The EDHEC-Risk team has released the latest performance update of the EDHEC-Risk Alternative Indexes.

March was characterized by an intensification of the crisis, with very slow economic in many countries, given the recommendation to stay at home. The S&P 500 index registered an even bigger decline than last month (-12.35%), its biggest drop in a month since October 2008, bringing it back to its January 2019 level. Market implied volatility further increased, reaching 53.54%, its highest value since November 2008.

On the bond market, the situation also deteriorated, as both regular bonds (-1.02%) and convertible bonds (-10.85%) posted negative returns. Concerning commodities market, the GSCI Commodity Spot index decreased for the third consecutive month and experienced a spectacular collapse (-28.71%), dropping to its lowest level since May 2003.

The dollar (1.77%) is holding up well, rising for the third consecutive month.

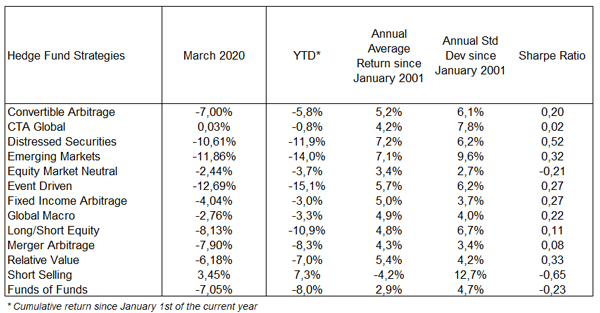

In this environment, all strategies except Short Selling and CTA Global posted negative returns. Some strategies, such as Event Driven, Long/Short Equity, Distressed Securities, Merger Arbitrage and Fund of Funds experienced their largest decline in a month since EDHEC-Risk hedge fund indices' inception (December 1996).

The best performing strategy was Short Selling (3.45%), which in maintaining short positions relative to the stock market, takes advantage of the current crisis for the second consecutive month. CTA limited damage, with a hardly positive return (0.03%). Unsurprisingly the worst performance was achieved by an equity-oriented strategy, namely Event Driven which reported a loss of -12.69%, followed by Emerging Markets (-11.86%) and Distressed Securities (-10.61%). The two other equity-oriented strategies, namely Long/short Equity (-8.13%) and Market Neutral (-2.44%) were also negatively impacted by the downturn in the stock market, though to a lesser extend in what concerns Market Neutral.

Overall, the Funds of Funds strategy posted a strong negative return (-7.05%),however clearly outperforming the S&P 500 index, like almost all hedge fund strategies this month, if we except Event Driven.