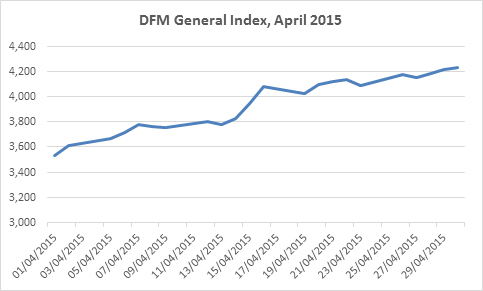

The Dubai Financial Market General Index increased by 20.3% to 4229 points at the end of April compared to 3514.4 points at the end of March. At the sectoral level, the nine sectors represented on DFM ended the month in the green, with the Banking index increased the most by 39.7% and the Consumer and Discretionary index up 28.7%, and the Financial & Investment services index up 14.9%.

The market capitalization increased at the end of this month by 17.3% to reach AED 373.6 billion compared to AED 318.6 billion at the end of March. The value of shares traded reached during this month AED 24.8 billion, compared to AED 9.6 billion recorded during March, up by 158.6%. The number of shares traded increased by 150.4% to reach 17.4 billion shares during this month compared to 6.9 billion shares traded during March. The number of transactions executed during April rose 95.2% to reach 216.3 thousands compared to 110.8 thousand deals carried out during the previous month.

As for the sectors’ contribution to trading volumes, the Real Estate and Construction sector ranked first in terms of the traded value, to reach AED 14.1 billion, or 56.8% of the total traded value in the market. Banking sector ranked second at AED 4.4 billion or 17.5%, followed by The Financial & Investment services sector with AED 4.2 billion or 17.1%. The Consumer and Discretionary sector with AED 907.6 million or 3.7%, the Transportation sector with AED 539.6 million or 2.2%, the Services sector with AED 301.4 million or 1.2%, the Insurance sector with AED 283.9 million or 1.1%, and the Telecommunication sector with AED 108.7 million or 0.4%, and the Industrial sector with AED 28.7 million.

The value of stocks bought by foreign investors during this month reached AED 11 billion comprising 44.3% of the total traded value. The value of stocks sold by foreign investors during the same period reached AED 10.7 billion comprising 43.3% of the total value traded. Accordingly, DFM net foreign investment in-flow reached AED 247.7 million.

|

Trading activity by nationality (April 2015) |

|||

|

|

Value of Stocks Bought - AED |

Value of Stocks Sold - AED |

Net Investment - AED |

|

Arab |

5,418,620,574 |

5,649,776,765 |

(231,156,191) |

|

GCC |

1,972,436,450 |

2,113,007,346 |

(140,570,896) |

|

Others |

3,593,216,299 |

2,973,784,168 |

619,432,131 |

|

Non - UAE |

10,984,273,323 |

10,736,568,279 |

247,705,044 |

|

UAE |

13,830,769,092 |

14,078,474,136 |

(247,705,044) |

|

Total |

24,815,042,415 |

24,815,042,415 |

|

On the other hand, the value of stocks bought by institutional investors during this month reached AED 5.5 billion comprising 22.4% of the total traded value. The value of stocks sold by institutional investors during the same period reached AED 5 billion which constitutes 20.2% of the total value traded. DFM net institutional investment in-flow amounted AED 545.7 million.

|

Trading activity by client type (April 2015) |

|||

|

|

Value of Stocks Bought - AED |

Value of Stocks Sold - AED |

Net Investment - AED |

|

Institutional |

5,547,010,109 |

5,001,269,511 |

545,740,599 |

|

Individuals |

19,268,032,306 |

19,813,772,904 |

(545,740,599) |

|

Total |

24,815,042,415 |

24,815,042,415 |

|