ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that actively managed ETFs listed globally gathered net inflows of US$13.40 billion during December, bringing year-to-date net inflows to US$122.64 billion. Assets invested in actively managed ETFs decreased by 0.5%, from US$490 billion at the end of November 2022 to US$488 billion, according to ETFGI's December 2022 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Actively managed ETFs listed globally gathered $13.40 Bn in net inflows during December.

- Net inflows of $122.64 Bn in 2022 are the 2nd highest, after $131.08 Bn in net inflows in 2021.

- 33rd month of consecutive net inflows.

- Assets of $488 Bn invested in actively managed ETFs at the end of December 2022.

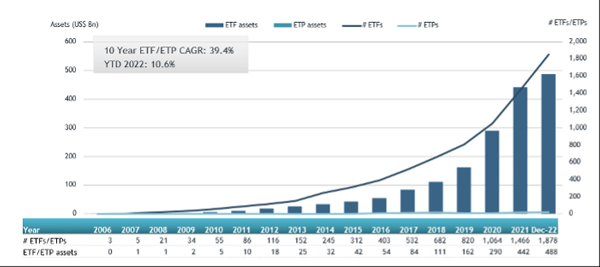

- Assets increased 10.6% year-to-date in 2022, going from $441 Bn at the end of 2021 to $488 Bn.

“The S&P 500 was down 5.76 % in December and was down 18.11% for 2022. Developed markets excluding the US were down 0.46% in December and were down 16.06% in 2022. Israel (down 6.05%) and US (down 17.45%) saw the largest decreases amongst the developed markets in December. Emerging markets decreased by 1.07% during December and were down 17.75% in 2022. Qatar (down 10.21%) and Peru (down 7%) saw the largest increases amongst emerging markets in December.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in actively managed ETF and ETP assets as of the end of December 2022

There were the 1,878 actively managed ETFs listed globally, with 2,369 listings, assets of $488 Bn, from 353 providers listed on 32 exchanges in 24 countries at the end of December.

Equity focused actively managed ETFs/ETPs listed globally gathered net inflows of $9.04 Bn during December, bringing year to date net inflows to $86.33 Bn, higher than the $68.56 Bn in net inflows equity products had attracted at this point in 2021. Fixed Income focused actively managed ETFs/ETPs listed globally attracted net inflows of $4.64 Bn during December, bringing net inflows for the year through December 2022 to $24.75 Bn, lower than the $46.48 Bn in net inflows fixed income products had reported in Year-to-date 2021.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered

$10.98 Bn during December. JPMorgan Ultra-Short Income ETF (JPST US) gathered $1.57 Bn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets December 2022

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

23,868.55 |

5,554.27 |

1,566.92 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

17,484.99 |

12,924.74 |

1,445.71 |

|

Samsung KODEX Active Korea Total Bond Market AA- ETF |

273130 KS |

1,836.01 |

732.58 |

744.32 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

1,311.14 |

549.01 |

636.22 |

|

First Trust Enhanced Short Maturity Fund |

FTSM US |

7,758.59 |

3,531.46 |

633.06 |

|

Kovitz Core Equity ETF |

EQTY US |

582.79 |

612.21 |

612.21 |

|

PGIM Ultra Short Bond ETF |

PULS US |

3,858.32 |

1,890.75 |

593.79 |

|

CI High Interest Savings ETF |

CSAV CN |

3,910.07 |

2,404.43 |

544.48 |

|

Dimensional US Core Equity 2 ETF |

DFAC US |

16,246.75 |

3,625.39 |

537.91 |

|

CI Enhanced Short Duration Bond Fund - ETF - CAD Hdg |

FSB CN |

673.48 |

379.49 |

456.60 |

|

Samsung KODEX 23-12 Bank Bond AA+ Active ETF |

448320 KS |

648.62 |

635.64 |

436.38 |

|

Innovator U.S. Equity Power Buffer ETF - December |

PDEC US |

612.67 |

412.85 |

415.99 |

|

Horizons High Interest Savings ETF |

CASH CN |

1,140.84 |

1,146.65 |

370.53 |

|

Dimensional US Small Cap Value ETF |

DFSV US |

1,087.77 |

1,071.50 |

337.04 |

|

Vanguard Ultra Short-Term Bond ETF |

VUSB US |

3,248.50 |

1,281.79 |

320.78 |

|

Dimensional International Core Equity 2 ETF |

DFIC US |

2,143.78 |

2,075.93 |

309.60 |

|

Avantis U.S. Small Cap Value ETF |

AVUV US |

4,743.74 |

2,644.60 |

292.63 |

|

Purpose High Interest Savings ETF |

PSA CN |

2,783.15 |

1,471.06 |

244.05 |

|

Amplify CWP Enhanced Dividend Income ETF |

DIVO US |

2,515.52 |

1,623.96 |

243.94 |

|

Dimensional Core Fixed Income ETF |

DFCF US |

2,073.11 |

2,008.06 |

235.62 |

Investors have tended to invest in Equity actively managed ETFs/ETPs during December.