Deal activity (mergers & acquisitions, private equity (PE), and venture capital (VC) financing) across the Asia-Pacific region witnessed a 26.5% nosedive during January 2022 as the spread of the Omicron variant had dampened investors’ risk appetite, reveals GlobalData, a leading data and analytics company.

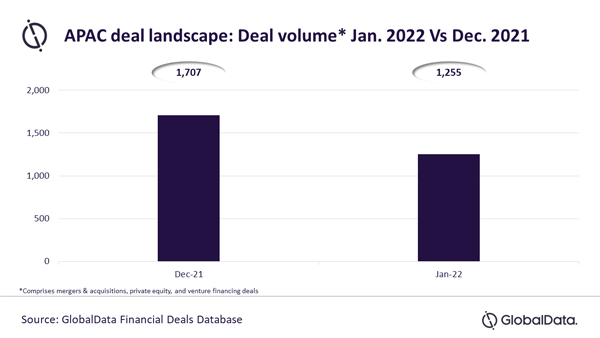

An analysis of GlobalData’s Financial Deals Database reveals that deal volume across APAC declined from 1,707 in December 2021 to 1,255 in January 2022.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Deal activity has taken a hit in many of the major APAC markets due to Omicron outbreak. For instance, following the lockdowns and travel restrictions, China, which happens to be the region’s key market, experienced a double-digit decline in deal activity.”

Key APAC markets such as China, India, Japan, South Korea, Australia, Singapore and Malaysia witnessed decline in deal volume by 29.5%, 21.2%, 3.4%, 12.9%, 60.2%, 22.5% and 42.1%, respectively, in January compared to the previous month.

All the deal types (under coverage) also witnessed decline in deal activity. The number of merger & acquisitions (M&A), private equity and venture financing deals month-on-month declined by 32.1%, 35.3% and 21.1%, respectively.

Bose concludes: “Even after successfully controlling the Omicron variant compared to their Western counterparts, widely diverging COVID-19 policies and healthcare systems are complicating investors’ search for winning safe bets across the APAC region. Investors seem to look for selective opportunities to grab while protecting their portfolios.”