A report published on Tuesday 31 May 2022 by the European Securities and Markets Authority (ESMA), confirms BETTER FINANCE’s findings that fund managers often don’t seem to act in the best interest of fund investors when it comes to securities lending.

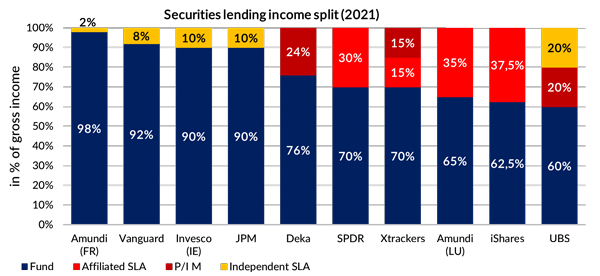

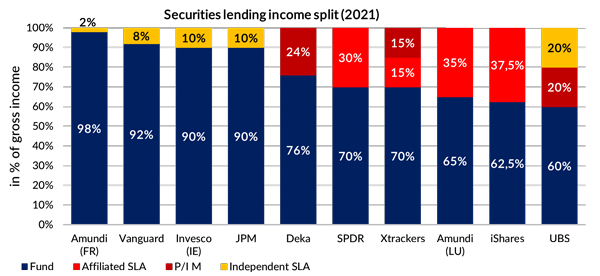

Three years after its first report,[1] BETTER FINANCE expanded on its research into securities lending[2] to once more find that fund managers’ “fee split”[3] arrangements, particularly with in-house agents, vary considerably and may be contrary to ESMA’s Guidelines.[4] Such practices could lead to investor detriment and actually constitute a breach of the generally duty of care[5] towards “retail” fund investors.

Click here for full details.

[2] The practice of lending a stock, bond or other financial instrument in exchange for interest, with our focus on EU equity UCITS exchange-traded funds (ETFs).

[4] European Securities and Markets Authority, Guidelines on ETFs and other UCITS issues (Guidelines for competent authorities and UCITS management companies, 1 August 2014) ESMA/2014/937EN, available at:

[5] According to MiFID [Art. 24(1)], and the UCITS V Directive [Art. 14(1)(a)], fund managers have the obligation to “act fairly, honestly, and professionally in accordance with the best interests of clients”.

[6] This is because ESMA’s Guidelines and Recommendations are not directly enforceable and must be transposed into national law by national competent authorities, or otherwise explain why not (comply or explain principle).

[7] Which cannot include “hidden revenues” for asset managers.

[8] ESMA Guidelines on ETFs and other UCITS issues, para 28.