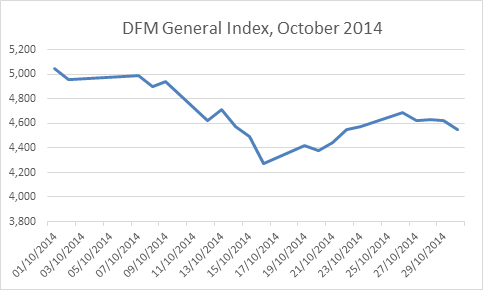

The Dubai Financial Market General Index down 9.9% to 4545.4 points at the end of October compared to 5042.9 points at the end of September. The Financial & Investment services index decreased the most by 15.8% and the Real Estate and Construction index down 12.6%, and the Services index decreased by 11.9%. In contrast, the Industrial and Consumer indices have seen no change during this month.

The market capitalization increased at the end of this month by 3.5% to reach AED 370.3 billion compared to AED 357.6 billion at the end of September. The value of shares traded reached during this month AED 23.3 billion, compared to AED 25.4 billion recorded during September, down 8.4%. The number of shares traded increased by 8.7% to reach 8.8 billion shares during this month compared to 8.1 billion shares traded during September. The number of transactions executed during October increased by 13% to reach 167.5 thousands compared to 148.3 thousand deals carried out during the previous month.

As for the sectors’ contribution to trading volumes, the Real Estate and Construction sector ranked first in terms of the traded value, to reach AED 17.1 billion, or 73.6% of the total traded value in the market. Banking sector ranked second at AED 2.9 billion or 12.5%, followed by The Financial & Investment services sector with AED 2.3 billion or 9.9%. The Transportation sector with AED 624.2 million or 2.7%, the Telecommunication sector with AED 94.7 million or 0.4%, the Consumer staples sector with AED 92.9 million or 0.4%, the Services sector with AED 77.3 million or 0.3%, and the Insurance sector with AED 50.4 or 0.2%.

The value of stocks bought by foreign investors during this month reached AED 11.5 billion comprising 49.5% of the total traded value. The value of stocks sold by foreign investors during the same period reached AED 11.8 billion comprising 50.8% of the total value traded. Accordingly, DFM net foreign investment out-flow reached AED 311.2 million.

|

Trading activity by nationality (October 2014) |

|||

|

|

Value of Stocks Bought - AED |

Value of Stocks Sold - AED |

Net Investment - AED |

|

Arab |

4,587,100,459 |

4,361,806,811 |

225,293,648 |

|

GCC |

2,021,079,201 |

2,260,255,554 |

(239,176,353) |

|

Others |

4,901,915,273 |

5,199,270,694 |

(297,355,420) |

|

Non - UAE |

11,510,094,933 |

11,821,333,059 |

(311,238,126) |

|

UAE |

11,757,090,599 |

11,445,852,473 |

311,238,126 |

|

Total |

23,267,185,532 |

23,267,185,532 |

0 |

On the other hand, the value of stocks bought by institutional investors during this month reached AED 7.5 billion comprising 32.3% of the total traded value. The value of stocks sold by institutional investors during the same period reached AED 7.8 billion which constitutes 33.6% of the total value traded. DFM net institutional investment out-flow amounted AED 296.9 million.

|

Trading activity by client type (October 2014) |

|||

|

|

Value of Stocks Bought - AED |

Value of Stocks Sold - AED |

Net Investment - AED |

|

Institutional |

7,516,535,928 |

7,813,399,925 |

(296,863,997) |

|

Individuals |

15,750,649,604 |

15,453,785,607 |

296,863,997 |

|

Total |

23,267,185,532 |

23,267,185,532 |

0 |