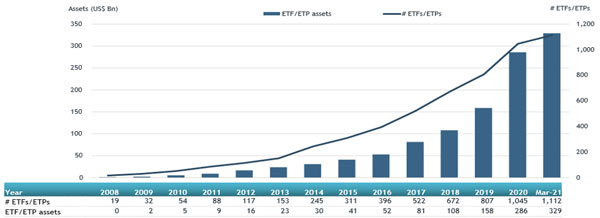

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that Active ETFs and ETPs gathered net inflows of US$13.35 billion during March, bringing year-to-date net inflows to a record US$47.15 billion. Assets invested in actively managed ETFs and ETPs finished the month up to 3.4%, from US$318 billion at the end of February to a record US$329 billion, according to ETFGI's March 2021 Active ETFs and ETPs industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Active ETFs and ETPs reached a record $329 billion at the end of Q1 2021.

- Active ETFs and ETPs gathered net inflows of $13.35 billion during March.

- Year-to-date Q1 net inflows are a record $47.15 billion beating the prior record of $9.46 billion gathered Q1 2018.

“The S&P 500® gained 4.4% in March and 6.2% in Q1, supported by the increasing pace of COVID-19 vaccinations and continued monetary and fiscal support. Global equities gained 2.5% in March and 5.2% in Q1, as measured by the S&P Global BMI. 38 of the 50 countries advanced during the month and 35 were positive at the end of Q1. Developed markets ex-U.S. gained 2.3% in USD terms in March and 4.0% in Q1. Emerging markets were down 1.6% in USD terms in March and up 2.8% in Q1, as measured by the S&P Emerging BMI.“ According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in actively managed ETF and ETP assets as of the end of March 2021

Fixed Income focused actively managed ETFs/ETPs listed globally gathered net inflows of $6.45 billion during March, bringing net inflows for Q1 2021 to $17.91 billion, more than the $1.14 billion in net inflows Fixed Income products had attracted in Q1 2020. Equity focused actively managed ETFs/ETPs listed globally attracted net inflows of $5.57 billion during March, bringing net inflows for Q1 to $25.72 billion, much greater than the $5.10 billion in net inflows equity products had attracted in Q1 2020.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered $9.51 billion during March. The Hwabao WP Cash Tianyi Listed Money Market Fund (511990 CH) gathered $2.82 billion the largest net inflows.

Top 20 actively managed ETFs/ETPs by net new assets March 2021

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

25,872.96 |

5,271.57 |

2,824.39 |

|

ARK Innovation ETF |

ARKK US |

22,996.04 |

7,132.44 |

1,666.71 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

2,611.41 |

1,626.09 |

570.29 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

16,675.32 |

1,070.75 |

547.81 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

852.03 |

653.28 |

372.58 |

|

ARK Space Exploration & Innovation ETF |

ARKX US |

344.26 |

344.26 |

344.26 |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

3,874.68 |

1,630.79 |

332.55 |

|

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF |

PDBC US |

4,196.48 |

1,075.81 |

314.43 |

|

First Trust Global Tactical Commodity Strategy Fund |

FTGC US |

834.14 |

576.54 |

306.47 |

|

iShares Commodities Select Strategy ETF |

COMT US |

567.91 |

327.64 |

303.90 |

|

Fidelity Sustainable USD EM Bond UCITS ETF - GBP Hdg Acc |

FEMP LN |

248.07 |

246.74 |

246.74 |

|

First Trust Senior Loan ETF |

FTSL US |

1,770.41 |

445.23 |

229.78 |

|

First Trust Preferred Securities and Income Fund |

FPE US |

6,194.18 |

321.75 |

205.18 |

|

AGFiQ Global Infrastructure ETF |

QIF CN |

201.79 |

195.97 |

195.97 |

|

Fidelity Sustainable Global Corporate Bond Multifactor UCITS ETF - GBP Hdg Acc |

FSMP LN |

194.18 |

194.33 |

194.33 |

|

Avantis US Equity ETF |

AVUS US |

953.81 |

296.17 |

189.69 |

|

JPMorgan Ultra-Short Municipal Income ETF |

JMST US |

1,586.40 |

438.69 |

175.97 |

|

NBI Sustainable Canadian Corporate Bond ETF |

NSCC CN |

166.39 |

166.65 |

166.65 |

|

NBI Unconstrained Fixed Income ETF |

NUBF CN |

1,654.87 |

227.55 |

164.37 |

|

Aseman Omid ETF - Acc |

MAOF1 |

188.90 |

172.63 |

160.67 |

Investors have tended to invest in Fixed Income actively managed ETFs/ETPs during March.