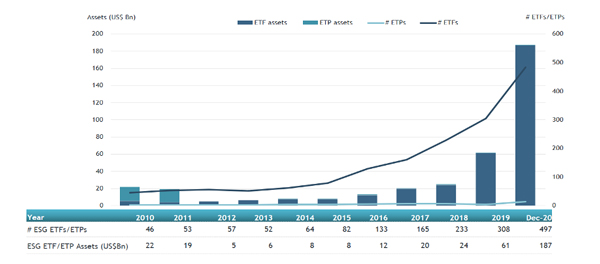

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in ESG (Environmental, Social, and Governance) ETFs and ETPs reached a new milestone of US$187 billion at the end of 2020. Assets invested in ESG ETFs and ETPs increased by 206% in 2020. During December ESG ETFs and ETPs gathered net inflows of US$18.46 billion during, bringing 2020 net inflows to US$88.95 billion which significantly greater than the US$27.79 billion gathered in 2019, according to ETFGI’s December 2020 ETF and ETP ESG industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in ESG ETFs and ETPs listed globally reached a new milestone of $187 billion.

- Assets invested in ESG ETFs and ETPs increased 206% in 2020.

- 2020 net inflows are a record $88.95 billion which is significantly greater than the $27.79 billion gathered in 2019.

- 53.6% of the assets and 47% of ESG ETFs and ETPs are in Europe.

“The S&P 500® was up 3.8% for December and finished the year at an all-time high, having added 18.4% the year. Developed ex-U.S. gained 5.5% during December, concluding 2020 up 11.1%. The S&P Emerging BMI gained 6.1% during December, finishing 2020 up 15.5%. Emerging BMI gained 6.1% during December, and finished 2020 up 15.5%. “According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ESG ETF and ETP asset growth as at end of December 2020

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products has increased steadily. Globally there were 497 ESG ETFs and ETPs, with 1,452 listings, assets of U$187 Bn, from 113 providers listed on 35 exchanges in 29 countries at the end of 2020.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $9.30 billion at the end of December. Huatai-PineBridge CSI Photovoltaic Industry ETF (515790 CH) gathered $1.41 billion alone.

Top 20 ESG ETFs/ETPs by net new assets December 2020

|

Name |

Ticker |

Assets (US$ Mn) Dec-20 |

NNA (US$ Mn) YTD-20 |

NNA (US$ Mn) Dec-20 |

|

Huatai-PineBridge CSI Photovoltaic Industry ETF |

515790 CH |

1481.58 |

1411.79 |

1411.79 |

|

iShares Global Clean Energy ETF |

ICLN US |

4699.99 |

2624.25 |

924.22 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

5364.98 |

2972.25 |

857.61 |

|

iShares MSCI World ESG Enhanced UCITS ETF - Acc |

EDMW GY |

948.15 |

893.37 |

700.45 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

13424.18 |

9578.87 |

622.54 |

|

iShares JP Morgan ESG USD EM Bond UCITS ETF - Acc - Acc |

EMSA LN |

1125.35 |

611.27 |

452.04 |

|

iShares MSCI USA ESG Enhanced UCITS ETF - Acc |

EDMU GY |

1293.80 |

1147.86 |

446.84 |

|

AMUNDI INDEX MSCI USA SRI - UCITS ETF DR (C) - Acc |

USRI FP |

1767.89 |

1468.26 |

359.43 |

|

iShares MSCI USA ESG Screened UCITS ETF - Acc - Acc |

SASU LN |

1911.78 |

1139.75 |

358.32 |

|

iShares MSCI EM ESG Enhanced UCITS ETF |

EDM2 GY |

690.76 |

612.14 |

324.42 |

|

AMUNDI S&P 500 ESG UCITS ETF DR - EUR Hdg - Acc |

S500H FP |

327.82 |

319.13 |

312.04 |

|

Invesco WilderHill Clean Energy ETF |

PBW US |

2174.78 |

1010.95 |

308.89 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

1598.18 |

1350.07 |

308.54 |

|

First Trust NASDAQ Clean Edge Green Energy Index Fund |

QCLN US |

1999.28 |

1181.34 |

304.15 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

2517.75 |

1463.16 |

299.56 |

|

AMUNDI INDEX MSCI EUROPE SRI - UCITS ETF DR (C) - Acc |

EUSRI FP |

1679.94 |

1184.18 |

289.98 |

|

iShares ESG MSCI EM ETF |

ESGE US |

6133.64 |

4160.04 |

272.68 |

|

iShares MSCI USA SRI UCITS ETF - Acc |

SUAS LN |

4906.74 |

2148.55 |

260.46 |

|

Xtrackers MSCI Japan ESG UCITS ETF - 1C - Acc |

XZMJ LN |

1376.64 |

1009.26 |

244.13 |

|

Vanguard ESG US Stock ETF |

ESGV US |

2981.32 |

1577.96 |

243.69 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity. Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.