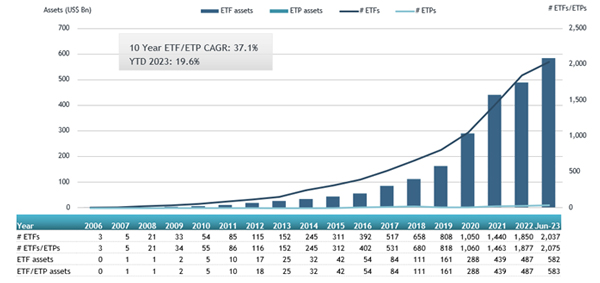

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today assets invested in actively managed ETFs listed globally reached a record US$583 billion at the end of June. Actively managed ETFs gathered net inflows of $10.69 billion during June, bringing year-to-date net inflows to $69.47 billion. Assets increased 19.6% year-to-date in 2023, going from $487.21 Bn at the end of 2022 to $582.56 Bn, according to ETFGI's June 2023 Active ETFs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record assets of $583 Bn invested in actively managed ETFs listed globally at the end of June.

- Assets increased 19.6% year-to-date in 2023, going from $487.21 Bn at the end of 2022 to $582.56 Bn.

- Net inflows of $10.69 Bn gathered during June 2023.

- Year-to-date net inflows of $69.47 Bn in 2023 are the second highest on record, after year-to-date net inflows of $81.51 Bn in 2021.

- 39th month of consecutive net inflows.

“The S&P 500 increased by 6.61% in June and is up 16.89% year-to-date in 2023. Developed markets excluding the US increased 4.46% in June and are up 11.07% YTD in 2023. Korea (up 2.23%) and Israel (up 1.51%) saw the largest increases amongst the developed markets in June. Emerging markets increased by 4.33% during June and are up 4.64% YTD in 2023. Pakistan (up 8.61%) and Turkey (up 5.85%) saw the largest increases amongst emerging markets in June.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

There were 2,075 actively manage ETFs listed globally, with 2,580 listings, assets of $583 Bn, from 373 providers listed 33 exchanges in 25 countries at the end of June.

Equity focused actively managed ETFs listed globally gathered net inflows of $8.67 Bn during June, bringing year-to-date net inflows to $49.69 Bn, significantly higher than the $41.67 Bn in net inflows YTD in 2022. Fixed Income focused actively managed ETFs listed globally attracted net inflows of $2.04 Bn during June, bringing net inflows for the year through June 2023 to $20.77 Bn, much higher than the $11.61 Bn in net inflows YTD in 2022.

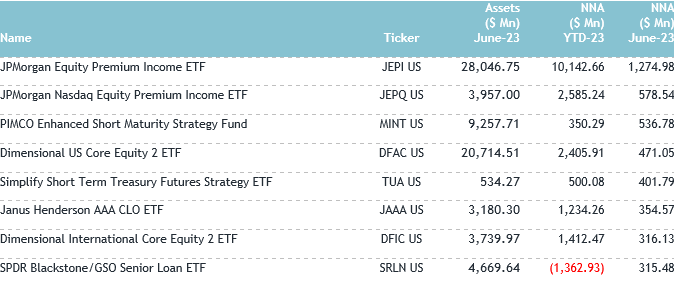

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered

$6.83 Bn during June. JPMorgan Equity Premium Income ETF (JEPI US) gathered $1.27 Bn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets June 2023

Investors have tended to invest in Equity actively managed ETFs/ETPs during June.