ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$2.66 billion during November. Total assets invested ESG ETFs and ETPs increased by 7.40% from US$48.75 billion at the end of October to a record US$52.35 billion, according to ETFGI’s November 2019 ETFs and ETPs ESG industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ESG ETFs and ETPs listed globally rose 7.4% in November 2019, to reach new record AUM of $52.35 billion.

- ESG ETFs and ETPs listed globally gathered $2.66 billion in net new assets during November.

- Europe leads with 118 ESG products and 54% of the assets.

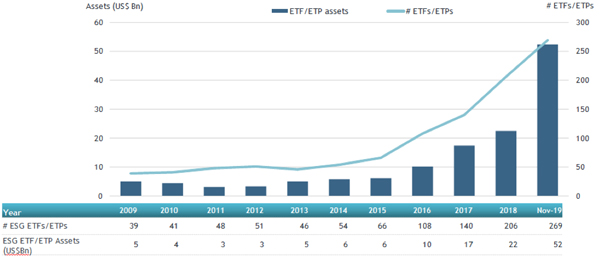

At the end of November 2019, the Global ETF/ETP industry had 269 ETFs/ETPs, with 753 listings, assets of $52.35 Bn, from 71 providers on 29 exchanges in 58 countries. Following net inflows of $2.66 billion and market moves during the month, assets invested in ESG ETFs/ETPs listed globally increased 7.4%, from $48.75 billion at the end of October 2019 to a record $52.35 billion.

Global ESG ETF and ETP asset growth as at end of November 2019

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products has increased steadily, with 269 ESG ETFs/ETPs listed globally at the end of November 2019. In November, 7 new ESG ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $1.48 billion in November, JPMorgan Global Emerging Markets Research Enhanced Index Equity ESG UCITS ETF (JREM LN) gathered $201.25 million alone.

Top 20 ESG ETFs/ETPs by net new assets November 2019

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

(US$ million) |

(US$ million) |

(US$ million) |

||

|

Nov-19 |

YTD-19 |

Nov-19 |

||

|

JPMorgan Global Emerging Markets Research Enhanced Index Equity ESG UCITS ETF |

JREM LN |

224.93 |

217.03 |

201.25 |

|

Shin Kong 10 Years China Treasury Policy Bank Green Bond ETF |

00774B TT |

841.06 |

849.59 |

98.14 |

|

UBS ETF (LU) MSCI World Socially Responsible UCITS ETF (USD) A-dis |

UIMM GY |

1340.87 |

358.33 |

92.82 |

|

Vanguard ESG US Stock ETF |

ESGV US |

790.74 |

610.61 |

89.63 |

|

iShares EUR High Yield Corp Bond ESG UCITS ETF |

EHYA NA |

88.39 |

88.16 |

88.16 |

|

UBS ETF (LU) MSCI Pacific Socially Responsible UCITS ETF (USD) A-dis |

UIMT GY |

467.29 |

338.57 |

87.51 |

|

iShares USD High Yield Corp Bond ESG UCITS ETF |

DHYE NA |

84.39 |

84.44 |

84.44 |

|

iShares MSCI USA ESG Screened UCITS ETF - Acc |

SASU LN |

128.71 |

121.64 |

74.71 |

|

UBS Irl ETF plc - S&P 500 ESG UCITS ETF - CHF Hdg - Acc |

5ESGS SW |

71.94 |

70.65 |

69.12 |

|

iShares MSCI EAFE ESG Optimized ETF |

ESGD US |

1361.52 |

754.18 |

66.80 |

|

UBS (Irl) ETF plc - MSCI ACWI Socially Responsible UCITS ETF |

AWSRIW SW |

199.51 |

92.42 |

63.25 |

|

Amundi Index MSCI Europe SRI UCITS ETF DR |

EUSRI FP |

209.58 |

187.88 |

62.67 |

|

iShares MSCI Japan SRI UCITS ETF |

SUJP LN |

192.99 |

134.31 |

59.44 |

|

UBS ETF (LU) - MSCI EMU Socially Responsible UCITS ETF (EUR) A-dis |

UIMR GY |

953.73 |

151.00 |

53.60 |

|

iShares MSCI EM SRI UCITS ETF |

SUES LN |

474.76 |

208.93 |

52.48 |

|

iShares MSCI KLD 400 Social ETF |

DSI US |

1747.32 |

225.87 |

52.02 |

|

iShares MSCI EM IMI ESG Screened UCITS ETF - Acc |

SAEM LN |

175.37 |

153.47 |

50.52 |

|

Vanguard ESG International Stock ETF |

VSGX US |

541.28 |

455.90 |

46.41 |

|

iShares Global Water UCITS ETF |

IH2O LN |

975.68 |

295.17 |

44.47 |

|

iShares Trust iShares ESG MSCI USA ETF |

ESGU US |

1352.94 |

1109.85 |

44.30 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.