ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports Smart Beta ETFs and ETPs listed globally gathered a record US$18.39 billion in net inflows during February bringing year-to-date net inflows to a record US$29.45 billion. Smart Beta Equity ETF/ETP assets have increased by 5.9% from US$994 billion to US$1.05 trillion, with a 5-year CAGR of 22.9%, according to ETFGI’s February 2021 ETF and ETP Smart Beta industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (report looks at equity focused Smart Beta products, All dollar vales in USD unless otherwise noted.)

Highlights

- Assets in Smart Beta ETFs and ETPs listed globally reach a record $1.05 Tn at the end of February.

- Record monthly net inflows of $18.39 Bn in February passing the prior record of $16.76 Bn in November 2020.

- YTD net inflows are a record $29.45 Bn, higher than the $15.60 Bn gathered YTD in 2020 and beating the prior record of $25.86 Bn set in February 2018.

There were 1,344 smart beta equity ETFs/ETPs, with 2,573 listings, assets of $1.05 trillion, from 192 providers on 45 exchanges in 37 countries at the end of February 2021.

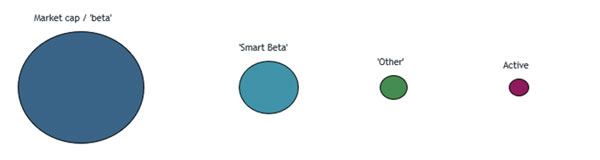

Comparison of assets in market cap, smart beta, other and active equity products

Alternative Weighting ETFs and ETPs attracted the greatest monthly net inflows, gathering $10.05 Bn during February. Quality ETFs and ETPs suffered the greatest net outflows during the month and amounted to $584 Mn.

Substantial inflows can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $16.6 Bn during February. SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF (SSPU GY) gathered $5.54 Bn.

Top 20 Smart Beta ETFs/ETPs by net new assets February 2021

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc |

SPPU GY |

5,521.04 |

5,537.99 |

5,537.99 |

|

Vanguard Value ETF |

VTV US |

66,511.18 |

2,550.61 |

1,379.20 |

|

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) - 1C - Acc |

XDEW GY |

3,809.16 |

1,300.75 |

926.79 |

|

iShares S&P Mid-Cap 400 Value ETF |

IJJ US |

7,397.75 |

1,215.71 |

815.16 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

14,140.91 |

480.49 |

796.06 |

|

Invesco S&P 500 Equal Weight ETF |

RSP US |

20,785.96 |

1,636.20 |

757.88 |

|

Schwab US Dividend Equity ETF |

SCHD US |

18,527.63 |

1,351.20 |

725.41 |

|

iShares MSCI EAFE Value ETF |

EFV US |

11,478.10 |

3,956.72 |

683.73 |

|

Invesco Dynamic Leisure and Entertainment ETF |

PEJ US |

1,649.33 |

779.79 |

649.89 |

|

iShares Edge MSCI USA Value Factor ETF |

VLUE US |

11,979.55 |

1,668.07 |

635.96 |

|

iShares Core Dividend Growth ETF |

DGRO US |

15,807.62 |

944.67 |

582.43 |

|

L&G ESG Emerging Markets Corporate Bond USD UCITS ETF |

EMUG LN |

519.21 |

523.59 |

488.52 |

|

iShares Edge MSCI USA Momentum Factor ETF |

MTUM US |

14,688.14 |

1,448.46 |

423.59 |

|

3D Printing ETF |

PRNT US |

611.44 |

499.12 |

359.37 |

|

iShares MSCI EAFE Growth ETF |

EFG US |

10,207.01 |

409.64 |

328.60 |

|

Vanguard Growth ETF |

VUG US |

67,615.38 |

(612.55) |

322.33 |

|

Lyxor S&P Eurozone Paris-Aligned Climate (EU PAB) (DR) UCITS ETF - Acc |

EPAB FP |

673.42 |

327.14 |

313.96 |

|

US Global Jets ETF |

JETS US |

3,793.51 |

386.44 |

312.51 |

|

SPDR Portfolio S&P 500 Value ETF |

SPYV US |

8,512.71 |

587.56 |

303.47 |

|

iShares Ageing Population UCITS ETF - Acc |

AGES LN |

678.26 |

292.47 |

274.10 |