Derivatives markets are a key segment of the capital markets around the world. They are central to the efficiency and stability of capital markets and thus to economic growth.

Derivatives exchanges are active nowadays in all developed economies. Among emerging economies, there are vibrant derivatives exchanges in large and/or sophisticated markets e.g. Brazil, China, India, South Africa. However, many smaller emerging economies do not yet have this important capital markets institution. These countries are very interested in launching derivatives and learning “best practices”.

Some history is important: Agricultural futures – rice futures - appeared in Japan in 1730, and took off in the US in 1848, with the Chicago Board of Trade. Financial derivatives started in Chicago, in the mid-1970’s: FX futures in 1972, interest-rate futures in 1975 and stock index futures in 1982. Trading volumes grew rapidly in the U.S., prompting these products to adopted by other countries. In the mid-1980’s financial derivatives were introduced to Europe, Canada and Brazil, and in the 1990’s they took off in Asia where they experienced strong growth.

According to the Futures Industry Association (FIA), global trading volumes have grown steadily. In the last 10 years, annual contract volumes have approximately doubled, i.e. a CAGR of 7% p.a... In 2020, the worldwide volume traded was around 47 billion contracts/year. Most of this volume was concentrated in developed economies – North America, Europe and a few large, advanced emerging markets: Brazil, China, India.

Several emerging economies have been actively considering derivatives markets in recent years: Philippines, Chile, Romania, Morocco, Egypt, Kazakhstan come to mind.

What the key “prerequisites” for exchange-traded derivatives?

The first prerequisite is viable capital markets. Derivatives, especially exchange-listed derivatives, emerge when the capital markets have already attained a certain degree of development and sophistication.

Exchange-traded derivatives have multiple functions as they are universal tools for

- Risk management or risk transfer (i.e. hedgers transferring portfolio risk to speculators)

- Expressing market views (i.e. bullish or bearish attitude)

- Gaining “synthetic exposure” to the market

- Achieving greater leverage than possible in cash markets (you can trade derivative contracts by investing only the initial margin amount i.e. perhaps around 10 % of the notional value of the contract)

- Arbitrage (e.g. arbitrage with cash market)

By supporting all the above investment objectives, Exchange Traded derivatives generally help increase the liquidity of underlying markets. In many markets, the derivatives volumes traded may exceed the size and trading volumes of underlying cash markets.

Often, derivatives also help attract foreign investors who seek to trade emerging markets in a simple way at low cost. For example, this can be done by trading the equity index future, which simplifies the task of a remote investor (no need for stock picking, execution of multiple trades, multiple settlements etc.).

So, when is a market ready to launch Exchange Traded derivatives?,/p>

Figures 1 and 2 below offer some clues and suggest informal quantitative criteria

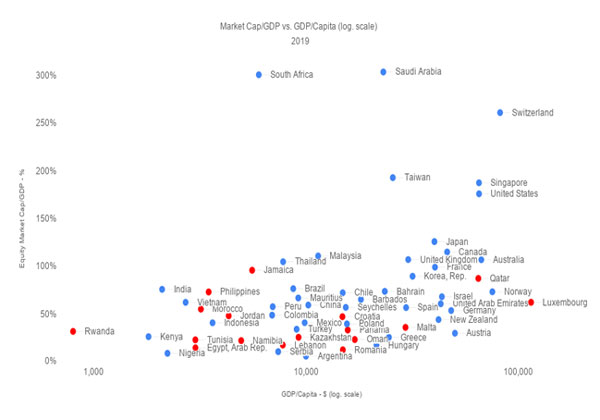

In Figure 1, we see a relationship among the level of development of the underlying economy, as measured by GDP/Capita, on the horizontal axis, and the level of development of capital markets, measured via a proxy, the ratio of the equity market capitalization to GDP on the vertical axis. Each market is represented by a blue dot where there is an Exchange traded derivatives market, and a red dot where there is no derivatives market.

Figure 1: Capital Markets size vs Country Economic Development

The chart shows mostly red dots, i.e. no listed derivatives market, when GDP /Capita is below ~ $7000 and market capitalization/GDP is below 30-40%

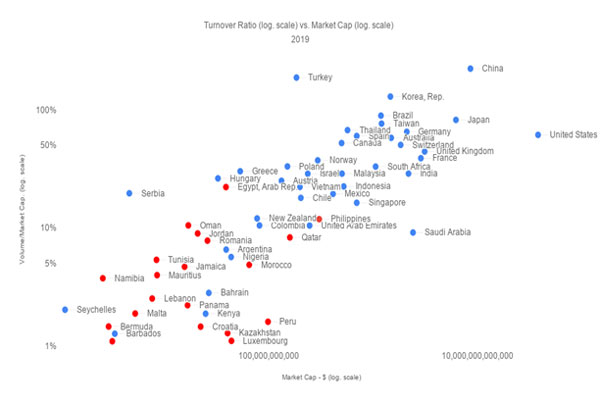

In Figure 2, we see a relationship between the level of market development, measured as the ratio of the equity market capitalization to GDP, on the horizontal axis, and market liquidity measured as the ratio of volume traded to market capitalization or “turnover velocity”. Red dots, i.e. no derivatives market yet, are concentrated among the lesser developed markets, typically those with small market capitalizations (below $100 billion) and low liquidity (volume traded /market cap below 25%).

Figure 2 Stock Market Liquidity vs Market Size

This chart suggests that to develop viable derivatives markets, emerging markets stock exchanges must first grow their underlying cash markets and improve their liquidity.

Our experience with emerging markets listed derivatives also provides some “rules-of-thumb” for the success of a derivatives contract:

There must be at least 50 or so steadily active significant players in a derivatives contract, with a balanced mix of hedgers, speculators, and arbitrageurs, to achieve a stable minimal liquidity.

I

n the case of the smaller emerging markets, finding 50 meaningful large players in a specific derivative contract could be a challenge, since there are relatively few meaningful institutional investors, such as pensions, mutual funds, etc. and even fewer hedge funds or “professional speculators” in a typical country.

Therefore, foreign investors will be critical to the take-off of derivatives markets. In fact, foreign investors are typically key for the development of the emerging economy overall capital markets, until local institutional investors become sufficiently large and sophisticated.

Another general observation: for a derivative contract to achieve reasonable liquidity, it is important to have a steady arbitrage opportunity among the derivative and some other instrument, e.g. interest rate future vs. government bond, stock index futures vs. baskets of stocks. It is this steady arbitrage, which enables arbitrageurs to make a small on-going profit, that stimulates trading and creates on-going liquidity. In this kind of arbitrage, the local traders (as opposed to the foreign traders) , who have day -to-day contact with the underlying cash markets, tend to play a key role.

The mission of the emerging markets stock exchanges is to get started and accelerate the evolution towards derivatives markets. They must prepare the way, emphasizing the adoption of “best practices” standards, for key infrastructural aspects of the markets, such as securities borrowing and lending, clearing and settlement processes.

They must offer on-going training programs for investors and traders to familiarize them with the benefits and risks of listed derivatives.

They must create the role of market-maker and provide adequate compensation and technological support for market-making.

In this regard, there are notable new technologies for automated trading which can make a critical difference. Horizon Software, a French-based firm led by Sylvain Thieullent, has focused on market-making and algorithmic trading which enable traders to be very efficient and manage risk much better in evolving market conditions. Horizon’s platform, a global leader in trading technology has proven itself in several emerging and frontier markets.

Other initiatives that will be important include the development of Exchange-Traded-Funds, products which intrinsically stimulate liquidity in underlying cash markets and offer synergies with derivatives, such as equity index futures.

Emerging markets exchanges need to prepare comprehensive roadmaps for development of both cash markets and derivatives markets. Such roadmaps might include the following elements: regulatory preparation, stimulating cash liquidity by introducing market-maker programs and attracting active foreign investors, development of robust central securities depository institutions, development of strong clearinghouses, preparing a robust framework for securities borrowing and lending, training local investors, lobbying the government for retirement reform and a favourable tax treatment of capital markets transactions.

The CBM Group is a New York-based management consulting firm specialized in financial services, led by Andre Cappon acappon@thecbmgroup.com

Since its founding in 1992, CBM has advised 70+ leading financial institutions in North America, Europe, Latin America, Asia and Africa, including several emerging markets exchanges.

Key exchange clients include: BM&F BOVESPA (Brazilian exchange), Euronext, TMX Group (Canadian exchanges), London Stock Exchange, NASDAQ OM, Philippine Stock Exchange, Santiago Exchange (Chile), Merval (Argentina)

Ricardo Angulo is a consultant with The CBM Group.

Leon Bitton, is CEO of LBA Finance, a consulting firm in Montreal, and a consultant with The CBM Group.

Mr. Bitton is a seasoned professional with 36 years of experience in financial markets. Mr Bitton served as Vice President, Research and Development, at Montreal Exchange, the derivatives arm of TMX Group. He has played a key role in the development of the Canadian derivatives markets.