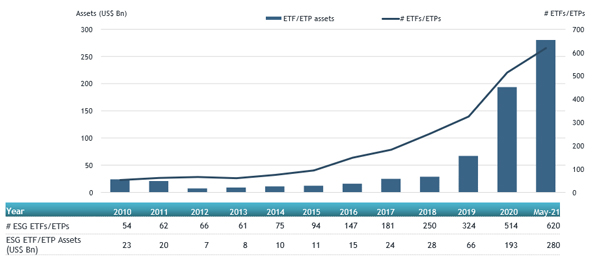

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally reached a record of US$280 billion at the end of May 2021. ESG ETFs and ETPs listed globally gathered net inflows of US$6.54 billion during May, bringing year-to-date net inflows to US$73.95 billion which is much higher than the US$26.42 billion gathered at this point last year. Total assets invested in ESG ETFs and ETPs increased by 4.1% from US$269 billion at the end of April 2021 to US$280 billion, according to ETFGI’s May 2021 ETF and ETP ESG industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

-

Assets invested in ESG ETFs and ETPs listed globally reached a record of $280 Bn at the end of May.

-

Record YTD net inflows of $73.95 Bn beating the prior record of $26.42 Bn gathered YTD in 2020.

“The S&P 500 gained 0.7% in May and 12.62% YTD, with positive figures for four consecutive months. Developed markets ex-U.S. gained 3.11% in May. Austria 8.29% and Luxembourg 8.12% were the leaders for the month while New Zealand lost the most at 3.92%. Emerging markets were up 2.58% at the end of May. Hungary (up 15.54%) and Poland (up 13.98%) were the leaders, whilst Egypt (down 3.86%), Chile (down 3.64%), and Malaysia (down 2.79%) were down the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The Global ESG ETF/ETP had 620 ETFs/ETPs, with 1,834 listings, assets of US$280 Bn, from 139 providers on 37 exchanges in 30 countries. Following net inflows of $6.54 Bn and market moves during the month, assets invested in ESG ETFs/ETPs listed globally increased by 4.1% from $269 Bn at the end of April 2021 to $280 Bn at the end of

May 2021.

Global ESG ETF and ETP asset growth as at end of May 2021

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily, with 620 ESG ETFs/ETPs and 1,834 listings globally at the end of May 2021.

During May, 18 new ESG ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$4.03 Bn in May. iShares Trust iShares ESG Aware MSCI USA ETF (ESGU US) gathered $417 Mn he largest net inflows.

Top 20 ESG ETFs/ETPs by net new assets May 2021

|

Name |

Ticker |

Assets (US$ Mn) May-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) May-21 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

17,363.46 |

2,283.56 |

417.28 |

|

iShares MSCI USA ESG Enhanced UCITS ETF - Acc |

EDMU GY |

2,683.17 |

1,157.93 |

362.63 |

|

BMO MSCI USA ESG Leaders Index ETF |

ESGY CN |

689.00 |

635.05 |

323.95 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

3,239.67 |

2,242.77 |

295.64 |

|

iShares ESG MSCI EAFE ETF |

ESGD US |

5,842.26 |

1,352.77 |

254.12 |

|

Vanguard ESG US Stock ETF |

ESGV US |

4,471.20 |

1,117.98 |

236.15 |

|

iShares MSCI USA SRI UCITS ETF - Acc |

SUAS LN |

6,996.54 |

1,471.66 |

235.87 |

|

iShares MSCI USA ESG Enhanced UCITS ETF |

EEDS LN |

910.16 |

568.09 |

225.55 |

|

iShares MSCI Europe ESG Enhanced UCITS ETF - Acc |

EDM6 GY |

497.88 |

252.96 |

193.32 |

|

iShares ESG 1-5 Year USD Corporate Bond ETF |

SUSB US |

940.18 |

425.97 |

179.80 |

|

JPMorgan US Research Enhanced Index Equity UCITS ETF - Acc |

JREU LN |

331.14 |

136.89 |

172.56 |

|

iShares Global Clean Energy ETF |

ICLN US |

5,951.09 |

2,676.96 |

171.02 |

|

KraneShares Global Carbon ETF |

KRBN US |

379.58 |

331.20 |

144.36 |

|

iShares ESG MSCI EM ETF |

ESGE US |

7,538.01 |

1,010.74 |

138.91 |

|

iShares MSCI EM ESG Enhanced UCITS ETF |

EDM2 GY |

1,020.87 |

280.62 |

138.28 |

|

Fidelity Sustainable Global Corporate Bond Multifactor UCITS ETF - GBP Hdg Acc |

FSMP LN |

329.65 |

320.33 |

125.72 |

|

Vanguard ESG International Stock ETF |

VSGX US |

2,237.58 |

491.86 |

107.56 |

|

Lyxor Net Zero 2050 S&P Eurozone Climate PAB (DR) UCITS ETF - Acc |

EPAB FP |

895.72 |

445.73 |

105.41 |

|

iShares MSCI USA SRI UCITS ETF USD - Acc |

3SUR GY |

406.03 |

116.33 |

101.69 |

|

iShares EUR Corp Bond 0-3yr ESG UCITS ETF |

SUSS LN |

2,295.28 |

1,061.18 |

98.62 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity. Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.