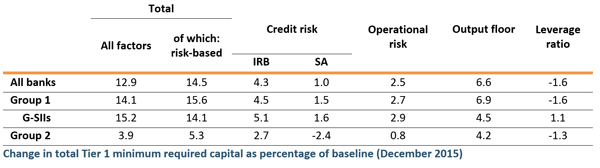

The European Banking Authority (EBA) welcomes the agreement reached on the finalisation of the Basel III framework by the Basel Committee on Banking Supervision (BCBS), which concludes the global post-crisis prudential reforms. ‘Strong international standards are an essential common yardstick that will support a safe and sound cross-border banking on a global scale' Andrea Enria, Chairperson of the EBA, said in welcoming the Basel agreement. ‘The EBA is committed to engaging with Competent Authorities and European co-legislators to ensure a successful implementation of the standards in the EU' Enria added. The EBA published today a summary of the results showing the impact of the agreed reforms on the EU banking sector.

Key findings of the EBA impact assessment

Background

- The impact assessment published today is based on data as of December 2015. As a consequence, numbers may not fully reflect EU banks' current situation as they do not account for the significant capital increases and adjustments made to business models since 2015.

- The sample used to assess the impact of the revised standards includes 88 European institutions from 17 EU Member States, of which 36 are Group 1 institutions and 52 are Group 2 institutions.