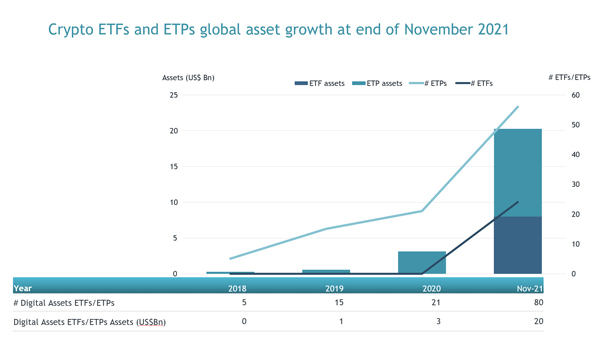

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today a record US$20.23 billion invested in Crypto ETFs and ETPs listed globally at the end of November 2021. Crypto ETFs and ETPs listed globally gathered net inflows of US$1.11 billion during November, bringing year-to-date net inflows to US$9.26 billion which is much higher than the US$278 million gathered at this point last year. Total assets invested in Crypto ETFs and ETPs increased by 3.7% from US$19.52 billion at the end of October 2021 to US$20.23 billion at the end of November, according to ETFGI’s November 2021 Crypto ETFs and ETPs industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $20.23 invested in Crypto ETFs and ETPs listed globally at the end of November.

- Assets increased by 3.7% from $19.52 billion at end October to $20.23 billion at end November.

- Assets have increased 549% year to date in 2021 going from $3.12 Bn at end of 2020 to $20.23 Bn at end November.

- Crypto ETFs and ETPs listed globally gathered net inflows of $1.11 billion during November.

- Record YTD net inflows of $9.26 Bn beating the prior record of $278 Mn gathered YTD in 2020.

- $9.40 Bn in net inflows gathered in the past 12 months.

- 4 Consecutive months of net inflows.

“Due to the growing threat of a new COVID variant Omicron, the S&P 500 declined 0.69% in November, however, the index is up 23.18% year to date. Developed markets, excluding the US, experienced a fall of 4.94% in November. Israel (down 1.03%) and the US (down 1.47%) experienced the smallest losses among the developed markets in November, while Luxembourg suffered the biggest loss of 16.90%. Emerging markets declined 3.53% during November. United Arab Emirates (up 8.15%) and Chile (up 5.51%) gained the most, whilst Turkey (down 13.72%) and Poland (down 11.95%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Since the launch of the first Crypto ETP in 2015, the Bitcoin Tracker One-SEK, the number and diversity of products have increased steadily. At the end of November there were 80 Crypto ETFs/ETPs with 224 listings assets of US$20.23 Bn, from 21 providers listed on 16 exchanges in 13 countries. During November, 10 new Crypto ETFs/ETPs were launched.

Crypto ETFs and ETPs listed globally gathered net inflows of $1.11 billion during November. Bitcoin ETFs/ETPs reported net inflows of $528 Mn during November, bringing year to date net inflows to $5.23 Bn, much higher than the $226 Mn in net inflows Bitcoin ETFs/ETPs had attracted year to date in 2020. Ethereum ETFs/ETPs listed in had net inflows of $342 Mn during November, taking year to date net inflows to $1.98 Bn, greater than the $25 Mn in net inflows Ethereum ETFs/ETPs had reported at this point in 2020.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$908 Mn during November. ProShares Bitcoin Strategy ETF (BITO US) gathered $352 Mn the largest individual net inflow in November.

Top 20 Crypto ETFs/ETPs by net new assets November 2021

|

Name |

Ticker |

Assets (US$ Mn) Nov-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) Nov-21 |

|

ProShares Bitcoin Strategy ETF |

BITO US |

1,422.63 |

1,594.56 |

351.57 |

|

CI Galaxy Ethereum ETF |

ETHX/B CN |

832.89 |

576.96 |

99.20 |

|

3iQ CoinShares Bitcoin ETF |

BTCQ/U CN |

1,275.26 |

990.33 |

69.51 |

|

CI Galaxy Bitcoin ETF - Acc |

BTCX/B CN |

248.47 |

223.04 |

45.09 |

|

21Shares Ethereum ETP - Acc |

AETH SW |

527.39 |

218.90 |

43.76 |

|

21Shares Solana ETP |

ASOL SW |

190.35 |

141.64 |

32.69 |

|

21Shares Polkadot ETP - Acc |

ADOT SW |

121.15 |

106.82 |

27.15 |

|

Purpose Ether ETF - CAD Hdg |

ETHH CN |

165.60 |

115.94 |

24.97 |

|

Valour Solana (SOL) |

VALSOL SS |

59.46 |

59.46 |

23.03 |

|

21Shares Crypto Basket Index ETP - Acc |

HODL SW |

229.53 |

89.16 |

22.58 |

|

VanEck Vectors TRON ETN - Acc |

VTRX GY |

78.96 |

86.78 |

20.20 |

|

Bitcoin ETF - CAD - Acc |

EBIT CN |

115.30 |

101.95 |

19.91 |

|

21Shares Cardano ETP |

AADA SW |

82.82 |

104.50 |

18.18 |

|

21Shares Avalanche |

AVAX SW |

16.22 |

17.99 |

17.99 |

|

Vaneck Bitcoin Strategy ETF |

XBTF US |

17.37 |

17.57 |

17.57 |

|

Hashdex Nasdaq Bitcoin Reference Price Fundo de Índice |

BITH11 BZ |

36.77 |

40.30 |

16.00 |

|

VanEck Vectors Ethereum ETN - Acc |

VETH GY |

161.56 |

103.38 |

15.43 |

|

Hashdex Nasdaq Crypto Index ETF |

HDEX BH |

476.74 |

476.02 |

15.33 |

|

WisdomTree Bitcoin - Acc |

BTCW SW |

348.08 |

17.34 |

14.92 |

|

ETHetc - ETC Group Physical Ethereum - Acc |

ZETH GY |

351.78 |

230.64 |

12.59 |

.jpg)