Volume overview

|

Commodity |

Unit |

Q1/2019 |

Q1/2018 |

Change |

|

Power Spot Market European Power Derivatives Market US Power Derivatives Market Power Total |

TWh |

152.8 1,030.6 405.2 1,588.7 |

141.4 737.6 247.6 1,126.6 |

+8% +40% +64% +41% |

|

Gas Spot Market Gas Derivatives Market Natural Gas Total |

TWh |

374.9 209.0 583.9 |

336.5 188.7 525.2 |

+11% +11% +11% |

|

EU Environmental Products |

Million tonnes |

284.5 |

500.7 |

-43% |

|

US Environmental Products |

contracts |

23,822 |

n/a |

n/a |

|

Agricultural Products |

contracts |

10,558 |

10,002 |

+6% |

|

Freight |

contracts |

19,000 |

7,715 |

146% |

Key achievements

- EEX has successfully completed the acquisition of the shares in Grexel Systems Oy. As of February 2019, EEX holds 100% of the shares in the company.

> Read more about the benefits of the acquisition of Grexel. - On 4 February 2019, the first trade on the local flexibility platform enera was completed successfully. As part of EEX Group, EPEX SPOT is involved in the project with more than 30 partners to launch Germany's first exchange-based flexibility market for grid congestion management.

> See how enera partners and EPEX SPOT launch Germany's first exchange-based flexibility market for grid congestion management.

- In February 2019, EEX has been awarded the Recognised Overseas Investment Exchange (ROIE) status for the United Kingdom by the Financial Conduct Authority (FCA).The ROIE status ensures that will be able to continue to operate in the UK regardless of the consequences of the upcoming Brexit. Powernext has received the ROIE status in March.

> Get known how the ROIE and BoE status ensures that our customers continue to have the ability to trade and clear with us.

- On 29 March 2019, Nodal Exchange launched the world’s first financially settled Trucking Freight Futures contracts in partnership with FreightWaves, the leading provider of freight market news, data and analytics, and DAT, the largest spot freight marketplace in North America.

> Find detailed information on Trucking Freight Futures in the Press Release.

Spotlight: Nodal Exchange

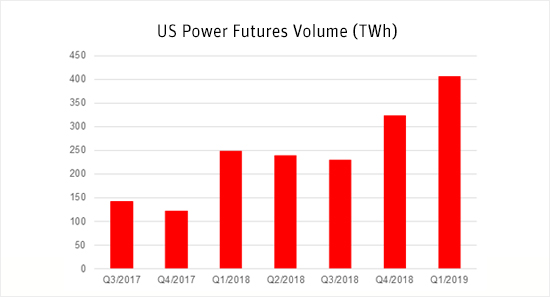

In the first quarter Nodal Exchange achieved a record trading volume of 405 TWh in US power futures, (notional value of $13 billion per side) which corresponds to a market share of 33%. It’s the highest quarterly volume in Nodal’s history following the last peak in the fourth quarter of 2018 with a trading volume of 322 TWh . This development follows Nodal Exchange’s strong performance in 2018. Nodal Exchange achieved a record annual power futures trading volume in 2018 with 1,039 TWh. Find out more: https://bit.ly/2HXFiPK

EEX Group provides market platforms for energy and commodity products across the globe and provides access to a network of more than 600 trading participants. The group offers trading in energy, environmental products, freight, metal and agriculturals as well as subseq uent clearing and registry services. EEX Group consists of the trading venues European Energy Exchange (EEX), EPEX SPOT, Powernext (which operates the PEGAS platform), EEX Asia, Power Exchange Central Europe (PXE) and Nodal Exchange as well as the registry provider Grexel Systems and the clearing houses European Commodity Clearing (ECC) and Nodal Clear. EEX is a member of Deutsche Börse Group.

> More information: www.eex-group.com.