Today CryptoCompare has released its latest Digital Asset Management Review which is a monthly report covering the most innovative institutional products in the industry. The data shows that assets under management (AUM) and trading volumes are surging for regulated digital asset products such as Listed Trusts and ETNs.

Here are the key takeaways:

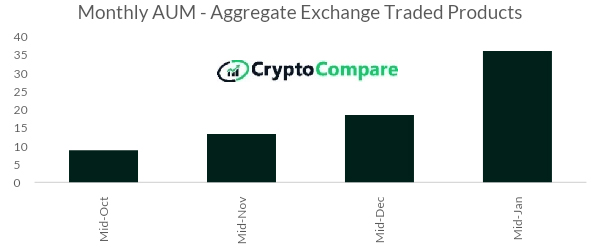

- AUM across all ETPs increased 95% to a record $35.96bn

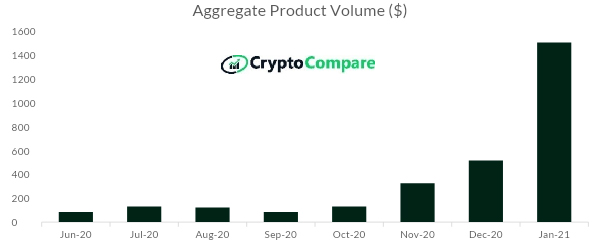

- Aggregate ETP volumes almost tripled in January to $837mn/day

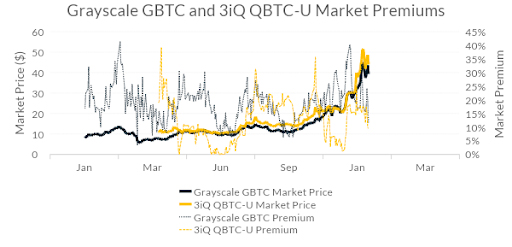

- Grayscale’s listed trust products underperformed relative to other large ETPs while 3iQ’s QBTC outperformed

ETP activity is perhaps the best bellwether of institutional investor demand as these products are often the only way highly regulated investors can gain exposure to digital assets. The data paints a clear picture of surging institutional investor demand and this supports the widely believed narrative that this bull market is largely institutional investor led, as opposed to the retail driven 2017 bull market.

|

|

ETP Trading Volumes

Aggregate daily ETP volumes across all product types have increased by an average of 191.3% in January 2021 compared to December 2020. Average daily volumes now stand at $1.51bn compared to $516.8mn in the previous month.

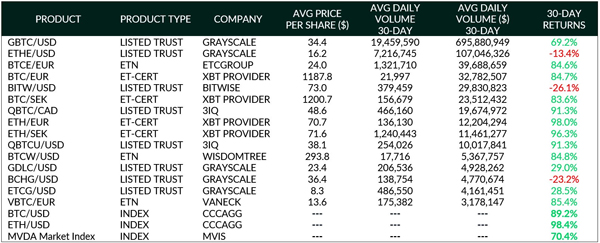

ETP Price Performance

The best performing Bitcoin product by market price over the last 30 days was 3iQ’s Listed Trust Product (QBTC) with 91.3%. This exceeds CryptoCompare’s CCCAGG BTC/USD index performance (89.2%).

Another top performing product (among the most liquid exchange traded products by volume) include XBT Provider’s Ether Tracker Euro (trading into EUR) with 98% 30-day returns in line with CryptoCompare’s CCCAGG ETH/USD index performance (98.4%).

Poor performing products relative to others was Grayscale’s Ethereum Trust product (ETHE) with a loss of 13.4% in market price vs 30 days prior and Bitwise’s BITW/USD product with losses of 26.1%.

Among the top 15 ETP markets by volume, 6 underperformed relative to the MVDA index. These markets include: Grayscale’s GBTC, ETH, BCHG, ETCG and GDLC products, and Bitwise’s BITW product. The MVDA index is a market cap-weighted index that tracks the performance of a basket of the 100 largest digital assets. The index serves as benchmark and universe for the other MVIS CryptoCompare Digital Assets Indices.

Market Premiums – Grayscale and 3iQ Listed Trust Products

Bitcoin traded at an all-time high (above $41,000) on the 8th of January. Since then, market premiums for both Grayscale’s and 3iQ’s Listed Bitcoin products have decreased from 17.4% to 11.6% (Grayscale) and 17.8% to 9.6% (3iQ) respectively by mid-January.

The MVIS CryptoCompare Digital Assets Indices can be licensed to clients for a variety of purposes, including:

- Performance measurement and attribution

- Investment product development, as the basis for structured products such as ETPs and futures contracts

- Asset allocation

- Research