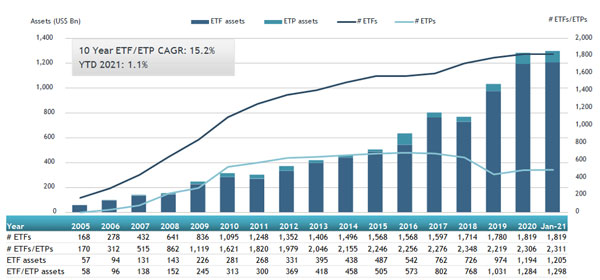

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in ETFs and ETPs listed in Europe reach a record US$1.30 trillion at the end of January. A strong start to the year with record net inflows of US$20.51 billion during January, which is significantly more than the net inflows of US$15.16 billion in January 2020. Assets invested in the European ETFs/ETPs industry have increased by 1.1%, from US$1.28 trillion at the end of December, to US$1.30 trillion, according to ETFGI's January 2021 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets reach a new record $1.30 trillion invested in ETFs and ETPs listed in Europe at the end of January.

- Net inflows set a new record of $20.51 billion in January.

- Equity ETFs/ETPs listed in Europe attracted the biggest part of net inflows during January with

$15.92 billion.

“The S&P 500 posted a loss of 1% for January due to the sell-off during the last week of the month. Small and mid-cap stocks outperformed in January, with the S&P Mid-Cap 400® and the S&P SmallCap 600® up 2% and 6%, respectively. Slower-than-expected COVID-19 vaccine distribution affected global impacted equities globally. The Developed markets ex- the U.S. ended the month down 1% while Emerging markets were up 3% for the month. “According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Europe ETFs and ETPs asset growth as at the end of January 2021

Equity ETFs/ETPs listed in Europe reported net inflows of $15.92 BN during January, which is significantly more than the $7.73 Bn in net inflows equity products attracted in January 2020. Fixed income ETFs/ETPs listed in Europe had net inflows of $2.10 Bn during January, which is lower than the $5.35 Bn in net inflows reported in January2020. Commodity ETFs/ETPs reported $2.36 Bn in net inflows,, which is higher than the $2.15 Bn in net inflows gathered in January 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $10.43 Bn during January. AMUNDI INDEX MSCI USA SRI - UCITS ETF DR (C) - Acc (USRI FP) gathered $1.07 Bn.

Top 20 ETFs by net inflows in January 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

|

AMUNDI INDEX MSCI USA SRI - UCITS ETF DR (C) - Acc |

USRI FP |

2,828.99 |

1,072.73 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

6,499.48 |

871.93 |

|

Amundi MSCI USA ESG Leaders Select UCITS ETF DR - Acc |

SADU GY |

1,122.14 |

751.60 |

|

UBS ETF-MSCI Emerging Markets UCITS ETF A - Acc - Acc |

EMMUSC SW |

3,041.95 |

748.99 |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

29,305.54 |

675.11 |

|

iShares China CNY Bond UCITS ETF - Acc |

CYBA NA |

2,738.42 |

658.06 |

|

UBS (Irl) ETF plc - MSCI ACWI ESG Universal UCITS ETF CHF ACC |

AWESGS SW |

748.18 |

510.46 |

|

UBS (Irl) ETF plc - MSCI ACWI ESG Universal UCITS ETF USD ACC |

AWESGW SW |

747.43 |

484.59 |

|

iShares China CNY Bond UCITS ETF |

CNYB NA |

4,369.82 |

432.23 |

|

UBS (Irl) ETF plc - MSCI ACWI ESG Universal UCITS ETF EUR ACC |

AWESGE SW |

659.25 |

428.99 |

|

iShares Core MSCI Pacific ex-Japan UCITS ETF - Acc |

CSPXJ SW |

2,643.01 |

428.83 |

|

Vanguard FTSE All-World UCITS ETF |

VWRD LN |

6,945.61 |

415.20 |

|

iShares Core FTSE 100 UCITS ETF |

ISF LN |

11,909.51 |

396.46 |

|

iShares MSCI USA ESG Screened UCITS ETF - Acc - Acc |

SASU LN |

2,277.08 |

393.84 |

|

iShares MSCI EM IMI ESG Screened UCITS ETF - Acc - Acc |

SAEM LN |

1,543.87 |

375.55 |

|

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) - 1C - Acc |

XDEW GY |

2,729.36 |

373.96 |

|

L&G US Equity Responsible Exclusions UCITS ETF - Acc |

RIUS LN |

1,703.24 |

367.75 |

|

iShares J.P. Morgan EM Local Govt Bond UCITS ETF |

SEML LN |

6,489.70 |

363.91 |

|

iShares Edge MSCI USA Value Factor UCITS ETF - Acc |

IUVL LN |

2,562.39 |

348.03 |

|

iShares Core MSCI World UCITS ETF - EUR Hdg |

IWLE GY |

703.83 |

336.05 |

The top 10 ETPs by net new assets collectively gathered $1.76 Bn during January. Invesco Physical Gold ETC – Acc (SGLD LN) gathered $421 Mn.

Top 10 ETPs by net inflows in January 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

14,212.26 |

421.23 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3,508.97 |

278.06 |

|

CoinShares Physical Bitcoin - Acc |

BITC SW |

225.88 |

224.85 |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

14,253.04 |

217.65 |

|

Invesco Physical Gold ETC - EUR Hdg Acc |

SGLE IM |

206.60 |

154.97 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

3,594.56 |

150.68 |

|

WisdomTree Physical Silver - Acc |

PHAG LN |

2,619.76 |

86.71 |

|

WisdomTree Copper - Acc |

COPA LN |

421.33 |

82.02 |

|

WisdomTree Physical Gold - GBP Daily Hedged - Acc |

GBSP LN |

1,577.77 |

75.15 |

|

Xetra Gold EUR - Acc |

4GLD GY |

13,008.70 |

68.88 |

Investors have tended to invest in Equity ETFs and ETPs during January.

.jpg)