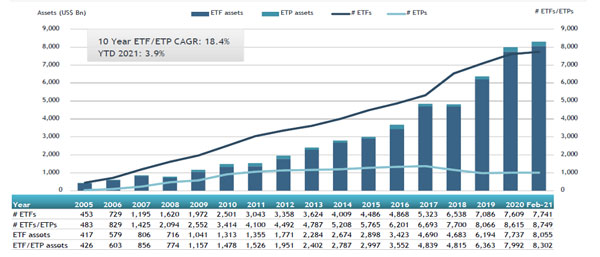

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that reports assets invested in ETFs and ETPs listed around the world reach a new record of US$8.30 trillion at the end of February. ETFs and ETPs listed globally gathered the highest ever monthly net inflows of US$139.46 billion during February, bringing year-to-date net inflows to a record level of US$222.54 billion. Assets invested in the global ETFs/ETPs industry have increased by 3.0% from US$8.06 trillion at the end of January 2021, to US$8.30 trillion at the end of February, according to ETFGI's February 2021 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs and ETPs listed globally reach a new record of $8.30 trillion at the end of February.

- Net inflows of $139.46 Bn in February are the highest ever beating the prior record of $131.99 Bn set in Nov 2020

- YTD net inflows are a record $222.54 Bn ahead of the $98.31 Bn in 2020 and beating the prior record of $130.95 set in February 2017

- $110.80 Bn of net inflows went into Equity products during February.

“Despite a sell-off in the last week of the month, the S&P 500 gained of 2.76% in February, driven by optimism on COVID-19 vaccines, as well as continued monetary and fiscal stimulus. Developed markets ex- the U.S. ended the month up 2.50% while Emerging markets were up by 1.50% for the month. The leaders of the developed market in February were Hong Kong (6.03%), Canada (5.66%) and Spain (5.32%) .“ according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Global ETF and ETP assets as of the end of February 2021

The Global ETF/ETP industry had had 8,749 ETFs/ETPs, with 17,421 listings, assets of $8.30 trillion, from 528 providers listed on 77 exchanges in 62 countries at the end of February.

During February 2021, ETFs/ETPs listed globally gathered net inflows of $139.46 Bn Equity ETFs/ETPs listed globally gathered net inflows of $110.80 Bn over February, bringing net inflows for 2021 to $159.89 Bn, greater than the $37.87 Bn in net inflows equity products had attracted YTD in 2020. Fixed Income ETFs/ETPs reported $9.08 Bn in net inflows bringing net inflows for 2021 to $22.33 Bn, which is lower than the $35.74 Bn in net inflows fixed income products had attracted YTD in 2020. Commodity ETFs/ETPs saw net outflows of $2.04 Bn in February, bringing YTD net inflows to $791 Mn, which is much less than the net inflows of $9.29 Bn over the same period last year. Active ETFs/ETPs listed globally reported net inflows of $16.90 Bn during February, bringing net inflows for 2021 to $33.80 Bn, much higher than the $12.47 Bn in net inflows active products had attracted YTD in 2020

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $60.61 Bn during February, Vanguard S&P 500 ETF (VOO US) gathered $11.53 billion.

Top 20 ETFs by net new inflows February 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

|

VOO US |

194,031.31 |

13,082.72 |

11,524.52 |

|

iShares Core S&P 500 ETF |

|

IVV US |

245,880.07 |

6,028.46 |

8,355.95 |

|

SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc |

|

SPPU GY |

5,521.04 |

5,537.99 |

5,537.99 |

|

Invesco QQQ Trust |

|

QQQ US |

151,588.73 |

(577.59) |

3,540.81 |

|

iShares Russell 2000 ETF |

|

IWM US |

67,492.50 |

2,465.24 |

3,445.80 |

|

Financial Select Sector SPDR Fund |

|

XLF US |

34,403.86 |

7,028.51 |

2,878.93 |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

328,759.50 |

(8,975.27) |

2,837.82 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

211,342.93 |

5,455.24 |

2,631.08 |

|

ARK Innovation ETF |

|

ARKK US |

23,431.99 |

5,465.72 |

2,368.57 |

|

Vanguard Total Bond Market ETF |

|

BND US |

70,895.92 |

4,755.35 |

2,009.48 |

|

iShares Core MSCI Emerging Markets ETF |

|

IEMG US |

76,321.74 |

4,921.28 |

1,765.28 |

|

iShares U.S. Real Estate ETF |

|

IYR US |

5,606.59 |

154.27 |

1,742.63 |

|

Vanguard FTSE Emerging Markets ETF |

|

VWO US |

76,615.84 |

2,279.19 |

1,699.56 |

|

ARK Fintech Innovation ETF |

|

ARKF US |

4,412.96 |

2,355.98 |

1,689.80 |

|

ARK Web x.O ETF |

|

ARKW US |

8,075.87 |

2,412.75 |

1,583.86 |

|

Energy Select Sector SPDR Fund |

|

XLE US |

20,457.34 |

2,697.95 |

1,468.92 |

|

Schwab US TIPS ETF |

|

SCHP US |

15,821.60 |

1,930.38 |

1,397.79 |

|

Vanguard Total International Stock Index Fund ETF |

|

VXUS US |

41,479.37 |

2,356.12 |

1,391.57 |

|

Vanguard Value ETF |

|

VTV US |

66,511.18 |

2,550.61 |

1,379.20 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

|

511990 CH |

23,331.65 |

2,447.18 |

1,362.84 |

The top 10 ETPs by net new assets collectively gathered $3.37 Bn over February. ProShares Ultra VIX Short-Term Futures (UVXY US) gathered $1.10 Bn.

Top 10 ETPs by net new inflows February 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

ProShares Ultra VIX Short-Term Futures |

|

UVXY US |

2,525.89 |

1,375.77 |

1,102.02 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

|

VXX US |

1,577.04 |

658.86 |

486.03 |

|

iShares Silver Trust |

|

SLV US |

16,429.09 |

1,638.19 |

456.43 |

|

Invesco DB Commodity Index Tracking Fund |

|

DBC US |

1,891.86 |

352.56 |

355.66 |

|

BTCetc - Bitcoin ETP - Acc |

|

BTCE GY |

846.45 |

310.13 |

290.57 |

|

Xetra Gold EUR - Acc |

|

4GLD GY |

12,213.12 |

229.34 |

160.45 |

|

Invesco DB Agriculture Fund |

|

DBA US |

895.49 |

196.34 |

154.09 |

|

SPDR Gold MiniShares Trust |

|

GLDM US |

4,006.79 |

324.06 |

137.62 |

|

MicroSectors FANG+ Index 3X Leveraged ETNs due January 8, 2038 |

|

FNGU US |

1,526.00 |

134.33 |

134.33 |

|

ProShares VIX Short-Term Futures ETF |

|

VIXY US |

469.68 |

179.50 |

97.52 |

Investors have tended to invest in Equity ETFs/ETPs during February.