Startups seeking early-stage funding (Seed and Series A) got a much bigger slice of the Asia-Pacific (APAC) venture capital (VC) investment pie during 2021. Early-stage funding rounds accounted for 68.4% of the total VC deals (with disclosed funding rounds) announced in the region during the year, according to GlobalData, a leading data and analytics company.

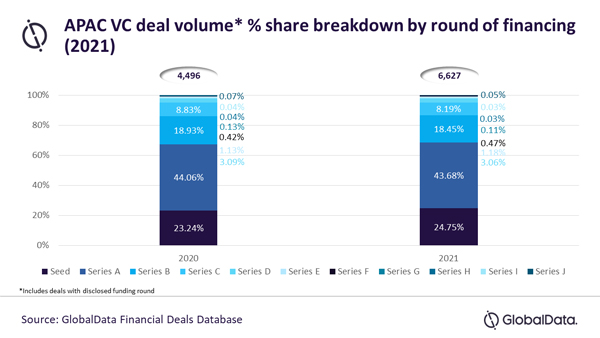

An analysis of GlobalData’s Financial Deals Database reveals that a total of 6,627 VC deals with disclosed funding rounds (Seed to Series J) were announced during 2021, which is an improvement of 47.4% against the 4,496 VC deals announced in 2020.

In total 1,640 Seed and 2,895 Series A funding rounds were announced during 2021, which accounted for 24.7% and 43.7% of the total deal volume, respectively. These early-stage funding rounds also witnessed volume growth of around 50% in 2021 compared to 2020.

Aurojyoti Bose, Lead Analyst at GlobalData, says: “The assessment of startups’ area of operations and the region they operate in plays a key role. Interestingly, promising startups in the region have been successful in securing VC investors’ backing from their very early days of operations irrespective of the market conditions. The growth in early-stage funding rounds is a testimony of that.”

Other funding rounds including growth/expansion/late-stage funding rounds (comprising Series B, Series C, Series D, Series E, Series F, Series G, Series I and Series J) collectively accounted for 31.6% of the total VC deal volume in 2021.

The number of Series B, Series C, Series D, Series E, Series F and Series G funding rounds increased by 43.7%, 36.8%, 46%, 52.9%, 63.2% and 16.7%, respectively, in 2021 compared to the previous year. Meanwhile, the volume of Series H, Series I and Series J funding rounds remained flat.