ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, released a report today that reveals Korean retail investors continued to favor overseas ETFs in April 2025, with 32 of the top 50 overseas securities purchased being ETFs listed in the United States and Japan.

The figure marks a steady upward trend: 30 ETFs made the list in March, 25 in February, and 22 in January. This represents a net increase of 10 ETFs over the past four months, underscoring growing investor appetite for diversified, globally listed financial instruments. (All dollar values in USD unless otherwise noted)

Highlights

- 32 of the top 50 overseas securities purchased by Korean retail investors were ETFs listed in the United States and Japan

- Eighteen of the thirty-two ETFs on the top 50 list provide leverage or inverse exposure.

- The largest purchase was US$3.22 billion of DIREXION DAILY SEMICONDUCTORS BULL 3X SHS ETF listed in the United States.

Top 10 overseas ETF purchased in April 2025

|

ETF Name |

Purchase Amount in USD |

|

DIREXION DAILY SEMICONDUCTORS BULL 3X SHS ETF |

3,223,886,573 |

|

DIREXION DAILY TSLA BULL 2X SHARES |

1,575,543,517 |

|

PROSHARES ULTRAPRO QQQ ETF |

1,241,221,882 |

|

PROSHARES TRUST ULTRAPRO SHORT QQQ NEW 2022 |

659,508,225 |

|

ISHARES 0-3 MONTH TREASURY BOND ETF |

455,423,222 |

|

DIREXION SEMICONDUCTOR BEAR 3X ETF |

443,980,126 |

|

ISHARES 20+ YEAR TREASURY BOND ETF |

387,054,381 |

|

GRANITESHARES 2.0X LONG NVDA DAILY ETF |

380,549,816 |

|

SCHWAB US DIVIDEND EQUITY ETF |

380,043,274 |

|

INVESCO QQQ TRUST SRS 1 ETF |

300,610,421 |

Source, Korea Securities Depository.

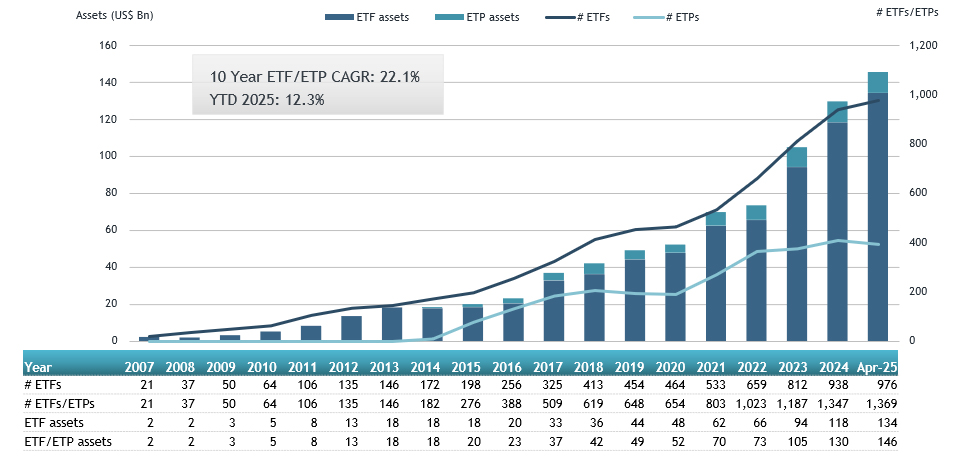

The ETFs industry in Korea has 1,369 ETFs, with assets of $145.64 Bn, from 38 providers listed on the Korea Exchange at the end of April. According to data from ETFGI, 24.40% of the ETFs provide leverage or inverse exposure which account for 8.07% of the assets in the ETFs industry in Korea.

Asset Growth in the Korean ETFs industry at the end of April 2025