Click here to download CryptoCompare's latest Exchange Review.

July was a positive month for the cryptocurrency markets as prices began to pick up toward the latter weeks – with Bitcoin and Ethereum rising 18.3% and 11.2% respectively month on month (MoM).

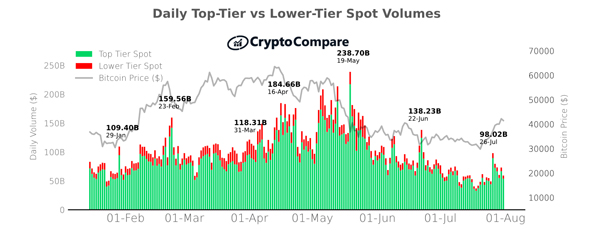

The impact of this can be seen in higher daily derivative and spot volumes, particularly in the last few days of the month. For example, a daily spot volume maximum of $98.0bn was traded on the 26th of July. Markets also reacted with the first MoM increase in aggregate open interest (7.5%) in the past three months.

In other news, exchanges such as Binance saw increased scrutiny from regulators across the globe, as did stablecoins, which received criticism from regulators regarding the potential risks to consumers and the wider financial system.

Key takeaways:

- Spot volumes plummeted 31.5% MoM to $1.9tn, the lowest levels recorded so far this year.

- Derivative volumes reached 56.9% of total cryptocurrency volume, the highest percentage share of total volume since November 2020.

- Monthly Bitcoin traded into USDT totaled 4.3mn in July - 61.6% of all Bitcoin traded into either fiat or stablecoins - the highest level since December 2020 when USDT accounted for took 63.1% of market share.

- Aggregate open interest rose for the first time in three months, from a weekly average of $16.4bn in June to $17.7bn in July (7.5% increase). This is adjacent to the rise in price in cryptocurrency markets in the last two weeks of July.

Additional insight can be found below

Trading Activity Across All Spot Markets Fell in JulyIn July,

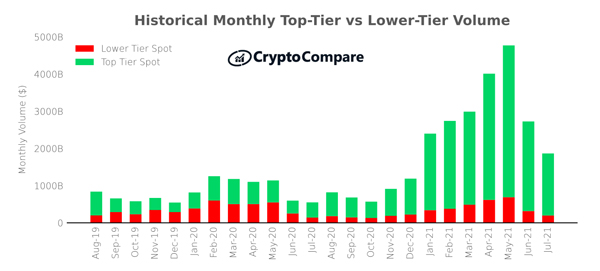

Top-Tier spot volumes decreased 30.7% to $1.7tn while Lower-Tier spot volumes decreased 37.8% to $197bn. Top-Tier exchanges now represent 89.4% of total spot volume.

Trading activity across all spot markets fell in July compared to the previous month. A daily volume maximum of $98.0bn was traded on the 26th of July, down 29.1% from the intra-month high in June.

In July, spot volume from the 15 largest Top-Tier exchanges decreased 31.7% on average (vs June).

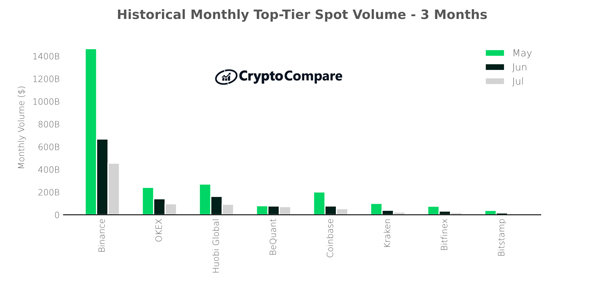

Binance (Grade A) was the largest Top-Tier spot exchange by volume in July, trading $455bn (down 31.9%). This was followed by OKEx (Grade BB) trading $96.8bn (down 31.4%), and Huobi Global (Grade A) trading $92.7bn (down 42.7%).

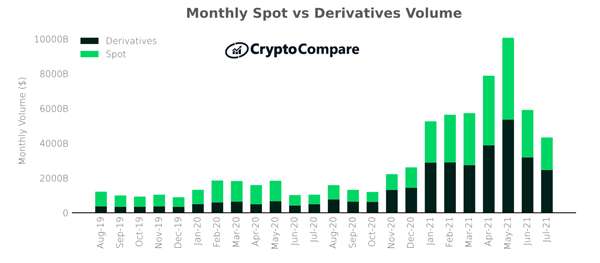

Derivatives Gain Market Share Over Spot Despite Fall in Volumes

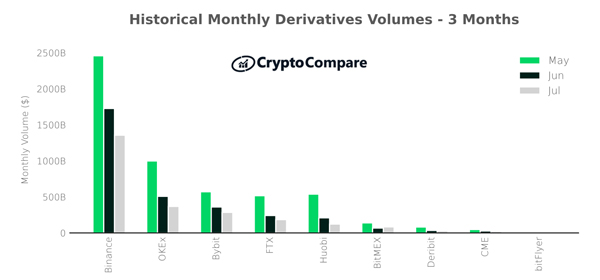

Derivatives volumes decreased by 22.6% in July to $2.5tn. Meanwhile, total spot volumes decreased by 31.5% to $1.9tn. The derivatives market now represents 56.9% of the total crypto market (vs 52.9% in June).

Binance was the largest derivatives exchange in July by monthly trading volume with $1.4tn (down 21.5% since June) followed by OKEx ($368n, down 27.6%), Bybit ($285bn, down 20.7%) and FTX ($185bn, down 23.4%).

Aggregate Open Interest Rises After 2 Months of Negative Growth

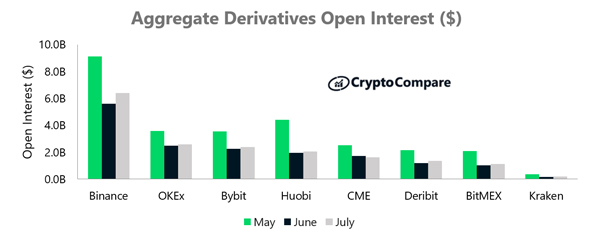

Aggregate open interest in July rose for the first time in three months, from a weekly average of $16.4bn in June to $17.7bn in July (7.5% increase).

Binance had the highest open interest across all derivative products on average at $6.4bn (up 13.7% since June). This was followed by OKEx ($2.6bn, up 4.1%) and Bybit ($2.4bn, up 6.9%).

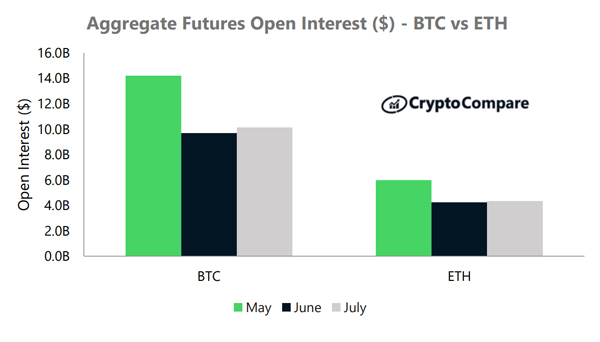

Aggregate open interest across BTC futures products rose marginally to $10.1bn (up 4.5% from June) while open interest across ETH futures products rose $4.3bn (up 2.4%).

July Exchange News

Coinbase

Coinbase Expands International Payments Options for Institutional Customers

Kraken

Kraken Solana Trading & Staking Now Live for USA, CA and AUS July 1

Crypto.com

Crypto.com Becomes The First Global Cryptocurrency Platform to Receive An Electronic Money Institution (EMI) License from the MFSA

The Derivatives Exchange Now Supports Advanced Order Types

BitMEX

Basket Indices Come to BitMEX: Introducing the ALTMEXUSD and DEFIMEXUSD Perpetual Swap Contracts

Binance

Binance Bolsters European Compliance Team with Hire of Jonathan Farnell

Bybit

New Launch: Trade Spot With Zero Maker Fees!

LMAX Digital

J.C. Flowers & Co to acquire 30% stake in LMAX Group

Read more news in CryptoCompare's Exchange Review.