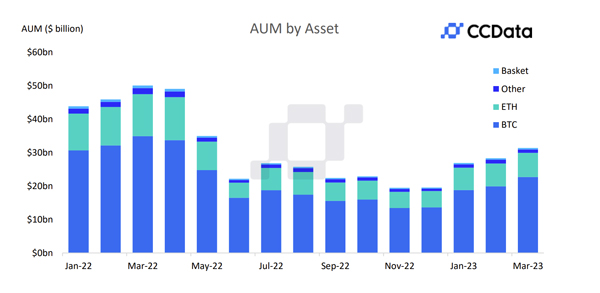

In March, the total assets under management (AUM) for digital asset investment products continued to trend upward for the fourth consecutive month, recording an increase of 10.9% compared to February, and 60.6% compared to last November (the lowest recorded AUM in

Increasing AUM, which reached $31.4 billion in March 2023, showcases the renewed interest in digital assets and the growth the industry has witnessed amid recent TradFi failures.

Download the full report here.

Key takeaways:

- The assets under management (AUM) for Bitcoin and Ethereum-based products saw an increase of 13.9% and 6.26%, respectively, reaching $22.7 billion and $7.22 billion. This surge in AUM saw Bitcoin-based products claim 72.4% market share, the highest dominance reached by these products since June 2022.

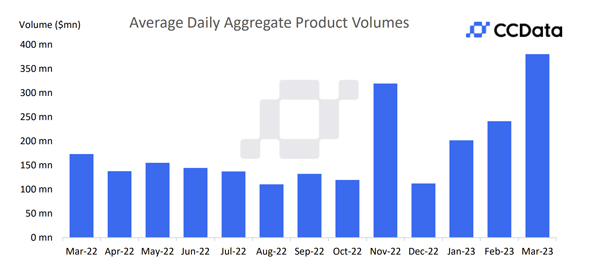

- In March 2023, average daily aggregate product volumes across all digital asset investment products saw a significant increase of 57.6% to $380 million. This growth in volume was a continuation of an upward trend that began at the start of the year, with March marking the third consecutive month of growth and a recorded increase of 239% since the beginning of the year.

- In March, CI Galaxy recorded the highest increase in AUM for the second consecutive month, rising 20.3% to $553 million, followed by ProShares with a 19.1% increase to $1.08 billion. Grayscale remained the dominant player with products recording a total AUM of $23.6 billion; a 13.2% increase compared to February.

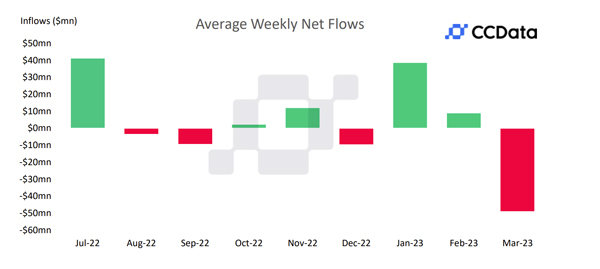

- Outflows saw a significant rise fuelled by the panic that followed Silicon Valley Bank’s (SVB) collapse and the depeg of Circle’s USDC. In March, outflows recorded a weekly average of $52.7 million, the highest since June 2022.

- BTC-based products remained dominant in terms of weekly net flows, with BTC-based products and Short-BTC products recording net flows of negative $62.2 million and positive $16.5 million, respectively.

AUM for Bitcoin-Based Products Rallies After a Surge in BTC Dominance

The assets under management (AUM) for Bitcoin and Ethereum-based products saw an increase of 13.9% and 6.26%, respectively, reaching $22.7 billion and $7.22 billion. The increase led Bitcoin-based products to reach 72.4% market share - the highest level reached since June 2022.

AUM for “Other” products witnessed a significant drop of 13.3% to $1.00bn in March, leading its market share to decline to 3.20%; a significant decrease compared to 13.3% in January 2021. The increase in Bitcoin market share was consistent with the surge in Bitcoin dominance and the shift away from altcoins that investors have been making in response to the recent market turbulence.

Average Daily Aggregate Product Volumes Rise for Third Month In A Row

In March 2023, average daily aggregate product volumes across all digital asset investment products saw a significant increase of 57.6% to $380 million. This volume growth was a continuation of an upward trend that began at the start of the year, with March marking the third consecutive month of growth and a recorded increase of 239% since the beginning of the year.

Outflows Surge Following Silicon Valley Bank & USDC Depeg

In March, outflows saw a significant rise fuelled by the panic that followed Silicon Valley Bank’s (SVB) collapse and the depeg of Circle’s USDC. Outflows recorded a weekly average of $52.7 million, the highest since June 2022.

BTC-based products remained dominant in terms of weekly net flows, with BTC-based products and Short-BTC products recording net flows of negative $62.2 million and positive $16.5 million, respectively.

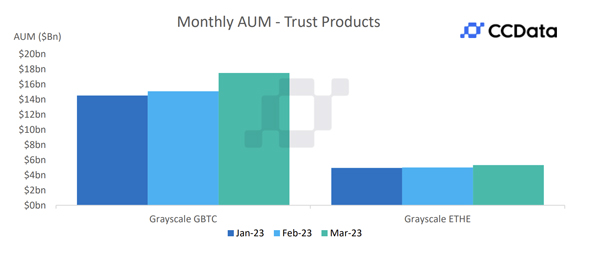

Grayscale Remains Dominant Trust Product With Over 70% Market Share

In March, Grayscale's Bitcoin Trust (GBTC) continued to be the dominant trust product in terms of assets under management (AUM), with a significant market share of 71.8% (Up from 69.8% in February) across all trust products. The product recorded an increase of 16.1% to $17.5 billion AUM in March.