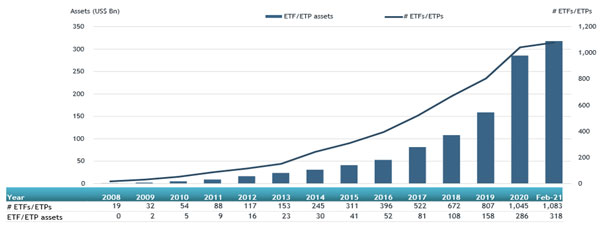

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that Active ETFs and ETPs gathered net inflows of US$16.90 billion during February, bringing year-to-date net inflows to a record US$33.80 billion. Assets invested in actively managed ETFs and ETPs finished the month up to 4.9%, going from US$303 billion at the end of January to a record US$318 billion, according to ETFGI's February 2021 Active ETF and ETP industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Active ETFs reached a high of $318 Bn at the end of February.

- Monthly net inflows of $16.90 Bn during February are the second highest behind the $18.56 Bn in November 2020.

- Record YTD net inflows of $33.80 Bn are much higher than the prior record of US$12.47 Bn set in February 2020.

“Despite a sell-off in the last week of the month, the S&P 500 gained of 2.76% in February, driven by optimism on COVID-19 vaccines, as well as continued monetary and fiscal stimulus. Developed markets ex- the U.S. ended the month up 2.50% while Emerging markets were up by 1.50% for the month. The leaders of the developed market in February were Hong Kong (6.03%), Canada (5.66%) and Spain (5.32%).“ according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in actively managed ETF and ETP assets as of the end of February 2021

Equity focused Active ETFs/ETPs listed globally attracted net inflows of $10.47 Bn during February, bringing YTD net inflows to $20.16 Bn, which is much greater than the $2.84 Bn in net inflows gathered YTD in 2020. Fixed Income focused Active ETFs/ETPs listed globally gathered net inflows of $5.25 Bn in February, bringing YTD net inflows to $11.46 Bn, more than the $9.03 Bn in YTD net inflows attracted in 2020.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered $12.74 Bn during February. Ark Innovation ETF (ARKK US) gathered $2.37 Bn.

Top 20 actively managed ETFs/ETPs by net new assets February 2021

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ARK Innovation ETF |

ARKK US |

23,431.99 |

5,465.72 |

2,368.57 |

|

ARK Fintech Innovation ETF |

ARKF US |

4,412.96 |

2,355.98 |

1,689.80 |

|

ARK Web x.O ETF |

ARKW US |

8,075.87 |

2,412.75 |

1,583.86 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

23,331.65 |

2,447.18 |

1,362.84 |

|

ARK Autonomous Technology & Robotics ETF |

ARKQ US |

3,609.34 |

1,794.19 |

877.96 |

|

ARK Genomic Revolution Multi-Sector ETF |

ARKG US |

10,486.05 |

3,293.29 |

858.24 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

2,026.97 |

1,055.79 |

708.63 |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

3,559.79 |

1,298.24 |

436.37 |

|

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF |

PDBC US |

3,934.77 |

761.37 |

419.05 |

|

Amplify Transformational Data Sharing ETF |

BLOK US |

1,091.22 |

543.51 |

409.32 |

|

AdvisorShares Pure US Cannabis ETF |

MSOS US |

1,019.40 |

708.03 |

375.75 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

16,142.13 |

522.93 |

284.33 |

|

E Funds SWIFT Cash Money Market Fund |

159001 CH |

442.13 |

263.88 |

238.23 |

|

First Trust Low Duration Mortgage Opportunities ETF |

LMBS US |

6,892.60 |

365.33 |

203.19 |

|

First Trust TCW Opportunistic Fixed Income ETF |

FIXD US |

5,040.80 |

463.65 |

200.08 |

|

First Trust Global Tactical Commodity Strategy Fund |

FTGC US |

541.84 |

270.07 |

178.89 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

445.33 |

280.69 |

149.43 |

|

Dimensional US Core Equity Market ETF |

DFAU US |

461.89 |

235.07 |

140.72 |

|

BlackRock Ultra Short-Term Bond ETF |

ICSH US |

5,327.33 |

88.43 |

131.35 |

|

Vanguard Growth ETF Portfolio |

VGRO CN |

1,665.40 |

228.60 |

123.61 |

Investors have tended to invest in Equity focused Active ETFs/ETPs during February.