |

CMU FP |

1,945.95 |

316.99 |

249.22 |

|

UBS ETF (IE) Bloomberg Commodity Index SF UCITS ETF (CHF) A-acc |

DCCHAS SW |

320.79 |

258.70 |

246.71 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

3,196.73 |

451.02 |

238.45 |

The top 10 ETPs by net new assets collectively gathered $2.55 Bn during April. Xtrackers IE Physical Gold ETC Securities – Acc (XGDU LN) gathered $198 Mn gathered the largest net inflows.

Top 10 ETPs by net inflows in April 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

XGDU LN |

1,435.97 |

1,191.74 |

1,065.85 |

|

Xtrackers IE Physical Gold ETC Securities - EUR Hdg Acc |

XGDE GY |

497.55 |

358.14 |

376.59 |

|

Xetra Gold EUR – Acc |

4GLD GY |

12,844.74 |

537.23 |

261.74 |

|

AMUNDI PHYSICAL GOLD ETC (C) – Acc |

GOLD FP |

3,293.67 |

254.26 |

217.08 |

|

WisdomTree Copper – Acc |

COPA LN |

777.72 |

325.64 |

163.81 |

|

iShares Physical Gold ETC – Acc |

SGLN LN |

12,894.33 |

(391.68) |

124.10 |

|

SEBA Bitcoin ETP (USD) |

SBTCU SW |

92.12 |

94.40 |

94.40 |

|

Xtrackers IE Physical Silver ETC Securities - Acc |

XSLR LN |

183.64 |

137.11 |

93.19 |

|

WisdomTree Core Physical Gold – Acc |

WGLD LN |

114.65 |

103.79 |

92.98 |

|

Invesco Physical Gold ETC – Acc |

SGLD LN |

12,376.83 |

(672.62) |

61.24 |

Investors have tended to invest in Equity ETFs and ETPs during April.