Investors have flocked to ETFs over 2021, adding $789 Billion of flows year-to-date.

ETFs on track to hit $10 trillion AuM, but European ETF flows slow

Having smashed through the $9 Trillion AuM barrier in July, growth continued, but slowed over August, according to the latest data from Trackinsight, setting the industry up for a record-setting year of unprecedented growth and issuance.

Over August, the 7,400 ETFs covered by Trackinsight saw $86.2 Billion of new flows to command a total of $9.32 Trillion in AuM. Investors have flocked to ETFs over 2021, adding $789 Billion of flows year-to-date.

Competing for this wave of new money are over 559 new ETFs which have launched this year, including over 160 actively-managed ETFs and 119 ESG ETFs. This far exceeds the 458 launches seen in 2020, indicating that ETFs have become the preferred distribution technology for asset managers promoting their investment ideas.

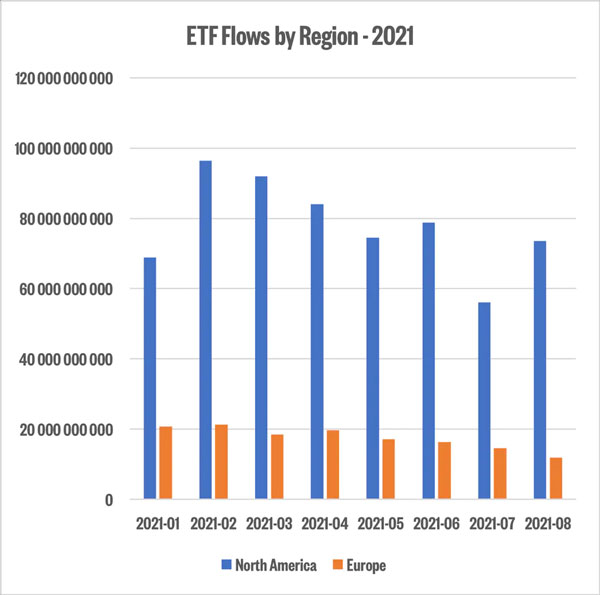

Flows in the North American markets over August remained within range at $73.6 Billion, whereas the European market witnessed a significant slowdown with only $11.8 Billion of flows. This is the worst month for European ETFs since October 2020. Flows into European ETFs have been slowing consistently month-on-month since reaching $19 Billion in April 2021.

While the 160 launches year-to-date, and 20 over August, indicate that Active managers have embraced the ETF wrapper, investors have not rushed to put money into these products. August flows into Active ETFs were a measly $5.6 Billion and only $76 Billion has been added to the sector this year. ESG ETFs, which had been a record-breaking growth story in 2020, have managed to maintain momentum in 2021, with $11 Billion of flows in August and $113 Billion of flows year-to-date. This is far ahead of the $90 Billion in flows captured over 2020 validating the decision by issuers to launch another 23 ESG ETFs over August.

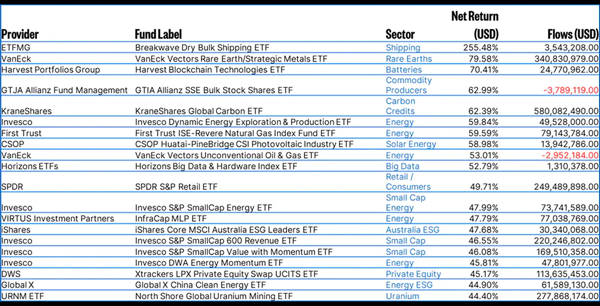

The top 20 best performing ETFs year-to-date have returned between 44% and 255% to investors. Energy remains a big theme, with 9 of the top 20 ETFs exposed to traditional or green energy securities. Battery technology, along with its essential rare earth components have also strongly performed this year.

However, few ETFs seem poised to compete with BDRY – Breakwave Dry Bulk Shipping ETF - which continues to be the best performer of the year so far, up 255%. Tracking an index of freight futures, this ETF has benefited from surging costs of shipping containers, port congestion, port closures and ongoing disruption to marine supply chains which have dramatically increased the cost of shipping goods across the world.

Anaelle Ubaldino, CFA, Head of ETF Research and Advisory at Trackinsight commented:

“So far, actively managed ETFs have not been the success story the industry was expecting. While the ETF wrapper can be a powerful distribution boost, it is not a magic bullet that can guarantee any strategy will gather assets. The lack of live track record and profusion of well-performing options within the traditional index-ETF markets might have hindered the growth of active managers in the ETF space so far. However, the heightened pace of new launches shows that the industry is betting more heavily than ever on active ETFs, perhaps motivated by Cathie Wood’s recent success story. Eventually, the choice lies with investors that will vote with their wallet.”