ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, Corporate and high-net-worth investor participation in ETFs more than doubled between 2021 and 2025, with corporate investors rising from 39,358 to 94,042 and HNIs from 2,939 to 11,183.

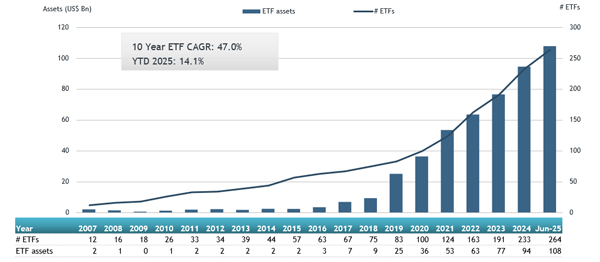

Total assets invested in the ETFs industry in India reached a record high of $107.82 billion in June 2025. This surpasses the previous highs of $93.44 billion in 2024 and $68.36 billion in 2023. (source: the Association of Mutual Funds in India (AMFI), all values are in USD unless otherwise noted.)

Corporate Investors remain the dominant force, accounting for 87.22% of total ETF assets in June 2025.

Foreign Institutional Investors (FIIs) represent the smallest share, with just 0.00004% of the market.

Both corporate and high-net-worth investor AUM have shown steady growth from June 2021 through 2025, reflecting increasing institutional and affluent individual interest in ETFs.

Five year comparison of investors in ETFs in India by investor classification.

|

Investor Classification |

AUM ($ Mn) Jun-25 |

AUM ($ Mn) Jun-24 |

AUM ($ Mn) Jun-23 |

AUM ($ Mn) Jun-22 |

AUM ($ Mn) Jun-21 |

|

Corporates |

94,040 |

82,429 |

60,794 |

47,474 |

39,358 |

|

Banks/FIs |

261 |

286 |

599 |

129 |

329 |

|

FIIs |

0 |

3 |

9 |

7 |

8 |

|

High Networth Individuals* |

11,183 |

8,187 |

5,378 |

4,179 |

2,939 |

|

Retail |

2,334 |

2,534 |

1,580 |

1,198 |

734 |

|

Total |

107,817 |

93,438 |

68,360 |

52,987 |

43,368 |

*Defined as individuals investing Rs 2 lakhs and above

Source: Association of Mutual Funds in India

Nearly 40% of assets invested in Gold ETFs are held by high-net-worth and retail investors.

A total of 228,700 High-Net-Worth Investors (HNI) portfolios reported holding $2.38 billion in Gold ETFs, representing a 31.44% market share. This marks a significant increase from 2021, when only 43,319 HNI portfolios held Gold ETFs. SEBI defines a high-net-worth investor as an individual who invests more than ₹200,000 (approximately $2,388.86) per transaction.

Over 7.41 million retail investor portfolios held $605 million in Gold ETFs, accounting for 8.01% of the market. In comparison, only 1.78 million retail portfolios reported Gold ETF holdings in 2021.

16,761 corporate portfolios reported holding $4.58 billion, which represents 60.55% of the total assets invested in Gold ETFs.

Investment in Gold ETFs in India by investor type as of the end of June

|

Gold ETFs |

Investor |

Assets (US$ Mn) |

% to Total |

No of Folios |

% to Total |

|

|

Corporates |

4,576 |

60.55 |

16,761 |

0.22 |

|

Banks/FIs |

0 |

0.00 |

4 |

0 |

|

|

|

FIIs |

- |

- |

- |

- |

|

High Networth Individuals* |

2,376 |

31.44 |

228,727 |

2.99 |

|

|

|

Retail |

605 |

8.01 |

7,408,666 |

96.79 |

|

Total |

7,558 |

100 |

7,654,158 |

100 |

*Defined as individuals investing Rs 2 lakhs and above

Source: Association of Mutual Funds in India

Corporate Dominance in Non-Gold ETF Investments – June 2025

As of June 2025, corporates account for 89.23% of the $100.26 billion invested in ETFs excluding gold, according to the latest data.

Together, over 20.5 million retail and HNI portfolios represent 10.50% of the total assets invested in non-gold ETFs. Despite their smaller share of assets, they make up 99.43% of all portfolios in this segment.

This marks a significant increase from 2021, when fewer than 5.34 million such portfolios reported holdings in non-gold ETFs.

Investment in ETFs (excluding gold ETFs) in India by investor type as of the end of June

|

ETFs(other than Gold) |

Investor |

Assets (US$ Mn) |

% to Total |

No of Folios |

% to Total |

|

|

Corporates |

89,463 |

89.23 |

118,325 |

0.57 |

|

Banks/FIs |

261 |

0.26 |

42 |

0 |

|

|

|

FIIs |

0 |

0 |

4 |

0 |

|

High Networth Individuals* |

8,807 |

8.78 |

1,207,365 |

5.86 |

|

|

|

Retail |

1,729 |

1.72 |

19,288,132 |

93.57 |

|

Total |

100,259 |

100 |

20,613,868 |

100 |

*Defined as individuals investing Rs 2 lakhs and above

Source: Association of Mutual Funds in India

The ETF industry in India had 264 ETFs, with 264 listings, assets of $107.74 Bn, from 24 providers on 2 exchanges, at the end of June, source from ETFGI. During June, the ETFs industry in India gathered net inflows of

$161.20 Mn. Commodity ETFs gathered the largest net inflows with $489.91 Mn, while equity ETFs suffered the largest net outflows of $323.84 Mn, followed by fixed income ETFs with $4.88 Mn.

ETFs industry in India asset growth at end of June 2025