ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed in Europe gathered net inflows of US$18.55 billion in July, bringing year-to-date net inflows to US$62.74 billion. Assets invested in the European ETF/ETP industry have increased by 1.1%, from US$900.66 billion at the end of June, to US$910.34 billion, according to ETFGI's July 2019 European ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

At the end of July 2019, the European ETF/ETP industry had 2,336 ETFs/ETPs, from 68 providers listed on 30 exchanges in 23 countries.

Highlights

- Assets invested in the European ETF/ETP industry reach an all-time high of $910.34 Bn.

- July marks the 58th consecutive month of flows into European listed products.

- Assets invested in the European ETF/ETP industry increased by 1.1% in July.

- During July 2019, ETFs/ETPs listed in Europe saw $18.55 Bn in net inflows.

“Despite the weak performance for European equity markets and the intensified trade dispute between US/China, the prospects for further loosening in monetary policy by FED and ECB led the European Equity ETF/ETPs to see significant inflows of US$9.97 Bn in July, and Fixed Income funds see net inflows of US$6.57 Bn” , according to Deborah Fuhr, managing partner and founder of ETFGI.

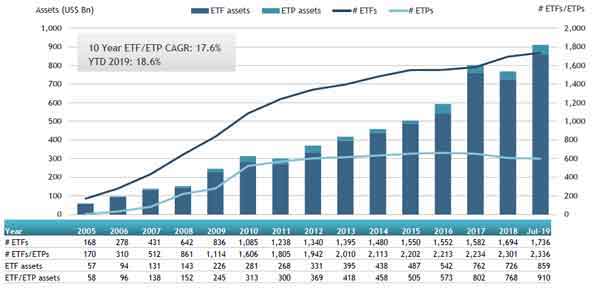

Europe ETF and ETP asset growth as at the end of July 2019

Equity ETFs/ETPs listed in Europe saw considerable net inflows of $9.97 Bn in July 2019, bringing net inflows for 2019 to $16.67 Bn, substantially less than the $24.51 Bn in net inflows equity products had attracted by the end of July 2018. Fixed income ETFs/ETPs listed in Europe attracted net inflows of $6.57 Bn in July, bringing net inflows for 2019 to $38.33 Bn, considerably greater than the

$8.48 Bn in net inflows fixed income products had attracted by the end of July 2018.

Substantial inflows can be attributed to the top 20 ETF’s by net new assets, which collectively gathered $13.35 Bn in July, the UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to USD) A-acc (ACWIU SW) gathered $1.54 Bn alone.

Top 20 ETFs by net new assets July 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to USD) A-acc |

ACWIU SW |

2304.62 |

1,364.95 |

1538.42 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to CHF) A-acc |

ACWIS SW |

1917.61 |

1,179.75 |

1373.46 |

|

iShares € High Yield Corp Bond UCITS ETF |

IHYG LN |

9483.22 |

3,856.16 |

1309.72 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to EUR) A-acc |

ACWIE SW |

2047.33 |

1,117.24 |

1191.86 |

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

13403.46 |

4,758.32 |

1152.99 |

|

Invesco MSCI Saudi Arabia UCITS ETF |

MSAU LN |

2364.61 |

2,255.20 |

1150.49 |

|

iShares USD Treasury Bond 0-1yr UCITS ETF - Acc |

IB01 LN |

1525.44 |

1,523.15 |

1106.56 |

|

iShares J.P. Morgan $ EM Bond UCITS ETF |

SEMB LN |

8895.35 |

1,956.27 |

742.81 |

|

iShares STOXX Europe 600 UCITS ETF (DE) |

SXXPIEX GY |

6637.08 |

(91.62) |

578.17 |

|

PIMCO Euro Short Maturity ETF |

PJS1 GY |

2689.77 |

250.62 |

412.29 |

|

iShares S&P 500 UCITS ETF |

IUSA LN |

9339.63 |

285.00 |

334.18 |

|

Invesco US Treasury 7-10 Year UCITS ETF GBP Hdg Dist |

TRXS LN |

1363.47 |

1,398.60 |

332.48 |

|

iShares Core MSCI World UCITS ETF |

IWDA LN |

18430.22 |

2,027.34 |

331.21 |

|

iShares $ High Yield Corp Bond UCITS ETF |

IHYU LN |

3437.67 |

726.11 |

321.44 |

|

iShares $ Corp Bond UCITS ETF |

LQDE LN |

4937.17 |

(594.71) |

270.31 |

|

Xtrackers Equity Low Beta Factor UCITS ETF (DR) - 1C |

XDEB GY |

425.97 |

265.32 |

258.13 |

|

iShares EURO STOXX 50 UCITS ETF |

EUN2 GY |

4495.17 |

(638.95) |

244.94 |

|

AMUNDI ETF S&P 500 UCITS ETF USD D |

500USD SW |

2217.62 |

665.56 |

235.22 |

|

iShares S&P 500 Health Care Sector UCITS ETF |

IHCU LN |

1348.90 |

159.30 |

232.95 |

|

iShares MSCI Europe ex-UK UCITS ETF |

IEUX LN |

1609.33 |

(621.07) |

231.02 |

Top 10 ETPs by net new assets July 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ETFS Physical Silver |

PHAG LN |

1225.55 |

374.47 |

318.32 |

|

iShares Physical Gold ETC |

SGLN LN |

5821.02 |

983.71 |

233.29 |

|

ETFS Brent Crude |

BRNT LN |

316.69 |

22.47 |

223.79 |

|

Amundi Physical Metals PLC |

GOLD FP |

491.15 |

470.42 |

165.13 |

|

Xtrackers Physical Gold Euro Hedged ETC |

XAD1 GY |

2191.95 |

206.37 |

155.42 |

|

Xtrackers Physical Silver ETC (EUR) |

XAD6 GY |

319.70 |

196.29 |

135.39 |

|

Xtrackers Physical Gold ETC (EUR) |

XAD5 GY |

3013.86 |

198.02 |

130.87 |

|

ETFS Physical Swiss Gold |

SGBS LN |

2134.19 |

1,222.57 |

125.79 |

|

GBS Bullion Securities |

GBS LN |

3596.78 |

(64.91) |

58.76 |

|

ETFS Physical Platinum |

PHPT LN |

333.38 |

91.11 |

23.74 |

Investors have tended to invest in Equity and Fixed Income ETFs/ETPs in July.