ETP volumes grew slightly in October, with an overall increase of 2.2% compared with September. Grayscale products have exhibited poor performance while Bitcoin ETPs by Wisdom Tree and ETC Group have seen above-market returns.

See below how the most salient institutional crypto products in the industry performed in our latest Digital Asset Management Review.

Key Takeaways

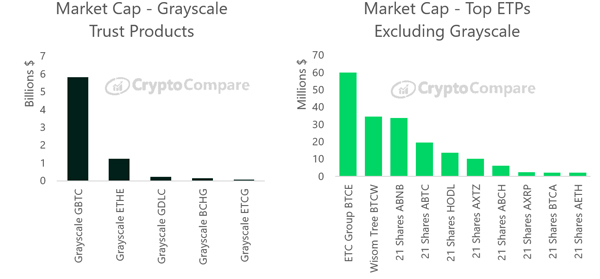

1. The top ETP products by market cap include: Grayscale’s Bitcoin trust product ($5.8bn), Grayscale’s Ethereum trust product ($1.25bn), ETC Group’s BTCE product ($60.1mn) and Wisdom Tree’s BTCW product at $34.5mn.

2. Daily average ETP volumes have increased by 2.2% in October ($66.6mn) compared to September ($65.2mn).

3. The top ETP markets by average 30-day volume were Grayscale’s GBTC/USD ($40.9mn) and ETHE/USD ($4.13mn) markets, BTC Group’s BTCE/EUR ($760.0k) market and 3iQ’s QBTC.u/USD ($695.8k) market.

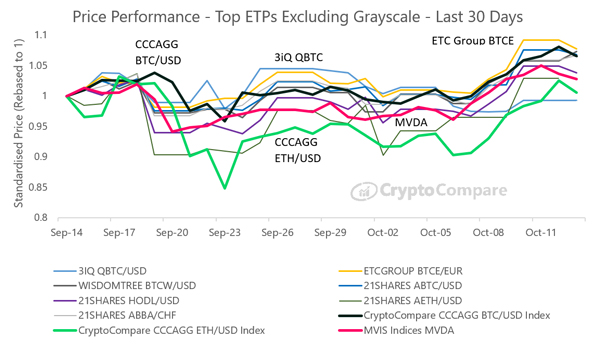

4. The ETPs with the highest returns over the last 30 days were ETC Group’s (BTCE) Bitcoin ETP at 7.7% and BTCW by WisdomTree at 7.3%. These products outperformed the spot market (based on the CCCAGG BTC/USD index by CryptoCompare) which experienced returns of 6.6% compared to 30 days prior.

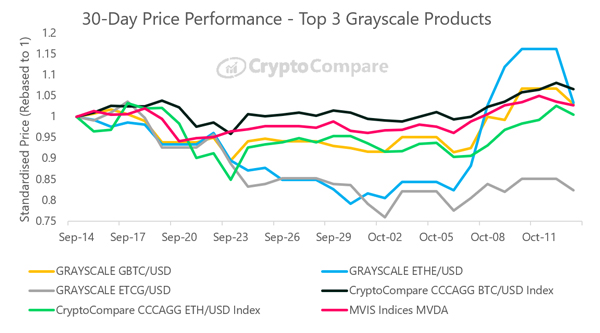

5. Grayscale’s GDLC and ETCG products, available on OTC Markets (OTCQX U.S.) experienced the largest 30-day losses in value among the top-traded ETPs at -19.9% and -17.6% respectively. Grayscale’s products generally underperformed compared to the market.

ETP News

22nd September – 21 Shares

21Shares Hires ETP Industry Veteran to Accelerate Institutional Adoption of Crypto Assets

23rd September – Hashdex, Nasdaq

Cryptocurrency ETF by Nasdaq and Hashdex Approved to List on Bermuda Stock Exchange

30th September – 3iQ

Canadian Firm 3iQ's Bitcoin Fund Listed on Gibraltar Stock Exchange

9th October - FCA

UK’s FCA bans crypto ETNs

14th October - Grayscale

Grayscale Announces Best Ever Quarter with Over $1B Raised

Market Cap

Grayscale’s GBTC Trust Product represents the highest market cap of all ETP products at $5.8bn (based on market price). This is followed by its Ethereum Trust Product ETHE with a market cap of $1.25bn.

Excluding Grayscale products, the largest ETP by market cap is now ETC Group’s BTCE product with a market cap of $60.1mn, followed by Wisdom Tree’s BTCW product at $34.5mn.

ETP Trading Volumes

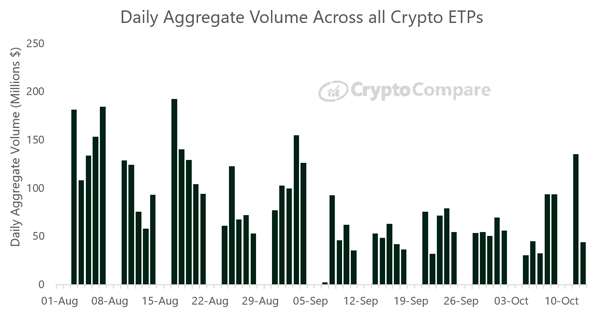

Daily ETP volumes have increased by an average of 2.2% in October ($66.6mn/day) compared to September ($65.2mn/day).

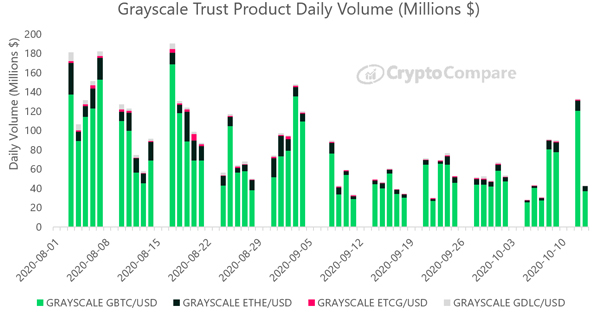

Grayscale’s Bitcoin Trust product still represents the vast majority of daily ETP volume at an average of $57.2mn in October. The Top 3 products (GBTC, ETHE, and ETCG) traded a combined average daily $65.5mn in September and now trade just over $64.7mn in daily volume (-1.19% vs September).

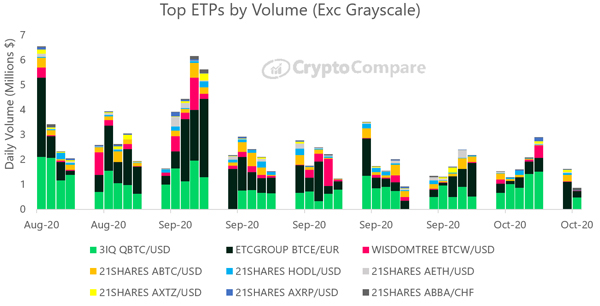

Crypto ETP trading activity for non-otc products has generally declined throughout the last 30 days. The aggregate average in October has been $1.82mn/day – down 28% compared to the average in September.

Excluding OTC products, 3IQ’s QBTC product which trades on the Toronto Stock Exchange has represented the majority of the volume in October ($816k/day on average). ETCGroup’s Bitcoin ETP (BTCE) also represented a significant proportion of the volume ($599k/day on average in Oct), trading on Deutsche Boerse XETRA.

|

|

Grayscale’s GDLC and ETCG products, available on OTC Markets (OTCQX U.S.) experienced the largest 30-day losses in value among the top-traded ETPs at -19.9% and -17.6% respectively.

Grayscale’s ETHE/USD trust product experienced poor price performance throughout the 30-day period, underperforming by up to ~10% below the equivalent CCCAGG ETH/USD spot price performance. However, there were better than market price returns (up to 16%) in the second week of October as ETH began to rise in value.

The ETPs with the highest returns over the last 30 days were the Bitcoin ETP by ETC Group (BTCE) at 7.7% and BTCW by WisdomTree at 7.3%. These products appeared to outperform the spot market (based on the CCCAGG BTC/USD index by CryptoCompare) which experienced returns of 6.6% compared to 30 days prior.

Towards the end of September 3iQ’s QBTC product performed best among all the top ETPs. However, its performance fell below that of other products towards the second week of October resulting in a 0.3% loss compared to 30 days prior.

Seven top ETP products in total outperformed the MVDA index, which is a market cap-weighted index that tracks the performance of a basket of the 100 largest digital assets. This index serves as a benchmark and universe for other MVIS CryptoCompare Digital Assets Indices.

The MVIS CryptoCompare Digital Assets Indices can be licensed to clients for a variety of purposes, including:

- Performance measurement and attribution

- Investment product development, as the basis for structured products such as ETPs and futures contracts

- Asset allocation

- Research